October 9, 2023

Commercial Planning Slows Down; Institutional Pushes Ahead

Three projects, each valued at $400M+ get rolling in California

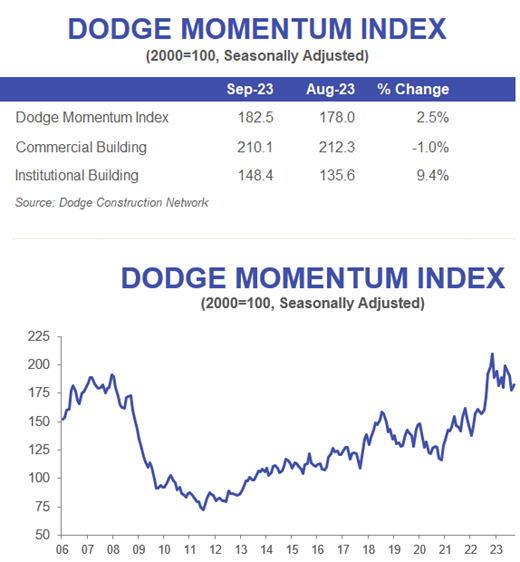

HAMILTON, N.J. — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, improved 3% in September to 182.5 (2000=100) from the revised August reading of 178.0. Over the month, the commercial component of the DMI fell 1%, while the institutional component increased 9%.

“Solid demand for data centers, life science labs and hospitals supported the uptick in nonresidential planning activity last month,” said Sarah Martin, associate director of forecasting for Dodge Construction Network. “While month-to-month trends can be volatile, year-to-date trends show an overall decrease in commercial planning, offset by more institutional projects entering the queue. If financial conditions improve in early 2024, steady planning activity should follow.”

Three-month trends: inside.lighting analysis over the last 90 days

Commercial vs. Institutional Planning Dynamics:

Commercial Planning: Commercial planning is experiencing a downward trajectory. In each of the most recent three months, the commercial component showed a decline: 0.2% in July, 1.6% in August, and 1% in September. The weaker office planning has been a significant driver of this decline. Although there were some major commercial projects entering planning in these months, the overall trend for commercial projects is bearish, and there is an overall decrease in commercial planning year-to-date.

Institutional Planning: Over the most recent three-month period, there is a general upward trend for institutional projects, especially in September when the institutional component increased by 9%. While there was a significant dip in August with a 14.8% decline, it is noteworthy that the increase from July to September indicates a level of resilience and recovery in this sector. Year-to-date trends for the period show an increase in institutional projects, particularly in sectors like education, life science buildings, and healthcare.

More Dodge info & analysis

Weaker office planning drove the commercial segment of the DMI down, while the acceleration in the institutional segment was supported by stronger education, notably life science buildings, and healthcare planning activity. Year over year, the DMI was 5% lower than in September 2022. The commercial segment was 12% below year-ago levels, while the institutional segment was up 12% over the same time period.

A total of 20 projects valued at $100 million or more entered planning in September. The largest commercial projects to enter planning included the $400 million Platform 16 office development in San Jose, California and the $230 million Waterford Millstone Data Center in Waterford, Connecticut. The largest institutional projects to enter planning included the $927 million UC San Diego Research Park in San Diego, California and phases three and four of the Kilroy Oyster Point Life Sciences Complex in San Francisco, California, valued at a total of $634 million.

The DMI is a monthly measure of the initial report for nonresidential building projects in planning, shown to lead construction spending for nonresidential buildings by a full year.

Watch Associate Director of Forecasting Sarah Martin discuss September’s DMI here.

September 2023 DODGE MOMENTUM INDEX

About Dodge Construction Network

Dodge Construction Network is a solutions technology company providing an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry. The company powers longstanding and trusted industry solutions to timely connect and enable decision makers across the entire commercial construction ecosystem. For more than a century, Dodge Construction Network has empowered construction professionals with the information they need to build successful, growing businesses. To learn more, visit construction.com