March 28, 2023

Universal Douglas Goes Dark: More Details & Fallout

The PE firm behind the shutdown. Stakeholders scramble while assessing delays and potential financial loss.

It’s been six days since the electrical industry was surprised by the abrupt, sudden and alarming closure of Universal Douglas. Stakeholders across the electrical and lighting industries were surprised and upset by the sudden closure – but perhaps none as much as Universal Douglas employees who were beckoned to attend a company-wide Wednesday morning conference call. No agenda or details were floated about the call, causing some to wonder if they were about to hear exciting news about Universal Douglas being acquired by another company.

As we now know, an acquisition was not announced. In fact, if one had to imagine an outcome that would be the extreme polar opposite of exciting acquisition news, this might be it. Nearly all employees learned that their jobs would be eliminated immediately. Company executives informed employees that Universal Douglas was shutting down immediately.

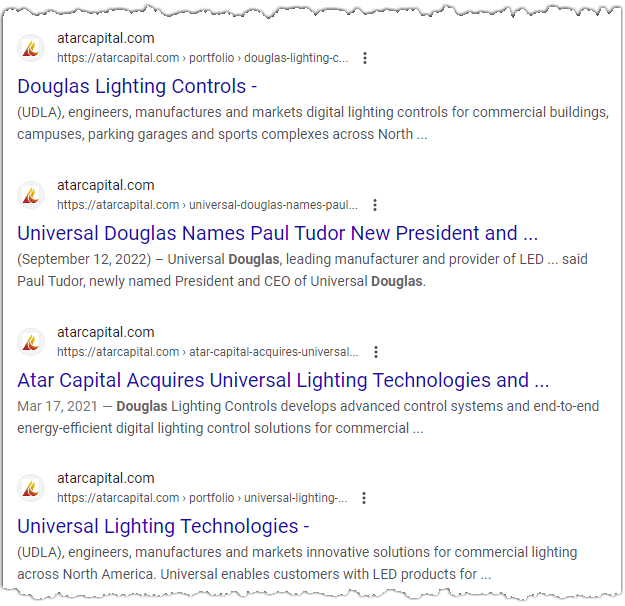

The websites of Universal Lighting Technologies and Douglas Lighting Controls are still active, but Atar Capital, the private equity firm that in 2021 acquired Universal Lighting Technologies and Douglas Controls from Panasonic, has scrubbed all mentions of ULT, Douglas Controls and Universal Douglas from its website.

Above: Google results of now-deleted webpages on the Atar Capital website

Atar Capital’s “Turnaround CEO”

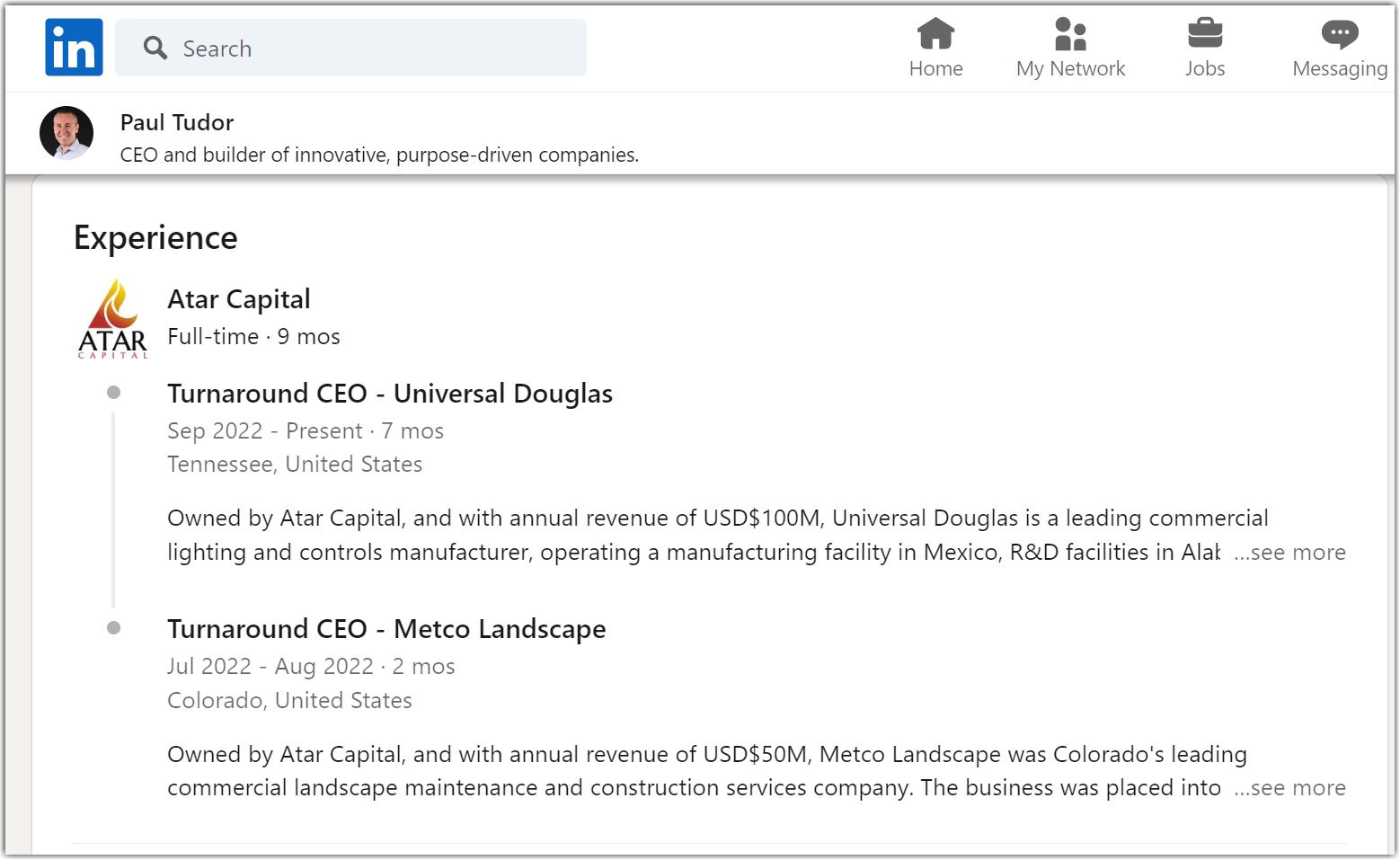

In September 2022, Universal Douglas announced Paul Tudor as its new President and CEO. Tudor succeeded Ty Anderson who, after fourteen years with the company, was retiring.

The LinkedIn profile for Universal Douglas CEO, Paul Tudor, cites him as being an employee with Atar Capital since July 2022. Tudor describes himself as a “Turnaround CEO” yet the first two assignments he’s had during his first eight months with Atar Capital have seemingly ended in abrupt layoffs and business liquidation.

Above: Excerpt from Tudor's LinkedIn Profile

Rinse & Repeat? Atar Capital had a similar shutdown in 2022

Atar Capital acquired Metco Landscape in 2021, the same year Colorado’s largest privately-owned landscaping company was ranked 27th on The Lawn & Landscape Top 100 list – citing $78 million in revenues and 550 employees. Shortly after Tudor joined Atar in 2022, the company laid off the remaining 343 workers and entered into receivership – meaning that an independent third party, was appointed by a court, a creditor or a regulator to take control of the business and its assets in order to recover the debts owed to creditors.

According to letters submitted by Metco Landscape to the Colorado Secretary of State, notification of Metco Landscape layoffs occurred on July 28, 2022, with the terminations occurring the same day. Metco claimed that it could not provide notice to employees any further in advance due to a number of factors.

With Tudor joining Metco the month before the company shut down, it wouldn’t be fair to blame the company’s failure on Tudor. Sometimes CEOs are brought in to crash the plane, and Metco’s failure may have been inevitable by the time Tudor joined.

Similarities Between Metco & Universal Douglas

It’s hard to ignore some of the parallels between Metco and Universal Douglas:

-

Atar Capital purchased each company in 2021

-

Both companies reportedly generated $75 million to $100 million in revenue

-

Atar Capital appointed Paul Tudor as CEO of each company

-

Abrupt announcement of immediate layoffs occurred before state governments were provided legally-required notice of mass layoffs

-

Abrupt announcement of immediate business closure

All of this makes us wonder how employees of the next Atar Capital portfolio company will feel when they learn that Paul Tudor is their new President and CEO.

More Fallout from Universal Douglas’ quick shutdown

Here is some of the anecdotal feedback we’ve learned from customers and other lighting stakeholders:

-

Systems awaiting parts: A number of Douglas Lighting Control projects are awaiting shipment of certain items to complete mid-large sized lighting control projects. Smart wall controls or occupancy sensors that work with Douglas Lighting Controls systems will not be shipped. This is causing kludgy makeshift solutions to be implemented that will hinder the specification intent of the system.

-

Quick Scramble/Substitution: A number of agents have Douglas Lighting Control projects in signoff and release status. Projects will not be shipped, causing specifiers and agents to hurriedly reengineer other lighting controls solutions – putting entire project timelines at risk. One agent cited the risk of losing an entire order, because the agency doesn’t represent brand that offers a wired lighting controls network solution – and wireless was not an consideration for the project.

-

LED Driver Swap-outs: Universal Lighting Technologies drivers are widely used and specified. OEMs and distributors are seeking other solutions from other manufacturers including:

-

Advance (Signify)

-

Analog Devices

-

eldoLED/OPTOTRONIC (Acuity Brands)

-

ERP Power

-

Fulham

-

Hatch Lighting

-

Inventronics

-

Keystone Technologies

-

LTF Technology

-

Lutron

-

Magnitude Lighting

-

Tridonic

-

Delays caused by driver swap-outs are causing shipment delays by lighting manufacturers who are adapting supply chain on the fly.

-

Employees left in the dark: The Universal Douglas fiscal year was reportedly about to end on March 31. Some bonus-eligible employees were on pace to earn a nice payday. Management hasn’t indicated whether or not bonuses will be paid, but recently terminated employees have reason to be skeptical about employees being given anything above what might be required by law. As of Sunday, some employees didn’t have official word on final paycheck eligibility or whether there would be severance for longtime employees.

-

Agent commissions: Lighting agents who have invested years, and possibly decades, into building ULT and Douglas Lighting Controls business in their local markets have not yet been compensated for February sales. Monthly commission payments are usually distributed on the 20th of the following month and, as of this morning, multiple agents report no February commission payments. The shutdown occurred on March 22.

-

Agent personnel: Agents that earned $5,000 - $10,000 per month in ULT commissions were able to cover most or all the cost of an inside person or outside salesperson with the monthly commissions. The immediate departure of those once steadily reliable commissions, may cause sporadic elimination of certain jobs for various agents.