November 1, 2021

Manufacturer Confidence Dips to Lowest Level Since May 2020

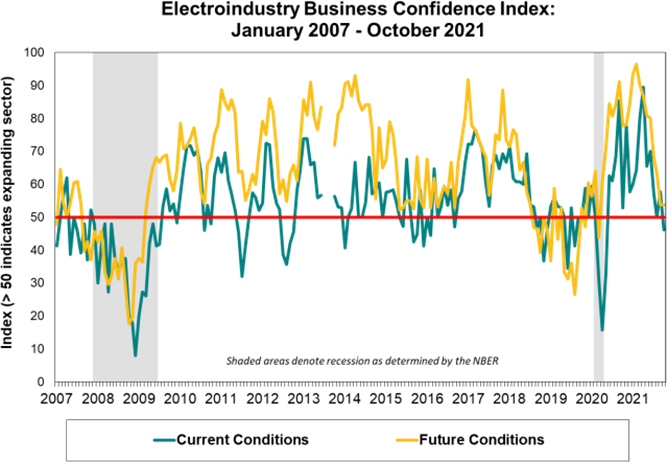

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

This most recent ECBI shows the number of positive sentiments decreasing slightly to prolonged supply chain issues. Below is the just-published October report:

Demand still strong, but supply concerns put downward pressure on current component

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)

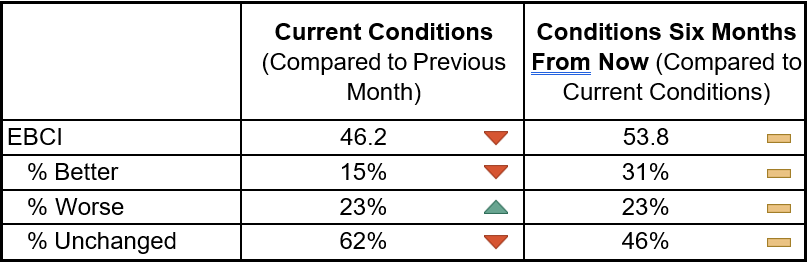

Despite reports of strong demand, supply side problems helped push the current conditions component to the first sub-50 reading since May 2020, when the electroindustry was just beginning to regain its footing after the pandemic’s onset. The nearly 12 point negative shift from 57.7 last month to 46.2 in October was driven largely by an increase in the share of responses indicating worse conditions during this survey period. The majority of respondents continued to note unchanged conditions, but that stable platform eroded slightly this month.

The prevailing sentiment was probably best expressed by the comment that, “supplies for products are becoming more difficult to obtain as the year goes on.”

The median reported magnitude of change in current electroindustry business conditions held steady at zero for the fourth consecutive month in October. The mean of the magnitude measure aligned with the median at zero this month, slipping from +0.2 in September.

Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Although the mix of respondents changed somewhat from last month, the resulting future

conditions component calculation did not budge, as the October reading stood firm at 53.8. The proportion of responses underlying the overall component measure mirrored September’s as well, with a plurality noting expectations for unchanged conditions in six months. Nearly a third of the panel indicated better conditions ahead, helping maintain the moderately positive outlook suggested by a score in the low to mid 50s.

SURVEY RESULTS:

Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

Please note that survey responses were collected from the period of October 10-22, 2021.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |