January 12, 2026

E-conolight: Cree Lighting’s Lifeline — or Its Liquidator?

Clearance tags and no-return policies for e-commerce arm hint at a strategic sell-off

Since last October, Cree Lighting has extended its furlough five times, each announcement offering a slightly different explanation — supply chain issues, holiday-period financing gaps, general delays. In every message, the company insists operations are “limited,” not suspended. Some orders are being shipped. Warranties are being honored.

But with production lines slowed, phone support scaled back, and furloughed employees seeking and landing other jobs, the company’s continued claims of order shipments prompt a sharper question: If Cree Lighting is still shipping products, where are those shipments coming from? The most revealing answer doesn’t lie on the factory floor. It lives in a browser window.

E-conolight: A Window Into Remaining Inventory

At first glance, E-conolight, a longstanding e-commerce platform, appears to be a standard online lighting retailer. Its branding is generic. Its product pages are clean. The site makes no overt mention of Cree Lighting ownership — but doesn’t deny the connection, either. A quick look at the privacy policy confirms its parent company: CLNA Holdings, which sits under the corporate umbrella of ADLT.

The ambiguity is strategic. For a distribution channel still wary of direct-to-contractor and end-user sales, E-conolight’s low-key approach stays under many radars. But behind that neutral façade is an assortment of luminaires that may convey more reality than the company’s optimistic-sounding furlough announcements have.

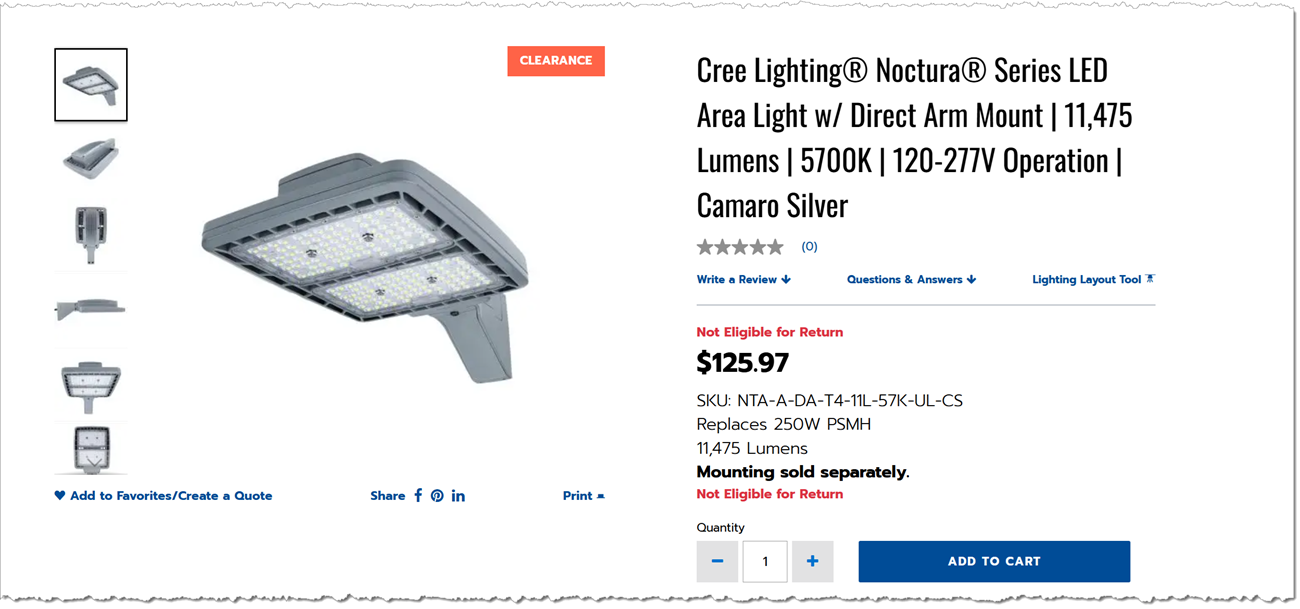

Above: Cree Lighting area light marked for final sale on E-conolight

Cree Lighting fixtures still appear on the site, alongside its budget-tier C-Lite and SAVR brands — in-house labels built for E-conolight. These represent the bulk of what’s marketed now. Supplementing them are “partner products” from third-party brands such as NICOR Lighting, NaturaLED, and GKOLED. E-conolight even lists Venture Lighting in its Winter 2026 catalog — a sister brand under the ADLT corporate umbrella. Third-party products are fulfilled via drop ship.

Notably, numerous Cree-branded items carry a familiar badge: CLEARANCE. Not Eligible for Return. These aren’t made-to-order fixtures. They’re boxed goods, excess inventory; already paid for, marked down, and ready to move.

The Strategic Signal, and the Potential Play

All of this raises a deeper question: What is E-conolight for right now?

One reading is about optics. E-conolight projects the image of a business still in motion. Customers are placing orders. Product is shipping. Phone lines are answered — we called and reached a polite, upbeat representative who didn’t comment on our direct mention of the furlough, but confidently assured us that in-house items still ship within a day.

For potential investors, creditors, or legal adversaries, that’s not nothing. It creates the appearance of viability — or at least forward motion. In an environment where Cree Lighting faces debt pressure, vendor collections, and a cloudy operational future, E-conolight becomes more than an e-commerce site. It becomes proof of life. In that sense, E-conolight may stabilize optics more effectively than it stabilizes balance sheets.

Or, is E-conolight simply convenient liquidation platform?

Another, equally plausible explanation is more pragmatic. Rather than reviving operations, E-conolight may simply be a more efficient way to wind them down. By funneling product directly to customers, Cree Lighting could be squeezing value from excess inventory — without resigning to the deep discount a wholesale liquidator would demand. In this framing, the platform isn’t about preserving the business. It’s about monetizing what’s left of it, slowly and quietly, before selling off any remaining pieces of value.

There’s no official word confirming either scenario. But both notions are plausible.

The Performance of Stability

If E-conolight is staging a performance, it’s a disciplined one. Its social media channels remain upbeat and on-brand, even through the company’s internal turbulence. Holiday greetings, product features, and lighting tips continue on schedule. The messaging doesn’t contradict Cree Lighting’s furlough — it simply avoids acknowledging it.

The result is a strange, composed image: a manufacturer on pause, an e-commerce platform running smoothly, and a slow stream of clearance inventory leaving quietly. E-conolight isn’t a comeback strategy. It’s a contingency — engineered to preserve narrative, buy time, or possibly extract whatever dollars remain on the shelf before anyone else gets involved.

Whether that’s a bridge to recovery or a soft landing into liquidation remains unclear. But it’s a plan. And in Cree Lighting’s current state, that alone makes it notable.