July 21, 2023

Universal Douglas’ Abrupt Shutdown Seemingly Planned for Two Months

More details emerge including the financial performance of Douglas Lighting Controls

Recently revealed documents in the Canadian bankruptcy proceedings of Douglas Lighting Controls shed more light on some of the behind the scenes developments that occurred after Atar Capital's 2021 acquisition of Universal Lighting Technologies, Douglas Lighting Controls, and Mexican factory Componentes Universales de Matamoros.

The companies, collectively known as Universal Douglas, were abruptly shut shown on March 22, 2023. Nearly all employees learned that their jobs would be eliminated immediately. Company executives informed employees that Universal Douglas was shutting down immediately. And all references to Universal Douglas were quickly removed from Atar Capital’s private equity website.

Funding and credit went dry

According to bankruptcy filings, Universal Douglas entered into a sale of accounts and security agreement with FGI Worldwide on March 12, 2021. This agreement facilitated a credit facility up to $25 million, giving FGI a priority interest in all assets of the companies. An amendment to this agreement occurred on September 16, 2021.

However, the bankruptcy filings indicate FGI is now due approximately $8.04 million. Universal Lighting Technologies faced considerable net losses in 2022 and 2023. To address this situation, Atar Capital reportedly added more equity into the firm, with a $3 million injection in late 2022 to enhance the group's liquidity.

The abrupt shutdown was seemingly planned for two months

In January 2023, Atar Capital notified Universal Douglas of its decision to stop continued funding, citing the firm's ongoing losses and a grim financial outlook. Subsequently, on January 25, Riveron Consulting LLC was brought in by Universal Douglas to review and assess available strategic options, including the potential sale of part or all of the business. Universal Douglas’ Chief Restructuring Officer, Steve Wybo, is an executive with Riveron.

On February 17, the companies entered a forbearance agreement with FGI due to Universal Douglas' continued losses and tight liquidity. As a turnaround or sale was not considered feasible, Atar Capital, FGI, Riveron, and Universal Douglas management determined that the best course of action was to wind down the business.

As a result, Douglas Lighting Controls halted operations and announced facility closures on March 22, 2023, and employee layoffs commenced.

Profitability Reversal at Douglas Lighting Controls

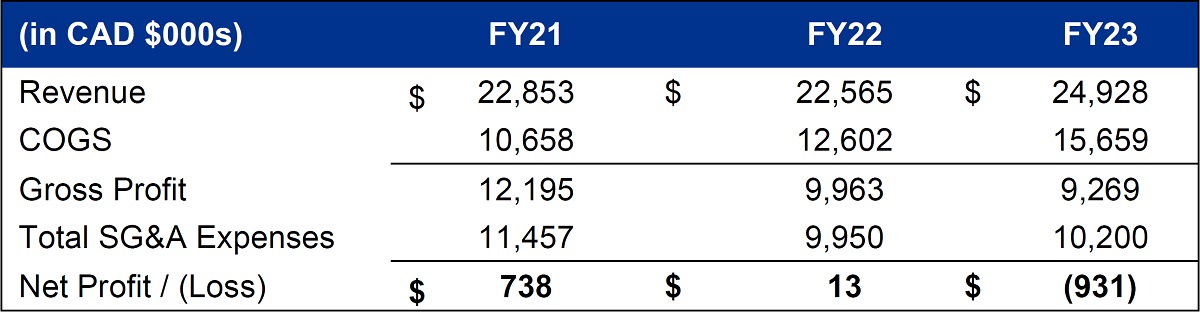

British Columbia-based Douglas Lighting Controls was actually a profitable business during and after the Atar Capital acquisition. But profits waned during the last two fiscal years. The fiscal year for the company reportedly ended March 31 each year, so the company was on the brink of exceeding $25 million CAD in revenues, but closed the doors with days remaining on FY23.

Backruptcy filings attribute the profit decline to the prolonged impact of the COVID-19 pandemic, leading to supply chain disruptions, delays, and heightened costs.

In fiscal 2021, the filings report that the company generated a net profit of around $738,000 CAD. By contrast, in fiscal 2022, the company's net profit dwindled to an approximate break-even point. In fiscal 2023, Douglas Lighting Controls reportedly incurred a net loss of about $931,000 CAD, ascribed to the aforementioned supply chain issues and an escalation in operating costs.

The Douglas Lighting Controls bankruptcy may insulate them and Atar Capital from Wrongful Termination lawsuits

Inside.lighting was the only electrical/lighting media to report on two lawsuits filed relating to the sudden shutdown of Douglas Lighting Controls.

Douglas Lighting Controls, along with its parent company, Atar Capital (California-based private equity firm), have found themselves facing two distinct, yet fundamentally similar lawsuits. Both suits are filed from the province of British Columbia, Canada, where two former employees allege wrongful termination.

Karen Veinot and Pedro Cabañas, represented by Vancouver's Samfiru Tamarkin LLP, both claim that their sudden layoffs from Douglas Lighting Controls on March 22 resulted in significant financial damages. Veinot, a veteran of the company with a 30-year tenure, was serving as Senior Production Design Coordinator with an annual income of $100,000 CAD. Cabañas, with 12 years under his belt, was earning $120,000 CAD annually in his role as Director of Information Technology.

In the Cabañas lawsuit, Atar Capital has informed the courts that the private equity firm is not responsible. Below are some of their claims:

-

Atar Capital denies being the parent company, owner, or a shareholder of any kind in Douglas Lighting. Douglas Lighting Controls Inc., which filed for bankruptcy protection in June 2023, operates as an independent business providing lighting solutions, according to Atar Capital.

-

Atar Capital refutes being a creditor of Douglas Lighting.

-

Atar Capital has no knowledge of the employment conditions of Pedro Cabañas, the plaintiff, at Douglas Lighting.

-

Atar Capital denies that Cabañas has suffered any loss or damage for which Atar Capital is responsible.

-

Atar Capital denies any involvement in an alleged scheme to defraud Cabanas or hinder his claims by manipulating Douglas Lighting's funds.

-

Atar Capital refutes all allegations made by Cabanas, labeling them as baseless and unfounded.

-

Atar Capital seeks to have the legal action against it dismissed and asks for special costs to be paid to them.

What about ULT and the Mexican factory?

Based on the way things are playing out, inside.lighting believes that some of ULT’s remaining assets will be sold to a strategic buyer in the U.S. and that ULT will eventually file for bankruptcy in a U.S. court. ULT had an auction of certain assets in Tennessee and Alabama last month.

Similarly, with numerous reported legal actions filed against ULT’s Mexican factory subsidiary, Componentes Universales de Matamoros, we expect that company to file for bankruptcy in Mexico and eventually be sold to another interest likely to be outside of the lighting industry.