February 5, 2026

Orion Eyes a Rare Breakout, If It Can Stick the Landing

Company signals sustained revenue momentum extending through FY27

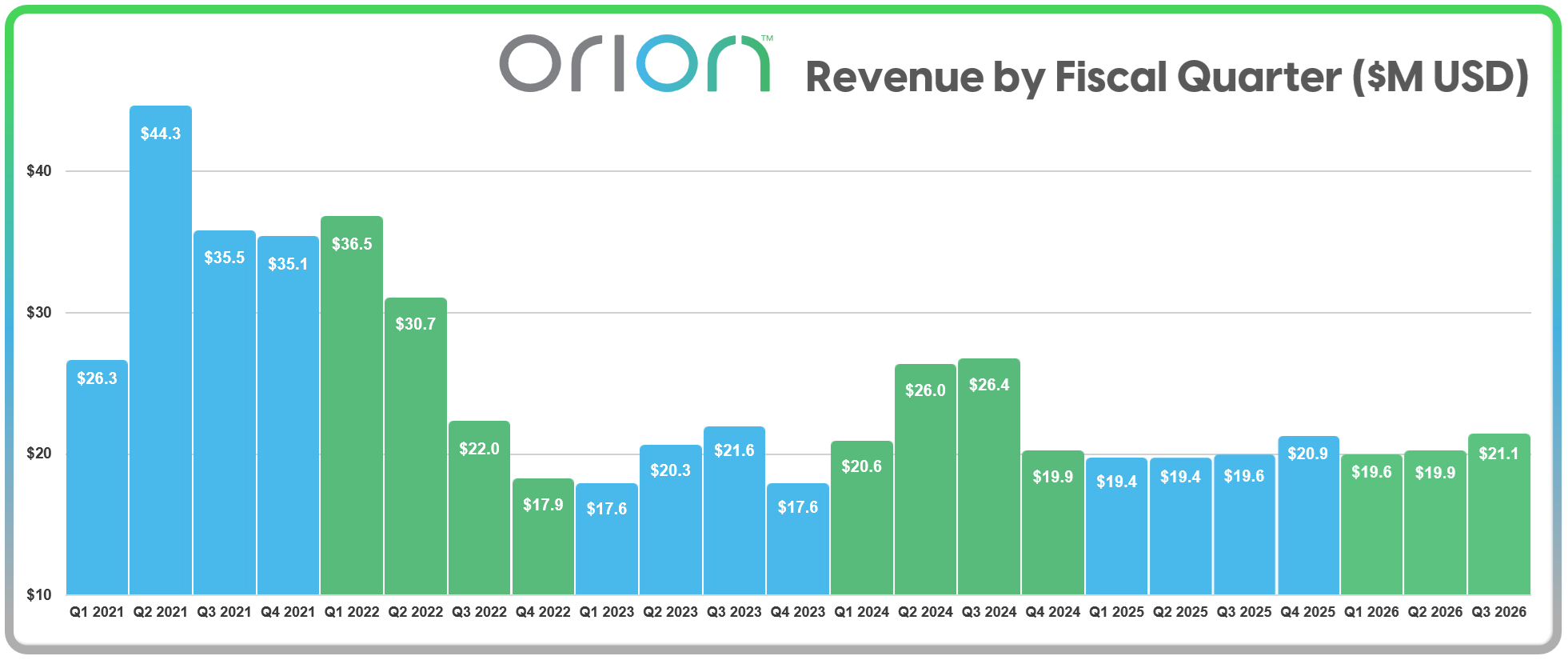

For two years, Orion Energy Systems has been circling the same tight revenue airspace: eight consecutive quarters in the $19-21 million range, delivering what can best be described as stable drift. But based on new filings released today, that pattern may finally be breaking. Quietly, and with caveats.

Orion’s third quarter results, tucked into this morning’s 8-K SEC filing, point to an implied Q4 revenue surge that, if achieved, would mark one of it's best top-line quarterly numbers in four years. To hit the company’s reiterated full-year guidance of $84-86 million, Orion must generate $23.4 to $25.4 million in its fourth fiscal quarter. That would not just break the pattern, it would shatter it.

There’s a catch: the quarter is already one-third over.

A closer look at quarterly results shows diverging trends across the business.

- LED lighting: Revenue was $12.1 million, down from $13.2 million a year earlier, reflecting weaker ESCO and turnkey project activity, partially offset by growth in the distribution channel.

- EV charging: Revenue rose to $4.7 million, up from $2.4 million, driven by the timing of larger projects and increased fleet installations.

- Maintenance: Revenue increased to $4.4 million, compared with $3.9 million a year earlier, supported by new customer contracts and expansions within existing accounts.

Orion generated approximately $800,000 in operating profit for the quarter — about 3.6% of revenue. That’s still a thin margin, but notably better than a year ago, when the company was barely breaking even.

A Pattern That Might Be Ending

Over the past year, Orion’s story has been one of increased discipline. CEO Sally Washlow has tightened expenses, improved gross margins, and restored modest profitability. But despite these internal wins, top-line growth has remained frozen in place. Revenue for Q3 clocked in at $21.1 million — right at the ceiling of the company's now-familiar range.

So why the optimism?

Partly, it’s math. Orion has already booked $60.6 million in revenue through the first nine months of its fiscal year. That leaves a substantial chunk needed in Q4 to meet its full-year forecast. Partly, it’s timing. The company is now five weeks into that critical quarter, so they see how things are unfolding. Finally, it’s momentum, albeit cautious, from recent wins.

Those include a new $14-15 million contract for exterior lighting awarded by Orion’s largest customer, widely believed to be The Home Depot, on the heels of a $42-45 million three-year preventative maintenance renewal set to begin in March. While the renewal itself won't contribute materially to Q4, the additional project work may.

Still Buying Time, Not Growth

All this arrives days after Orion raised $7 million via a public stock offering — a move aimed at paying down its revolver and preserving operational liquidity. The raise signaled both a lifeline and a red flag. It wasn’t about expansion; it was about keeping the machine running.

Meanwhile, the arbitration over the Voltrek earnout — tied to Orion’s 2022 EV charging acquisition in Lawrence, Massachusetts — continues to loom. The latest filing confirms that dispute remains unresolved. Orion’s stock-based partial payment of that earnout, combined with subordinated debt issuance, shows just how carefully the company is threading the liquidity needle.

The EV charging segment itself nearly doubled year-over-year to $4.7 million, though it remained flat sequentially. Orion attributes this to “variability in timing of larger projects,” which is another way of saying: don’t bank on a straight line up.

Can They Stick the Landing?

If Orion can actually deliver a $23-25 million fourth quarter, it would represent a rare breakout moment. It would also suggest that Washlow’s steady operational improvements are starting to pay off in material ways — not just on margin lines, but in revenue.

But there are still only 55 days left in the fiscal year. The window is open, but not wide. Orion now needs to close the quarter strong, deliver the kind of volume it hasn't seen in years, and do it while continuing to manage strained cash and an unresolved acquisition arbitration.

And if they do stick the landing, there’s little time to celebrate. On April 1, Orion resets the clock with a new fiscal year, and a new bar. The company is guiding fiscal 2027 revenue to fall between $95 million and $97 million. That would require quarterly averages of around $24 million. So while Q4 might mark a breakout, the real test is whether Orion can make the leap stick.