November 10, 2022

Another Rough Quarter for Energy Focus

Executives arrive, then leave. Nasdaq delisting notice. Smaller revenues. Larger losses.

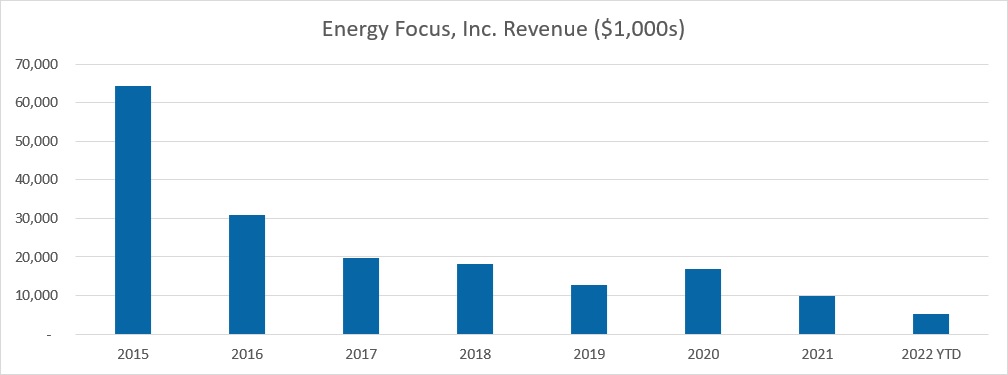

Energy Focus today reported quarterly results for the period ended September 30, and the company’s performance continues to reveal revenue and profit challenges. Quarterly revenues were $1.76 million while net losses grew to $2.66 million for the quarter. The Ohio company logged annual revenues in excess of $60 million in 2015 and has seen sales steadily decline since then.

2022 YTD sales are $5.3 million for the nine-month period ended September 30.

From a personnel perspective, Energy Focus issued two third-quarter announcements about important executive hires. In August, the company announced the appointment of “Three New Executives to Augment Commercial LED Lighting Industry Growth.” Today, only one of the three new executives still remain with the company. In September, Energy Focus announced the appointment of new CEO, Lesley Matt. The former TCP marketing executive was tapped to lead the company's turnaround amidst shrinking revenues and negative profits.

On August 15, inside.lighting observed that the company’s stock price had dipped below $1 for over thirty consecutive days and reported that Energy Focus Faces Risk of Nasdaq Delisting. One week later, Energy Focus received a Notice of Delisting from NASDAQ and has until February 20, 2023 to meet NASDAQ listing requirements by consistently maintaining a minimum closing bid price of $1.00 per share. Today the stock is selling at $0.32 per share during intraday trading.

Clifford Griffin, SVP, Corporate Controller and Chief Accounting Officer was one of the three new hires announced by the company in early August. He hasn’t filed any financial statements on behalf of the company since late August and has reportedly left the company. CEO, Lesley Matt, signed the SEC filings related to today’s quarterly earnings announcement.

In today’s announcement, Matt noted that “cost-cutting and inventory refresh efforts are ongoing, but have not yet started to contribute positively.”

With little time to settle in, managing costs and debt seem to be important priorities for the new CEO. In September, a private lender provided $450,000 at 8% APR that comes due in June 2023. In October, the company issued 385,000 shares of company stock, then trading around $0.50 per share to cover a $205,000 promissory note issued by Streeterville Capital in April 2021.

Stephen Socolof, Chairman of the Board of Directors and previously the Interim Chief Executive Officer reported that the Board of Directors described enthusiasm for now having Matt at the helm where she is aggressively pursuing further cost reduction opportunities and sales opportunities.

The company reports focusing on engineering and supply chain management initiatives, including supplier diversification, which is expected to reduce cost of goods and make Energy Focus more competitive.

See the complete Third Quarter report »