August 17, 2023

LSI Industries Solid Growth Trajectory Continues

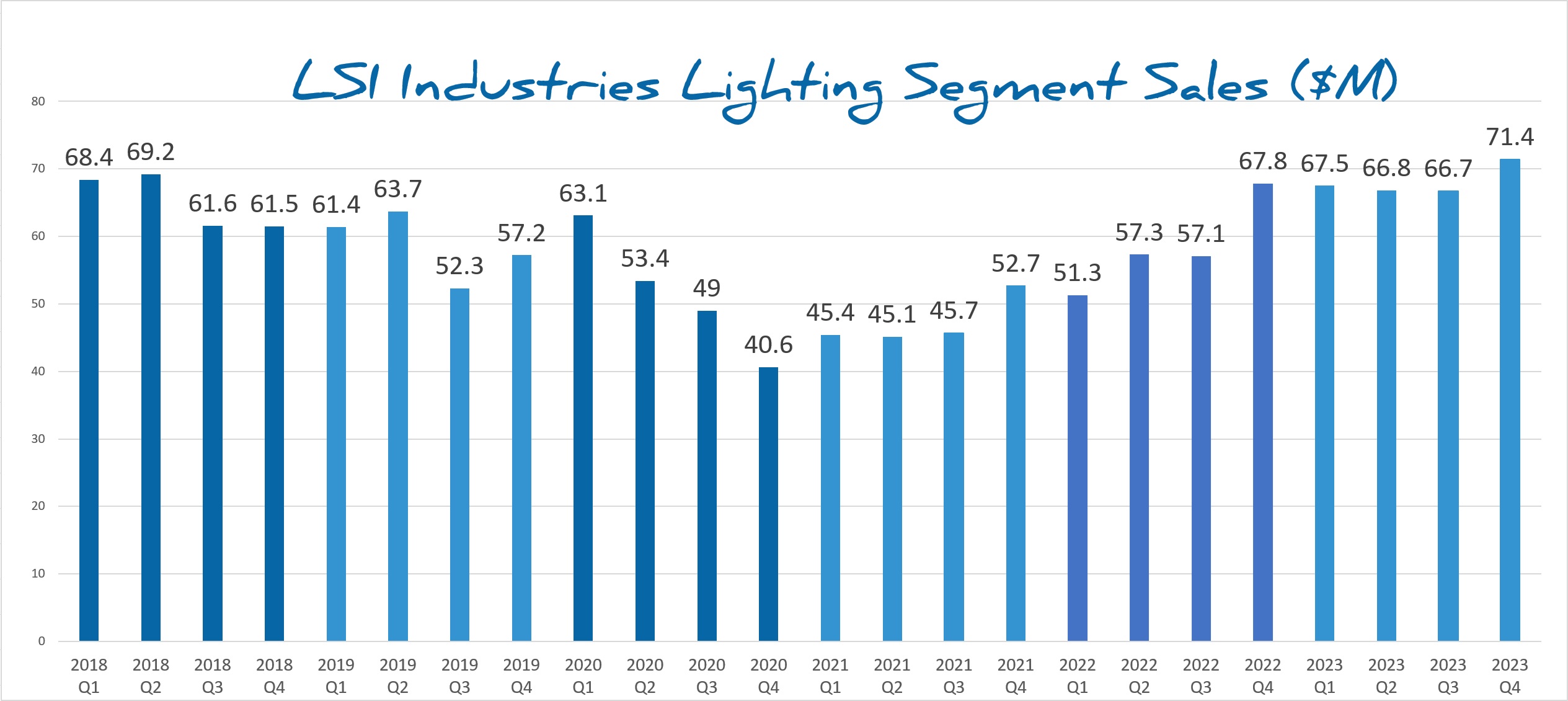

Lighting segment delivers $272 million, up 17% for the fiscal year

LSI Industries today announced its financial results for the fourth quarter and fiscal year that ended on June 30, 2023. It was another solid quarter and another good year for the Cincinnati-based lighting and displays company. The business's focus on vertical markets and complete solutions across its operations seems to continue to fuel its growth.

The company’s lighting segment grew to $71.4 million for the quarter, up 5%, and $272.5 million for the year, up 17%. Due to a 12% drop in the quarter in the Display Solutions Segment, total company quarterly sales dipped 3% but were still up 9% for the year.

The Lighting Segment comprises 55% of total sales for fiscal year 2023.

Three-Month Results, Ending June 30, 2023

Net sales for the quarter ending June 30, 2023, totaled $123.6 million, a 3% decline from the $127.5 million reported for the same period in 2022. Sales from the Lighting Segment rose 5% to $71.4 million, while the Display Solutions Segment experienced a 12% drop to $52.3 million. The company posted a net income of $8.4 million, or 28 cents per diluted share. This is up from the previous year's fourth quarter, which reported a net income of $5.2 million, or 18 cents per diluted share.

Annual Results, Ending June 30, 2023

For the year ending June 30, 2023, net sales reached $497.0 million, marking a 9% increase from 2022's $455.1 million. The Lighting Segment reported a notable increase of 17% with sales amounting to $272.5 million. Meanwhile, the Display Solutions Segment reported a modest 1% growth, with sales of $224.5 million. The company's net income for the year was $25.8 million, or 88 cents per diluted share, a rise from the previous year's $15.0 million, or 54 cents per diluted share.

Some Positive Takeaways:

Improved Financials:

-

Net Sales: An increase of 9% year-over-year (y/y) to $497.0 million for the full year.

-

Net Income: A notable growth of 71% y/y to $25.8 million.

-

Adjusted Net Income: Grew by 61% y/y to $29.0 million.

-

EBITDA: Stood at $46.7 million for the fiscal year with adjusted EBITDA rising by 47% y/y to $51.6 million.

-

Free Cash Flow: A significant increase, 94% y/y in the fourth quarter to $15.6 million and $46.4 million for the full fiscal year.

Lighting Segment:

-

Sales: In the Lighting segment, sales increased by 5% y/y in the fourth quarter and a notable 17% for the full fiscal year 2023.

-

Gross Margin Rate: Lighting adjusted gross margin rate surpassed 33% for the quarter, showing an increase of 220 basis points compared to the prior year.

-

Operating Income: There was an improvement of 31% to $9.3 million for the Lighting segment.

Debt Reduction: Reduced net debt by over 50% to $33.4 million, leading to a healthier balance sheet.

Operational Performance: The favorable demand conditions, new product adoption, strong price discipline, a high-value sales mix, and operational execution contributed to the company's impressive financial performance.

New Orders & Opportunities: The multi-million lighting order for the EV Battery manufacturing plant and potential Phase II of the manufacturing complex indicate promising future prospects for LSI.

Strategic Priorities & Plans: The company's Fast Forward value creation plan appears to be bearing fruit, and their updated five-year strategic plan targets an impressive sales growth of over 60% and adjusted EBITDA growth of 100% through fiscal 2028.

Dividends: LSI declared a regular cash dividend, indicating confidence in sustained profitability.

Other Observations:

- Quote-to-Order Conversion: The quote-to-order conversion period has lengthened, indicating potential delays in revenue realization.

- Display Segment: Despite the emphasis on the Lighting segment, it's still notable that the Display Solutions segment only had a modest growth of 1% y/y. Furthermore, the winding down of the $100 million multi-year quick service restaurant digital menu board program could impact future revenues negatively.

LSI Industries seems to be on a strong trajectory, especially in the lighting sector, backed by its financial and operational performance in fiscal 2023. However, as with any business, they face certain challenges, potentially finding sustained growth in the Display Solutions segment and with possible supply chain uncertainties.