February 3, 2026

Delviro Collapse Could Trigger Personal Liability for Owner

Investigators describe a tangled and murky flow of money and assets

By now, the strange implosion of Toronto-area Delviro Energy is fairly well known in lighting industry circles — the LED manufacturer that left a trail of missing gear, vanishing inventory, and eyebrow-raising transactions before collapsing into insolvency in 2025. A July 2025 receiver report gave us a list of eight red flags. Now, a third report, filed in late January, not only confirms those suspicions — it widens the blast radius.

Ernst & Young, the court-appointed receiver, has turned up over $15 million in what it calls “reviewable transactions” — many tied to owner Joseph Delonghi, his companies, and, possibly, his spouse. These are allegations made in court filings and have not been tested or proven before a judge.

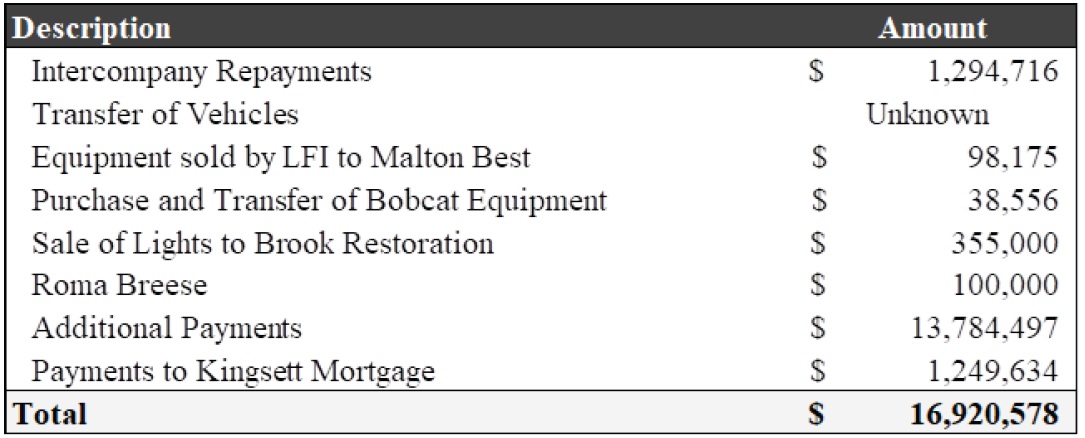

Delonghi hasn't been charged with any crime. But the civil legal stakes are rising — the receiver is now seeking to hold him personally liable for nearly $17 million.

The Original 8 Moves: Now Confirmed or Expanded

What began as eight oddities has become a far more detailed accounting of questioned transactions. Here’s what’s changed according to the latest Ernst & Young filing:

1. Missing Equipment

Confirmed. Now tied to a $98,175 sale, the report alleges fraudulent invoices by Delonghi’s real estate company LFI. The equipment was originally appraised at $140,000 and diverted after receivership began.

2. Cars for $1 Each

Still no lease documentation. Seven vehicles were transferred for a loonie each. One car, a Tesla, was reportedly in such bad shape it had “negative equity.” Delonghi refused to take that one.

3. Money Transfers

From $1 million to more than $15 million. The cash flowed fast, especially in the three months before Ernst & Young arrived. One chunk: $263,570 paid to related parties after Delviro ceased operations.

4. Intercompany Transactions

Now formally tracked and confirmed as undocumented, interest-free, and authorized solely by Delonghi. His explanation? Since he controlled all entities, there was no need for paperwork.

5. Construction Equipment

Tracked. Delviro bought a Bobcat loader for nearly $39,000, but the invoice was redirected to a Delonghi-linked company, Newbridge. The equipment? Gone from Delviro’s premises.

6. Cigarette Stuffing Machine

Still seized. Still valued, oddly, at over $2.1 million on Delviro’s books. It was detained by customs. Never licensed, never delivered, and never explained.

7. Missing Records

Diprofio, Delviro’s former finance manager, testified under oath last summer. But documentation gaps persist — no server lease, no equipment receipts, and no sign of the promised vehicle paperwork.

8. Inventory Disappearance

Still missing. The receiver has never been provided with a full reconciliation of Delviro’s $5.3 million in reported inventory. But one telling example emerged: in December 2024, $355,000 worth of lighting was sold to Brook Restoration. The invoice was issued not by Delviro, but by LFI, a related-party real estate firm. The money went to LFI — and no documentation shows Delviro ever transferred the inventory. The receiver says the transaction raises questions about whether assets were transferred without proper documentation.

What’s New: Fresh Red Flags

The January 2026 filing adds new names, new numbers, and new ways Delviro’s cash may have slipped away. According to Ernst & Young:

Questioned Paint Line Transactions

The “state-of-the-art” powder coating line, long featured on Delviro’s website, was quietly sold with other equipment — despite claims the company didn’t own it. Creditors later contacted the receiver over unpaid pigment invoices.

Mortgage Payments

Over $1.2 million in Delviro funds went to pay a mortgage for 94 Brockport — a property owned by LFI, not Delviro. The receiver believes the payments provided no benefit to Delviro while it was insolvent.

$100K to Roma Breese

An unsecured loan to Delonghi’s sister. No interest. No terms. No repayment plan. Just $100,000 out the door, while suppliers went unpaid.

The Legal Stakes: Veil Piercing & Personal Liability

The receiver is now swinging for the fences — asking the court to hold Joseph Delonghi personally liable. That’s not a routine move. It’s reserved for cases where someone has so thoroughly blurred the lines between business and self-interest that the court no longer recognizes a corporate boundary.

The report claims Delonghi treated Delviro and its affiliates “as interchangeable,” moved millions without documentation, and, in many cases, benefited from the proceeds. If the court agrees, he could be held jointly liable for nearly $17 million in identified transactions.

What’s Next?

The bankruptcy is now official. EY doesn’t expect much more to be recovered. Most assets are sold, gone, or tangled in the transactional mess left behind.

Meanwhile, Delonghi continues to argue that the National Bank of Canada signed off on most of what he did. That’s now the subject of separate litigation — one that could drag on for months or longer.

But for now, the court will decide whether Delonghi should be held personally liable for millions in allegedly diverted funds. And whether the tangled web of companies he controlled was ever really separate from Delviro at all.