August 15, 2022

Energy Focus Faces Risk of Nasdaq Delisting

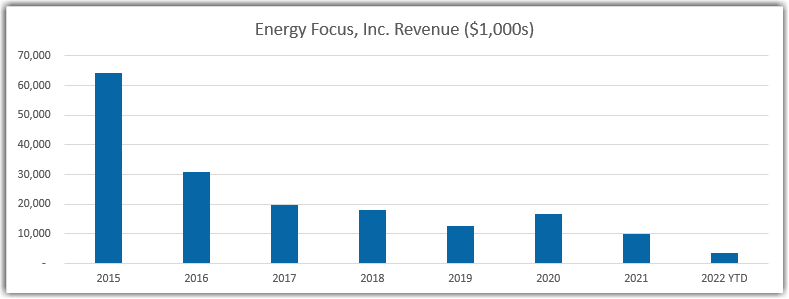

Once a $64 million company, last quarter's sales dip to $1.5 million

Ohio-based LED lighting maker, Energy Focus (NASDAQ:EFOI), recent quarterly earnings report revealed that the company continues its struggles as sales for its second quarter ended June 30 dipped to $1.5 million. For the 26th consecutive time, the company reported an unprofitable quarter, with the most recent quarter notching a net loss of $2.5 million.

The publicly traded company’s stock is currently trading intraday at $0.75 and has closed at a price less than $1.00 every trading day since July 8. This 30+ day under-one-dollar streak may soon cause Nasdaq to send a deficiency notice to the company, advising that it has a period of 180 calendar days to regain compliance with the applicable requirements, or face delisting. The company has received multiple delisting notices in past years, but has managed to remain compliant with stock exchange guidelines.

Earlier this year, Energy Focus announced the departure of CEO James Tu. Board member and experienced venture capitalist, Stephen Socolof, is currently serving as Interim CEO while the apparent search for a permanent CEO is underway.

Above: Reported revenues of Energy Focus, Inc. YTD is through June 30, 2022.

Net sales of $1.5 million decreased 28.6% compared to sales of $2.1 million in the second quarter of 2021. During last week's investor call Energy Focus Chief Accounting Officer, Cliff Griffin, stated that the dip was "mainly due to delayed funding related to military projects, utilizing our products, as well as fluctuations in the timing and pace of commercial projects, and the lingering macroeconomic supply chain impact as a result of the COVID-19 impact."