| Orion Q4’21 and FY 2021 Highlights | |||||||

| $ in millions except per share figures |

Q4’21 | Q4'20 | Change | FY 2021 | FY 2020 | Change | |

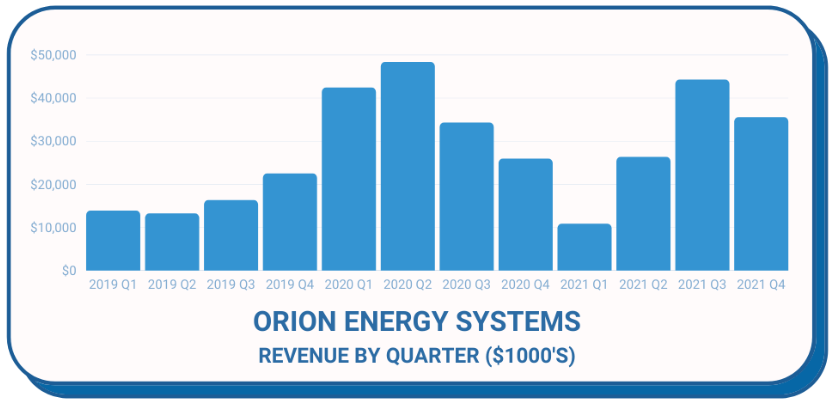

| Revenue | $35.5 | $25.9 | +$9.6 | $116.8 | $150.8 | -$34.0 | |

| Gross Profit | $9.2 | $5.8 | +$3.4 | $30.1 | $37.1 | -$7.0 | |

| Gross Profit % | 26.0% | 22.3% | +370 bps | 25.8% | 24.6% | +120 bps | |

| Net Income (Loss)* | $22.1 | ($0.5) | +$22.7 | $26.1 | $12.5 | +$13.7 | |

| EPS* | $0.71 | ($0.02) | +$0.73 | $0.83 | $0.40 | +$0.43 | |

| Net Income (Loss) Excluding Tax Benefit* | $1.2 | ($0.5) | +$1.7 | $5.2 | $12.5 | -$7.3 | |

| EPS Excluding Tax Benefit* | $0.04 | ($0.02) | +$0.06 | $0.17 | $0.40 | -$0.24 | |

| EBITDA** | $2.9 | $0.0 | +$2.9 | $8.4 | $14.7 | -$6.3 | |

| *Q4’21 and FY 2021 periods include a non-cash tax benefit of $20.9M, or $0.67 and $0.66 per diluted share, respectively, for the release of the valuation allowance against Orion’s deferred tax assets; see reconciliation below. **EBITDA reconciliation below. |

|||||||

Financial Highlights

- Q4’21 revenue rose 37% principally on strength of national account activity and some Q4’20 COVID-19 impact.

- Achieved FY 2021 full year revenue of $116.8M despite COVID-19 related business disruptions during the first half of the year.

- Gross profit percentage improved to 26.0% in Q4’21 and to 25.8% in FY 2021 primarily due to operational efficiencies and favorable product mix in the FY 2021 periods.

- Orion recorded a release of the valuation allowance against its deferred tax assets, resulting in a non-cash tax benefit of $20.9M, or $0.67 and $0.66 per diluted share, in Q4’21 and FY 2021, respectively.

- Q4’21 net income excluding the tax benefit improved to $1.2M, or $0.04 per diluted share, compared to a net loss of ($0.5M), or ($0.02) per diluted share, in Q4’20.

- FY 2021 net income excluding the tax benefit was $5.2M, or $0.17 per diluted share, versus $12.5M, or $0.40 per diluted share, in FY 2020, principally reflecting COVID-19 related business disruptions during the first half of FY 2021.

- Orion ended FY 2021 with $26.2M in net working capital, including $19.4M of cash, with no amounts drawn on its credit facility and all $25M available on the credit facility.

- Excluding any significant COVID-19 business impacts, Orion expects its FY 2022 revenue to increase at least 28% to a range of $150M to $155M.

CEO Commentary

Mike Altschaefl, Orion’s CEO and Board Chair, commented, “The Orion team achieved solid FY 2021 financial results despite very challenging first half business conditions due to the onset of the COVID-19 pandemic. Our full year performance benefitted from a significant rebound in our business in the second half as many customers returned to pre-COVID-19 levels of activity. We achieved profitability and positive cash flow from operations in Q4’21 and FY 2021 while also building our pipeline of project opportunities for FY 2022 and beyond. I extend our Board and management team's sincere appreciation and thanks to our team and our business partners for their dedication and perseverance through a very challenging period.

“In FY 2021, we continued to expand the breadth and diversity of our customer base across several sectors, including retail, warehousing and logistics, automotive OEMs, healthcare and the public sector. We also further enhanced our product line with continued investment in product development, enabling the introduction of our new Starline high-bay LED fixtures, a new line of exterior lighting products, and next generation linear LED fixtures. These new products provide efficient, cost-effective design and enhanced energy efficiency to support our customers' environmental and business goals, and they have been well received in the market.

“We also recently launched our new ISON PureMotion™ product line, expanding our business into airflow solutions to create healthier indoor spaces. The line includes ISON PureMotion Air; ISON PureMotion Light; and ISON PureMotion UVC, which uses UVC light rays in a sealed chamber to kill bacteria, fungi, mold and viruses to create a safer and healthier work environment.

“Our FY 2022 is poised to benefit from a growing and more diverse group of large national account customers and projects. These customers recognize the value of Orion’s innovative, energy efficient products and our unique, customized, turnkey LED lighting design-build-install capabilities and strong customer service. We have a proven track record executing large national retrofit installation programs with efficient, high-quality and customized products and excellent, on-schedule service.

“Reflecting the national scope of our service capabilities, during FY 2021 Orion launched a lighting, electrical and other maintenance services business that we believe can grow into an important longer-term recurring service revenue opportunity.

“Given the compelling benefits our solutions provide, ranging from improved illumination, enhanced work environments, greater safety, and environmental and cost benefits, we are very optimistic regarding Orion’s outlook for FY 2022 and beyond.

“Underscoring our optimism is the enormous untapped market for LED lighting and controls upgrades at facilities that have yet to be updated. Based on a U.S. Department of Energy study, the domestic LED retrofit opportunity in Orion’s key markets is estimated to be in excess of $20B today and growing to over $80B by 2035. To pursue this substantial market potential, Orion’s Board and management team have updated the Company’s strategic plan to help guide our organic and inorganic growth initiatives, with a long-term target of building Orion to a company generating up to $500M in annual revenue in approximately five years. To achieve this long-term target, our plan envisions organic growth of at least 10% per year, augmented by external growth initiatives including the active pursuit of strategic acquisitions and business partnerships. We set these financial goals to provide our stakeholders with a vision of what we believe Orion can become."

Business Outlook

Orion currently expects to achieve FY 2022 revenue of $150M to $155M, representing growth of at least 28% over FY 2021, excluding any recurrence of COVID-19 business impacts. This outlook is based on further progress in diversifying Orion's customer base and revenue sources and is supported by the following opportunities:

- Logistics: Orion is now the primary LED lighting supplier and project manager in North America for two very large warehouse and logistics providers. These customers are expected to be meaningful sources of project activity over several years.

- Major National Retail Customer: Orion anticipates significant additional product and service revenue from an existing large national retail customer for the retrofit of additional locations, new construction, outdoor lighting and other projects.

- Global Online Retailer: Orion expects ongoing revenue for custom-designed luminaires for a global online retailer’s new facilities.

- National Specialty Retailer: Orion expects to complete LED lighting retrofits for a national specialty retailer.

- Public Sector: Orion expects continued project activity for long-standing customers, including the U.S. Military, the Veterans Administration and the U.S. Postal Service.

- Healthcare & Hospitals: Orion anticipates meaningful revenue in the healthcare and hospital market in FY 2022.

- Academic Institutions: Orion is seeing significantly increased activity with academic institutions which should benefit FY 2022 and beyond.

- Automotive: Orion also anticipates strong activity from major existing automotive customers in FY 2022.

- Lighting, Electrical and Other Maintenance Services: Orion expects to grow this recently launched business and believes it is well positioned to achieve meaningful revenue in FY 2022.

- New Products: Orion's recently launched products, including LED outdoor and linear lighting fixtures and its ISON PureMotion™ air movement line, are expected to support revenue growth opportunities in FY 2022 and beyond.

Orion cautions investors that its financial outlook is subject to a range of factors that are difficult to predict, including but not limited to the COVID-19 pandemic and possible business and other economic impacts.

Tax Provision

As a result of the valuation allowance release at the close of FY 2021, Orion expects its financial results to reflect a GAAP tax provision in future periods that is more in line with statutory tax rates. However, based upon current tax laws and the Company’s federal net operating loss carryforwards of approximately $69M at 3/31/21, Orion does not expect to pay meaningful cash taxes for several years.

Financial Results

Orion’s Q4’21 revenue rose 37.0% or $9.6M to $35.5M from $25.9M in Q4’20, due to strong national account retrofit activity as business rebounded from COVID-19 related disruptions earlier in FY 2021. Q4’21 benefitted from several large national retrofit projects, including for a large national retail customer and a specialty retailer. FY 2021 revenue was $116.8M compared to $150.8M in FY 2020, principally due to pandemic related work stoppages and project delays during the first half of the year.

Gross profit rose 59.7% or $3.4M to $9.2M in Q4’21 from $5.8M in Q4’20. FY 2021 full year gross profit was $30.1M compared to $37.1M in FY 2020, primarily due to lower revenue, partially offset by an increase in gross profit percentage. The gross profit percentage increased 120 bps to 25.8% in FY 2021 from 24.6% in FY 2020, mainly due to improved product margins and managing supply chain and input costs, more than offsetting increases in raw material and component prices.

Total operating expenses were $23.3M in FY 2021 vs. $24.0M in FY 2020 but increased as a percentage of sales to 19.9% from 15.9%, year-over-year, primarily due to the impact of lower business volume. Q4’21 operating expenses improved to 18.8% of sales from 23.7% in Q4’20, principally reflecting the benefit of fixed cost absorption from higher business volume in Q4’21.

Orion generated EBITDA of $2.9M in Q4’21 versus $0.0M in Q4’20. FY 2021 EBITDA was $8.4M versus $14.7M in FY 2020, reflecting the pandemic’s impact on FY 2021 revenue.

Q4’21 and FY 2021 results included a non-cash tax benefit of $20.9M, or $0.67 and $0.66 per diluted share, respectively, resulting from the release of the valuation allowance previously recorded against Orion’s deferred tax assets. As a result, Orion’s reported net income and earnings per share are not representative of its operating results and comparisons to prior and future periods will not be meaningful without adjusting for such tax benefit.

Q4’21 net income excluding the tax benefit improved to $1.2M, or $0.04 per diluted share, compared to a net loss of ($0.5M), or ($0.02) per basic share, in Q4’20, reflecting higher revenue and gross profit. FY 2021 net income excluding the tax benefit was $5.2M, or $0.17 per diluted share, compared to net income of $12.5M, or $0.40 per diluted share, in FY 2020, principally reflecting higher revenue in FY 2020.

Cash Flow & Balance Sheet

Orion generated $7.4M of cash from operating activities in Q4’21 as compared to $6.1M in Q4’20. The increase was due to higher net income and favorable working capital changes. Orion generated $1.7M of cash from operating activities in FY 2021, versus $20.3M in FY 2020, with the difference attributable to lower net income plus working capital investments.

As of March 31, 2021, Orion’s net working capital balance was $26.2M, compared to $27.8M at March 31, 2020. Working capital at March 31, 2020 included $10.0M drawn from the Company’s revolving line of credit in response to pandemic uncertainties. In December 2020, Orion secured a new five-year $25.0M revolving credit facility. The facility provides a 25% increase in financing capacity and liquidity to support the Company’s strategic growth plans. As of March 31, 2021, Orion had no balance outstanding on its revolving credit facility, $19.4M of cash and cash equivalents and $25M of availability on its credit facility.

| Webcast/Call Detail | |

| Date / Time: | Today - Tuesday, June 1st at 4:30 p.m. ET (3:30 p.m. CT) |

| Call Dial-In: | (877) 754-5294 or (678) 894-3013 for international |

| Webcast/Replay: | https://edge.media-server.com/mmc/p/qppwkzuj |

| Audio Replay: | (855) 859-2056, ID# 2636878 (available shortly after the call through 6/8/21) |

About Orion Energy Systems

Orion provides innovative LED lighting systems and turnkey project implementation including installation and commissioning of fixtures, controls and IoT systems, as well as ongoing system maintenance and program management. We help our customers achieve energy savings with healthy, safe and sustainable solutions, enabling them to reduce their carbon footprint and digitize their business.

Non-GAAP Measures

In addition to the GAAP results included in this presentation, Orion has also included the non-GAAP measures, EBITDA (earnings before interest, taxes, depreciation and amortization), net income excluding the tax benefit and diluted earnings per share excluding the tax benefit. The Company has provided these non-GAAP measures to help investors better understand its core operating performance, enhance comparisons of core operating performance from period to period and allow better comparisons of operating performance to its competitors. Among other things, management uses these non-GAAP measures to evaluate performance of the business and believes this measurement enables it to make better period-to-period evaluations of the financial performance of core business operations. The non-GAAP measurements are intended only as a supplement to the comparable GAAP measurements and Orion compensates for the limitations inherent in the use of non-GAAP measurements by using GAAP measures in conjunction with the non-GAAP measurement. As a result, investors should consider these non-GAAP measurements in addition to, and not in substitution for or as superior to, measurements of financial performance prepared in accordance with generally accepted accounting principles.

Consistent with Regulation G under the U.S. federal securities laws, the non-GAAP measures in this press release have been reconciled to the nearest GAAP measures, and this reconciliation is located under the heading “Unaudited EBITDA Reconciliation” and “Unaudited Earnings Per Share Reconciliation” following the Condensed Consolidated Statements of Cash Flows included in this press release.

COVID-19 Impacts

The COVID-19 pandemic has disrupted business, trade, commerce, financial and credit markets, in the U.S. and globally. Orion’s business has been materially adversely impacted by measures taken by government entities and others to control the spread of the virus. As part of the Company’s recent response to the impacts of the COVID-19, management has taken a number of cost reduction and cash conservation measures. While restrictions have begun to lessen in certain jurisdictions, stay-at-home, face mask, and lockdown orders remain in effect in others, with employees asked to work remotely if possible. Many customers and projects require Orion employees to travel to customers and project locations. Some customers and projects are in areas where travel restrictions have been imposed, certain customers have either closed or reduced on-site activities, and timelines for the completion of multiple projects have been delayed, suspended, or extended. As of the date of this release, it is not possible to predict the overall impact the COVID-19 pandemic will have on the Company's business, liquidity, capital resources or financial results.

Safe Harbor Statement

Certain matters discussed in this press release, including under the headings “Financial Highlights”, “CEO Commentary”, and "Business Outlook" are "forward-looking statements" intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. These forward-looking statements may generally be identified as such because the context of such statements will include words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "will," "would" or words of similar import. Similarly, statements that describe our future plans, objectives or goals are also forward-looking statements. Such forward-looking statements are subject to certain risks and uncertainties that could cause results to differ materially from those expected, including, but not limited to, the following: (i) our ability to manage general economic, business and geopolitical conditions, including the impacts of natural disasters, pandemics and outbreaks of contagious diseases and other adverse public health developments, such as the COVID-19 pandemic; (ii) the deterioration of market conditions, including our dependence on customers' capital budgets for sales of products and services, and adverse impacts on costs and the demand for our products as a result of factors such as the COVID-19 pandemic and the implementation of tariffs; (iii) our ability to successfully launch, manage and maintain our refocused business strategy to successfully bring to market new and innovative product and service offerings; (iv) our recent and continued reliance on significant revenue to be generated in fiscal 2022 from the lighting and controls retrofit projects for two major global logistics companies; (v) our dependence on a limited number of key customers, and the potential consequences of the loss of one or more key customers or suppliers, including key contacts at such customers; (vi) our ability to identify and successfully complete transactions with suitable acquisition candidates in the future as part of our growth strategy; (vii) the availability of additional debt financing and/or equity capital to pursue our evolving strategy and sustain our growth initiatives; (viii) our risk of potential loss related to single or focused exposure within the current customer base and product offerings; (ix) our ability to sustain our profitability and positive cash flows; (x) our ability to differentiate our products in a highly competitive and converging market, expand our customer base and gain market share; (xi) our ability to manage and mitigate downward pressure on the average selling prices of our products as a result of competitive pressures in the light emitting diode ("LED") market; (xii) our ability to manage our inventory and avoid inventory obsolescence in a rapidly evolving LED market; (xiii) our increasing reliance on third parties for the manufacture and development of products, product components, as well as the provision of certain services; (xix) our increasing emphasis on selling more of our products through third party distributors and sales agents, including our ability to attract and retain effective third party distributors and sales agents to execute our sales model; (xx) our ability to develop and participate in new product and technology offerings or applications in a cost effective and timely manner; (xxi) our ability to maintain safe and secure information technology systems; (xxii) our failure to comply with the covenants in our credit agreement; (xxiii) our ability to recruit, hire and retain talented individuals in all disciplines of our company; (xxiv) our ability to balance customer demand and production capacity; (xxv) our ability to maintain an effective system of internal control over financial reporting; (xxvi) price fluctuations (including as a result of tariffs), shortages or interruptions of component supplies and raw materials used to manufacture our products; (xxvii) our ability to defend our patent portfolio and license technology from third parties; (xxviii) a reduction in the price of electricity; (xxix) the reduction or elimination of investments in, or incentives to adopt, LED lighting or the elimination of, or changes in, policies, incentives or rebates in certain states or countries that encourage the use of LEDs over some traditional lighting technologies; (xxx) the cost to comply with, and the effects of, any current and future industry and government regulations, laws and policies; (xxxi) potential warranty claims in excess of our reserve estimates, and (xxxii) the other risks described in our filings with the Securities and Exchange Commission. Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are made only as of the date of this press release and we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise. More detailed information about factors that may affect our performance may be found in our filings with the Securities and Exchange Commission, which are available at http://www.sec.gov or at http://investor.oriones.com/ in the Investor Relations section of our Website.

Twitter: @OrionLighting and @OrionLightingIR

StockTwits: @Orion_LED_IR

| Investor Relations Contacts | |

| Per Brodin, CFO | William Jones; David Collins |

| Orion Energy Systems, Inc. | Catalyst IR |

| [email protected] | (212) 924-9800 or [email protected] |

| ORION ENERGY SYSTEMS, INC. AND SUBSIDIARIES UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS (in thousands, except share amounts) |

||||||||

| March 31, | ||||||||

| 2021 | 2020 | |||||||

| Assets | ||||||||

| Cash and cash equivalents | $ | 19,393 | $ | 28,751 | ||||

| Accounts receivable, net | 13,572 | 10,427 | ||||||

| Revenue earned but not billed | 2,930 | 560 | ||||||

| Inventories, net | 19,554 | 14,507 | ||||||

| Prepaid expenses and other current assets | 1,082 | 723 | ||||||

| Total current assets | 56,531 | 54,968 | ||||||

| Property and equipment, net | 11,369 | 11,817 | ||||||

| Other intangible assets, net | 1,952 | 2,216 | ||||||

| Deferred tax assets | 19,785 | — | ||||||

| Long-term accounts receivable | — | 760 | ||||||

| Other long-term assets | 3,184 | 2,802 | ||||||

| Total assets | $ | 92,821 | $ | 72,563 | ||||

| Liabilities and Shareholders’ Equity | ||||||||

| Accounts payable | $ | 17,045 | $ | 19,834 | ||||

| Accrued expenses and other | 13,226 | 7,228 | ||||||

| Deferred revenue, current | 87 | 107 | ||||||

| Current maturities of long-term debt | 14 | 35 | ||||||

| Total current liabilities | 30,372 | 27,204 | ||||||

| Revolving credit facility | — | 10,013 | ||||||

| Long-term debt, less current maturities | 35 | 50 | ||||||

| Deferred revenue, long-term | 640 | 715 | ||||||

| Other long-term liabilities | 3,700 | 3,546 | ||||||

| Total liabilities | 34,747 | 41,528 | ||||||

| Commitments and contingencies | ||||||||

| Shareholders’ equity: | ||||||||

| Preferred stock, $0.01 par value: Shares authorized: 30,000,000 shares | ||||||||

| at March 31, 2021 and 2020; no shares issued and outstanding at March 31, 2021 and 2020 |

— | — | ||||||

| Common stock, no par value: Shares authorized: 200,000,000 at | ||||||||

| March 31, 2021 and 2020; shares issued: 40,279,050 and 39,729,569 at March 31, 2021 and 2020; shares outstanding: 30,805,300 and 30,265,997 at March 31, 2021 and 2020 |

— | — | ||||||

| Additional paid-in capital | 157,485 | 156,503 | ||||||

| Treasury stock: 9,473,750 and 9,463,572 common shares at | ||||||||

| March 31, 2021 and 2020 | (36,240 | ) | (36,163 | ) | ||||

| Retained deficit | (63,171 | ) | (89,305 | ) | ||||

| Total shareholders’ equity | 58,074 | 31,035 | ||||||

| Total liabilities and shareholders’ equity | $ | 92,821 | $ | 72,563 | ||||

| ORION ENERGY SYSTEMS, INC. AND SUBSIDIARIES UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except share and per share amounts) |

||||||||||||||||

| Three Months Ended March 31, | Twelve Months Ended March 31, | |||||||||||||||

| 2021 | 2020 | 2021 | 2020 | |||||||||||||

| Product revenue | $ | 25,774 | $ | 19,574 | $ | 87,664 | $ | 113,352 | ||||||||

| Service revenue | 9,723 | 6,318 | 29,176 | 37,489 | ||||||||||||

| Total revenue | 35,497 | 25,892 | 116,840 | 150,841 | ||||||||||||

| Cost of product revenue | 18,399 | 14,810 | 63,233 | 83,588 | ||||||||||||

| Cost of service revenue | 7,878 | 5,307 | 23,483 | 30,130 | ||||||||||||

| Total cost of revenue | 26,277 | 20,117 | 86,716 | 113,718 | ||||||||||||

| Gross profit | 9,220 | 5,775 | 30,124 | 37,123 | ||||||||||||

| Operating expenses: | ||||||||||||||||

| General and administrative | 3,183 | 2,910 | 11,262 | 11,184 | ||||||||||||

| Sales and marketing | 3,035 | 2,754 | 10,341 | 11,113 | ||||||||||||

| Research and development | 455 | 476 | 1,685 | 1,716 | ||||||||||||

| Total operating expenses | 6,673 | 6,140 | 23,288 | 24,013 | ||||||||||||

| Income (loss) from operations | 2,547 | (365 | ) | 6,836 | 13,110 | |||||||||||

| Other income (expense): | ||||||||||||||||

| Other income | — | 6 | 56 | 28 | ||||||||||||

| Interest expense | (76 | ) | (18 | ) | (127 | ) | (279 | ) | ||||||||

| Amortization of debt issue costs | (15 | ) | (61 | ) | (157 | ) | (243 | ) | ||||||||

| Loss on debt extinguishment | — | — | (90 | ) | — | |||||||||||

| Interest income | — | — | — | 5 | ||||||||||||

| Total other expense | (91 | ) | (73 | ) | (318 | ) | (489 | ) | ||||||||

| Income (loss) before income tax | 2,456 | (438 | ) | 6,518 | 12,621 | |||||||||||

| Income tax (benefit) expense | (19,668 | ) | 93 | (19,616 | ) | 159 | ||||||||||

| Net income (loss) | $ | 22,124 | $ | (531 | ) | $ | 26,134 | $ | 12,462 | |||||||

| Basic net income (loss) per share attributable to common shareholders | $ | 0.72 | $ | (0.02 | ) | $ | 0.85 | $ | 0.41 | |||||||

| Weighted-average common shares outstanding | 30,782,309 | 30,259,345 | 30,634,553 | 30,104,552 | ||||||||||||

| Diluted net income (loss) per share | $ | 0.71 | $ | (0.02 | ) | $ | 0.83 | $ | 0.40 | |||||||

| Weighted-average common shares and share equivalents | ||||||||||||||||

| Outstanding | 31,294,900 | 30,259,345 | 31,303,727 | 30,964,777 | ||||||||||||

| ORION ENERGY SYSTEMS, INC. AND SUBSIDIARIES UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands) |

||||||||

| Fiscal Year Ended March 31, | ||||||||

| 2021 | 2020 | |||||||

| Operating activities | ||||||||

| Net income | $ | 26,134 | $ | 12,462 | ||||

| Adjustments to reconcile net income to net cash provided by | ||||||||

| operating activities: | ||||||||

| Depreciation | 1,190 | 1,203 | ||||||

| Amortization of intangible assets | 290 | 359 | ||||||

| Stock-based compensation | 753 | 618 | ||||||

| Amortization of debt issue costs | 157 | 243 | ||||||

| Loss on debt extinguishment | 90 | — | ||||||

| Deferred income tax benefit | (19,860 | ) | — | |||||

| Loss on sale of property and equipment | 1 | 10 | ||||||

| Provision for inventory reserves | 275 | 205 | ||||||

| Other | 106 | 57 | ||||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | (2,384 | ) | 3,616 | |||||

| Revenue earned but not billed | (2,370 | ) | 3,186 | |||||

| Inventories | (5,322 | ) | (1,319 | ) | ||||

| Prepaid expenses and other assets | (396 | ) | 66 | |||||

| Accounts payable | (2,637 | ) | (79 | ) | ||||

| Accrued expenses and other liabilities | 5,797 | (192 | ) | |||||

| Deferred revenue, current and long-term | (95 | ) | (92 | ) | ||||

| Net cash provided by operating activities | 1,729 | 20,343 | ||||||

| Investing activities | ||||||||

| Purchase of property and equipment | (902 | ) | (814 | ) | ||||

| Additions to patents and licenses | (51 | ) | (131 | ) | ||||

| Proceeds from sales of property, plant and equipment | 7 | 9 | ||||||

| Net cash used in investing activities | (946 | ) | (936 | ) | ||||

| Financing activities | ||||||||

| Payment of long-term debt | (35 | ) | (92 | ) | ||||

| Proceeds from revolving credit facility | 8,000 | 74,100 | ||||||

| Payment of revolving credit facility | (18,013 | ) | (73,289 | ) | ||||

| Payments to settle employee tax withholdings on stock-based | ||||||||

| compensation | (84 | ) | (76 | ) | ||||

| Debt issue costs | (245 | ) | (91 | ) | ||||

| Net proceeds from employee equity exercises | 236 | 63 | ||||||

| Net cash (used in) provided by financing activities | (10,141 | ) | 615 | |||||

| Net (decrease) increase in cash and cash equivalents | (9,358 | ) | 20,022 | |||||

| ORION ENERGY SYSTEMS, INC. AND SUBSIDIARIES UNAUDITED EBITDA RECONCILIATION (in thousands) |

|||||||||||||||||||

| Three Months Ended | Twelve Months Ended | ||||||||||||||||||

| March 31, 2021 | Dec. 31, 2020 | March 31, 2020 | March 31, 2021 | March 31, 2020 | |||||||||||||||

| Net income (loss) | $ | 22,124 | $ | 4,315 | $ | (531 | ) | $ | 26,134 | $ | 12,462 | ||||||||

| Interest | 76 | 1 | 18 | 127 | 274 | ||||||||||||||

| Income taxes (benefit) expense | (19,668 | ) | 51 | 93 | (19,616 | ) | 159 | ||||||||||||

| Depreciation | 301 | 302 | 293 | 1,190 | 1,203 | ||||||||||||||

| Amortization of intangible assets | 65 | 73 | 77 | 290 | 359 | ||||||||||||||

| Amortization of debt issue costs | 15 | 20 | 61 | 157 | 243 | ||||||||||||||

| Loss on debt extinguishment | — | 90 | — | 90 | — | ||||||||||||||

| EBITDA | $ | 2,913 | $ | 4,852 | $ | 11 | $ | 8,372 | $ | 14,700 | |||||||||

| ORION ENERGY SYSTEMS, INC. AND SUBSIDIARIES UNAUDITED EARNINGS PER SHARE RECONCILIATION |

||||||||

| For the Three Months Ended March 31, 2021 |

For the Twelve Months Ended March 31, 2021 |

|||||||

| Numerator: (dollars in thousands) | ||||||||

| Net income | $ | 22,124 | $ | 26,134 | ||||

| Impact of tax benefit - valuation allowance release | 20,949 | 20,949 | ||||||

| Net income excluding tax benefit | $ | 1,175 | $ | 5,185 | ||||

| Denominator: | ||||||||

| Weighted-average common shares and share equivalents outstanding | 31,294,900 | 31,303,727 | ||||||

| Net income per common share: | ||||||||

| Diluted | $ | 0.71 | $ | 0.83 | ||||

| Diluted excluding tax benefit | $ | 0.04 | $ | 0.17 | ||||