June 6, 2024

Back in Black: Orion Returns to Profitability as Sales Recover

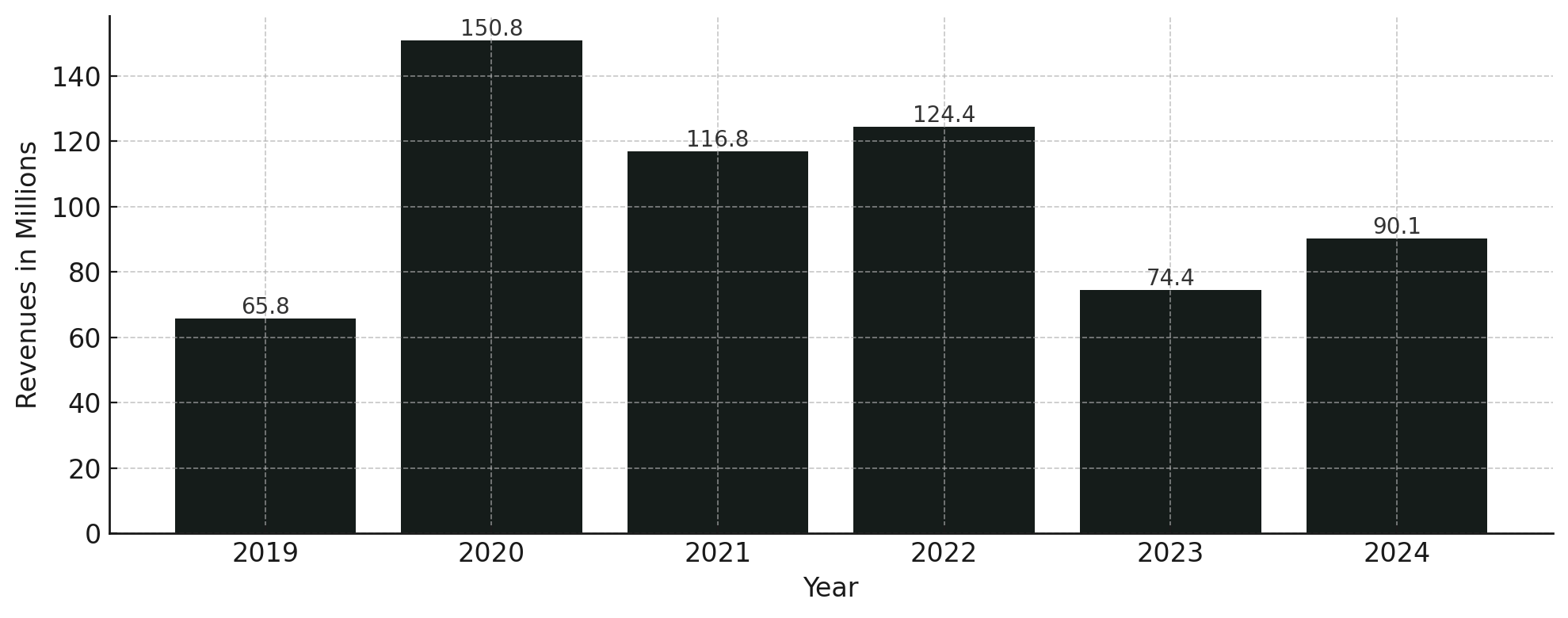

Company ends streak of unprofitable quarters while growing annual sales 17%

Amidst two years of lower revenues and a string of unprofitable quarters, Orion Energy Systems, Inc. has reversed its trend of red ink and is back in the black with its latest quarterly results. The Manitowoc, Wisconsin-based company today reported a net income of $1.6 million for the fiscal fourth quarter of 2024, a significant turnaround from the net loss of $5.1 million in the same period last year. This marks a pivotal moment for Orion, as it posted its first profitable quarter amidst two years of financial challenges.

Orion's recovery comes after a strategic shift away from its heavy reliance on project installations at The Home Depot locations, which accounted for 49% of its revenues in 2022. The completion of major projects for the retail giant led to a contraction in revenue, with fiscal year 2023 seeing a notable decline. However, the company's efforts to diversify its revenue base and expand into new markets have started to pay off.

For the fiscal year ended March 31, 2024, Orion reported a 17.1% increase in total revenue, reaching $90.6 million, driven by robust growth in LED lighting, EV charging solutions and maintenance services.

Orion's common stock price opened the day trading at $1.15, up 8.49 percent from yesterday's $1.06 close.

Financial Performance Highlights

Revenue Growth:

Orion achieved substantial revenue growth in Q4’24, with a 22.1% increase to $26.4 million, driven by strong performance across LED lighting, EV charging, and maintenance segments. For FY 2024, total revenue increased by 17.1% to $90.6 million.

Gross Profit and Margin:

The company’s gross profit improved by 43.5% in Q4’24 to $6.8 million, with a gross margin increase of 390 basis points to 25.8%. For the full fiscal year, gross profit rose by 19.4% to $20.9 million, with a gross margin of 23.1%.

Net Income:

Orion's net income for Q4’24 was $1.6 million, a significant turnaround from the net loss of $5.1 million in Q4’23. While the company ended it's streak of unprofitable quarters in Q4, it wasn't enough to overcome the full-year net loss which improved to $11.7 million from $34.3 million in the previous year.

| Q4'24 | Q4'23 | Change (%) | FY 2024 | FY 2023 | Change (%) | |

|---|---|---|---|---|---|---|

| LED Lighting Revenue | $16.3 | $14.4 | +13.1 | $61.1 | $56.5 | +8.0 |

| EV Charging Revenue | $4.9 | $3.4 | +42.1 | $12.3 | $6.3 | +96.5 |

| Maintenance Revenue | $5.2 | $3.7 | +37.4 | $17.1 | $14.6 | +17.8 |

| Total Revenue | $26.4 | $21.6 | +22.1 | $90.6 | $77.4 | +17.1 |

| Gross Profit | $6.8 | $4.7 | +43.5 | $20.9 | $17.5 | +19.4 |

| Gross Profit % | 25.8% | 21.9% | +390 bps | 23.1% | 22.6% | +50 bps |

| Net Income (Loss) | $1.6 | ($5.1) | +$6.7 | ($11.7) | ($34.3) | +$22.7 |

| Net Income (Loss) per Share | $0.05 | ($0.16) | +$0.21 | ($0.36) | ($1.08) | +$0.72 |

| Adjusted EBITDA | $0.4 | ($1.6) | +$2.0 | ($6.3) | ($7.6) | +$1.3 |

Above dollar values in $M USD

Segment Performance:

LED Lighting: Continued growth in revenue, driven by increased turnkey activities, particularly a U.S. Department of Defense project in Germany.

EV Charging: Revenue nearly doubled for FY 2024, reflecting robust project activity and the full year impact of the Voltrek acquisition.

Maintenance Services: Growth due to a new three-year agreement for preventative lighting maintenance and improved pricing in legacy contracts.

Cost Management:

Operating expenses decreased, primarily due to the reversal of earnout expenses. Excluding the earnout adjustments, operating expenses reflected higher sales commissions and Voltrek expenses.

Balance Sheet and Liquidity:

Orion ended the fiscal year with $5.2 million in cash and $14.0 million in accounts receivables. Working capital stood at $16.8 million. The company enhanced its financial liquidity through an amended bank credit facility, providing additional funds for operational and growth objectives.

2025 Business Outlook

-

FY 2025 Revenue Target: Orion targets a 10-15% revenue growth, driven by large LED lighting projects and expanding EV charging solutions.

-

LED Lighting: Expected growth supported by new state regulations banning fluorescent fixtures and increasing project activities.

-

EV Charging: Anticipated robust growth due to government stimulus and growing infrastructure needs.

-

Maintenance Services: Expected contraction in revenue but improvement in gross profit percentage due to repricing of contracts.

Orion Energy Systems, Inc. has demonstrated steady financial recovery and growth across its business segments. The company's strategic focus on expanding LED lighting and EV charging solutions, combined with effective cost management, positions it well for sustained growth in FY 2025. The diversification of revenue streams and the anticipated regulatory tailwinds provide a favorable outlook for continued performance improvements.