August 7, 2024

Orion Reports 13% Growth Driven by EV Charging Segment

The company's LED lighting segment saw modest growth of 1% to $12.8 million

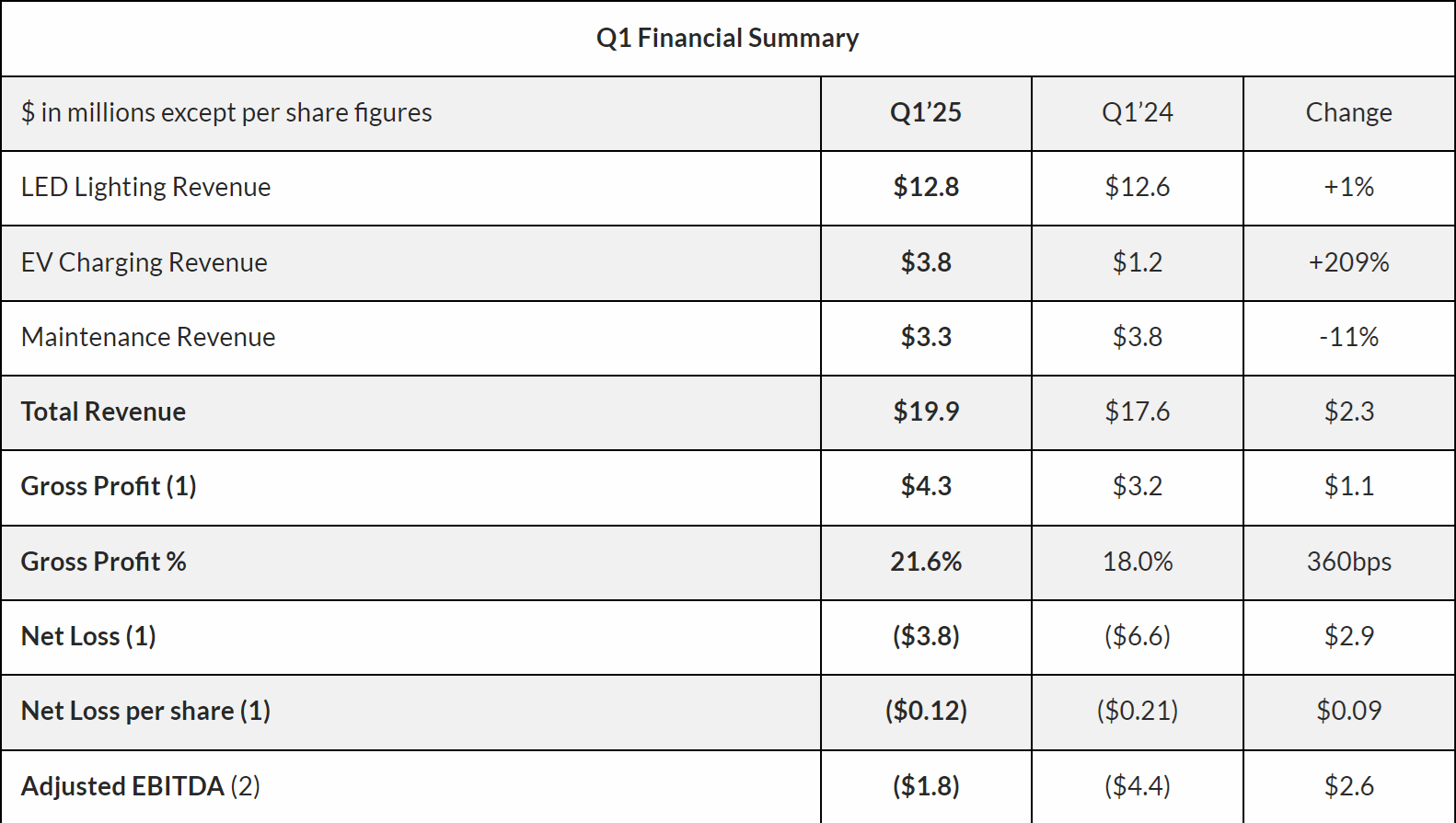

Orion Energy Systems Inc. reported a 13% increase in revenue for its fiscal 2025 first quarter ended June 30, 2024, primarily due to strong growth in its electric vehicle charging solutions business.

The company maintained its fiscal 2025 revenue growth target of 10-15%, which translates to approximately $99.7 million to $104.2 million based on 2024 revenue of $90.6 million. Orion cited expected revenue from large national LED lighting projects and continued strength in its EV charging solutions business as drivers for this projected growth.

Financial Performance and Challenges

Last quarter, we celebrated Orion’s first profitable quarter in two years in our article “Back in Black: Orion Returns to Profitability as Sales Recover” but in Q1, the company delivered net loss of $3.8 million, and after three quarters of sequential revenue growth they dipped below $20 million for the first quarter following its year of recovery.

The energy-efficient lighting and EV charging station provider posted total Q1 revenue of $19.9 million, up from $17.6 million in the same period last year. The increase was largely attributed to a 209% jump in EV charging revenue to $3.8 million.

Segment Performance and CEO Comments

While still in the red, comparing this quarter’s net loss to the same period a year ago marks an improvement from the $6.6 million loss, or $0.21 per share.

The company's LED lighting segment saw modest growth of 1% to $12.8 million. However, maintenance services revenue declined 11% to $3.3 million due to the non-renewal of certain large legacy contracts following pricing increases.

Orion CEO Mike Jenkins stated, "We anticipate continued momentum in this [EV charging] business as public and private sector organizations implement EV charging programs to support the growing base of electric vehicles across the country."

Orion ended the quarter with $14.0 million in financial liquidity, down from $15.3 million at the end of the previous quarter. The company secured a $3.525 million mortgage on its corporate headquarters and enhanced its borrowing base to improve liquidity.

While showing signs of improvement, Orion's financial results indicate ongoing challenges in achieving consistent profitability. The company's pivot towards EV charging solutions appears to be gaining traction, but it remains to be seen if this growth can offset potential declines in other segments.