October 1, 2021

Supply Chain is Impacting Business Confidence

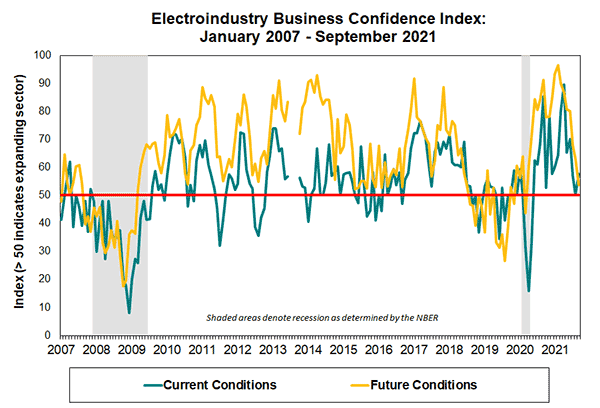

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

This most recent ECBI shows mostly unchanged sentiments, with the number of positive sentiments decreasing slightly due to supply chain issues. Below is the just-published September report:

Supply chain concerns restrain confidence measures

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)

The median reported magnitude of change in current electroindustry business conditions remained unchanged at zero for the third month in a row. The mean of the magnitude measure tipped back into positive territory this month, rising from -0.1 last month to +0.2 in September. Panelists are asked to report the magnitude of change on a scale ranging from – 5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

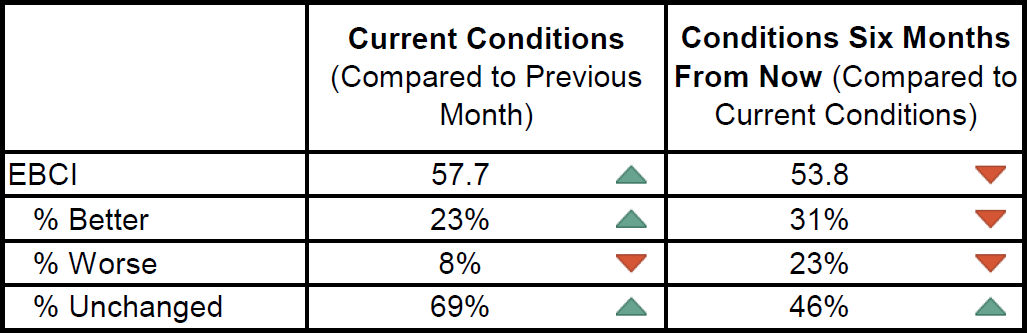

The current conditions component returned to presumed growth this month after hitting a plateau in August. The nearly 8-point expansion to 57.7 in September was driven largely by a decline in the share of respondents that reported worse conditions compared to the previous month. September’s score marked the third consecutive month in the 50s, suggesting that conditions remained conducive to expansion but at a bit less robust pace than in much of the past year. Comments reflected the opposing forces at play in the macroeconomy, with unresolved supply chain problems competing against unflagging demand.

Led by a sharp uptick in the proportion of responses indicating unchanged conditions, the future component narrowed from 63.3 last month to 53.8 in September, making this the lowest reading since March 2020, at the start of the pandemic response. These results indicated projections of marginally improved conditions in six months and a deceleration from the torrid pace of recent expectations. Uncertainty, primarily surrounding supply chain, permeated much of the commentary, but one commenter sounded a note of optimism because previously delayed projects were slated for release in Q4.

SURVEY RESULTS:

Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

Please note that survey responses were collected from the period of September 10-24, 2021.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |