October 30, 2023

11 Key Insights from Acuity Brands' Annual Report

Operational subtleties unveiled in the just-issued report from North America's lighting industry frontrunner

Acuity Brands, a juggernaut in the lighting industry routinely unveils crucial insights into its financial health each quarter. For the entire Fiscal Year 2023 which ended on August 31, sales stood at $3.95 billion, representing a slight 1.3% dip compared to the previous year. However, it's the annual report that truly lays bare the intricacies of the company’s operations, offering a more detailed picture of its financial and operational landscape.

Related: Acuity Brands 2023: Solid Performance Amidst Choppy Markets

At inside.lighting, we’ve meticulously combed through all 261 pages of Acuity Brands' 10-K report, filed last Thursday with the SEC. This wasn’t just a skim through the numbers; it was a deep dive, aimed at extracting the nuanced details that financial quarterly reports and accompanying press releases often overlook. Given our history of covering Acuity Brands' trajectory, we approached this task with an analytical lens, comparing and contrasting the findings with those of previous years.

Our analysis unearthed a myriad of insights. It explores subtle shifts in product sourcing, changes in employee headcount by country, the company's investment in R&D, and the number of properties they own and lease. The report paints a comprehensive picture of where Acuity Brands stands today and, possibly, where it's heading. Here are the essential takeaways that emerged from our in-depth review.

Increased R&D Investment:

Acuity Brands continues to demonstrate a firm commitment to innovation through its increased investment in research and development (R&D). The company's financial records for the fiscal years 2023, 2022, and 2021 show a steady rise in R&D expenditure. Specifically, these expenses amounted to $97.1 million in 2023, a slight increase from $95.1 million in 2022, and up from $88.3 million in 2021.

The company's R&D activities focus on creating new products and services, enhancing existing offerings, and improving energy efficiency. A significant portion of this investment is also channeled towards developing software applications and capabilities that boost data analytics for building performance, enterprise operations, and personal experiences.

By focusing on product vitality and the performance-to-cost ratio, the company aims to offer more efficient and cost-effective solutions to its customers.

Numbers behind KE2 Therm Acquisition

Acuity Brands acquired KE2 Therm Solutions, Inc., on May 15, 2023. This acquisition, funded through cash on hand, aligns with the company's ambition to broaden its Intelligent Spaces Group (ISG) segment. KE2 Therm, known for its intelligent refrigeration control solutions, brings to the table advanced technology aimed at enhancing safety, efficiency, and reliability, while also promising cost savings for customers.

Acquisition-related costs were deemed insignificant to Acuity Brands' financial statements. As of August 31, 2023, preliminary goodwill within the ISG segment was estimated at $15.0 million, an amount not expected to be tax-deductible. This goodwill reflects anticipated benefits from the expanded technology portfolio, the skilled workforce of KE2 Therm, and potential synergies from integrating the operations.

Numbers Behind Sunoptics Divestiture

In fiscal year 2023, Acuity Brands sold its Sunoptics prismatic skylights business to AES Industries, an Alabama-based manufacturer of roof curbs and provider of specialty recycling and landfill avoidance programs. The transaction, completed in November 2022, saw the transfer of assets totaling a carrying value of $15.1 million. These assets primarily comprised intangibles with definite lives, inventories, and allocated goodwill from the Acuity Brands Lighting (ABL) segment.

Acuity Brands recognized a pretax loss of $11.2 million on the sale. In addition to the recognized loss, Acuity Brands also recorded impairment charges for certain retained assets. These charges relate to the decrease in the recoverable value of assets that the company kept following the divestiture. Furthermore, the company incurred costs associated with employee severance and other expenses directly related to the sale.

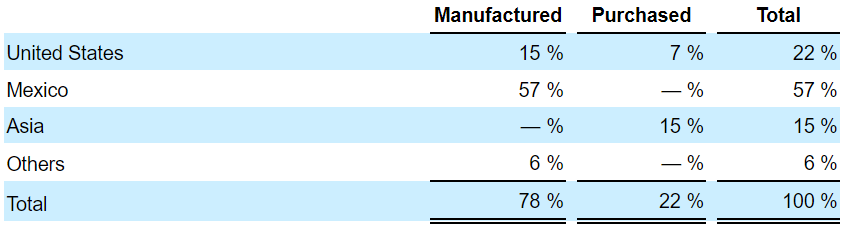

Finished Goods Origin: Over Half are Made by Acuity in Mexico

In fiscal 2023, Acuity Brands continued to show stability in its manufacturing and sourcing of finished goods across significant geographic regions. The data indicates that the company maintains a strong focus on in-house manufacturing, as reflected in the percentage of finished goods it produces.

Notably, there were no significant fluctuations in the distribution of finished goods origin when comparing 2022 and 2023. The most notable change, though minor, is the increase in the proportion of goods manufactured by the company itself. In fiscal 2023, Acuity Brands manufactured 78% of its finished goods, a slight rise from 75% in the previous year. This marginal increase underscores the company's ongoing commitment to maintaining control over its production processes and ensuring quality.

Warranty Costs Accelerate

In 2021, the company incurred $32.3 million in warranty and recall expenses. This figure surged to $47.0 million in 2022 and further increased to $52.4 million in 2023. inside.lighting, links this uptick in warranty costs to a widespread issue with purple streetlights.

The widely reported purple streetlight phenomenon, caused by LED phosphor degradation, has been observed in various U.S. and Canadian streets and highways. While Acuity Brands manufactures the AEL lighting fixtures where this issue has been detected, the actual LED components that are failing are sourced from semiconductor suppliers.

Additionally, a dispute with a vendor seems to be brewing behind the scenes. On October 4, Acuity Brands' CFO Karen Holcom disclosed that the company recorded a "$13 million pre-tax non-cash charge for the impairment of a receivable based on its collectability." This receivable, as Holcom explained, is from a supplier who owes warranty obligations to Acuity Brands. These obligations are tied to recovery of quality costs incurred for certain ABL outdoor lighting products manufactured and sold between 2017 and 2019. The company is actively pursuing recovery from this supplier.

We have contacted a representative from the semiconductor company, believed to be the supplier referenced by Acuity Brands, multiple times since October 4. Despite assurances of a response, none has been provided as of yet.

Headcount Dips by 1,000 Year-over-Year

Acuity Brands reported a noticeable shift in its workforce composition. As of August 31, 2023, the company had a global headcount of approximately 12,200 employees, a 7.5% decrease from the 13,200 employees reported in the previous year.

The distribution of Acuity Brands' workforce highlights a significant reliance on its operations in Mexico, where approximately 7,700 employees are based. This figure represents a reduction from 8,400 employees in 2022. The United States, where the company's headquarters is located, accounts for approximately 3,600 employees, down from 3,900 in the previous year. The remaining workforce is spread across various international locations, including Europe, Canada, and the Asia/Pacific region.

Notably, arrangements for about 6,500 employees in Mexico are set to expire within the next fiscal year, primarily due to the annual negotiations of union contracts. The company expressed confidence in maintaining strong relationships with both its unionized and non-unionized workforce.

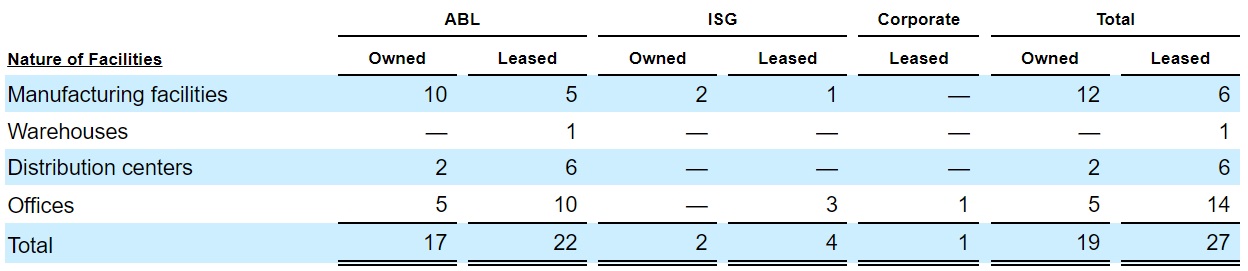

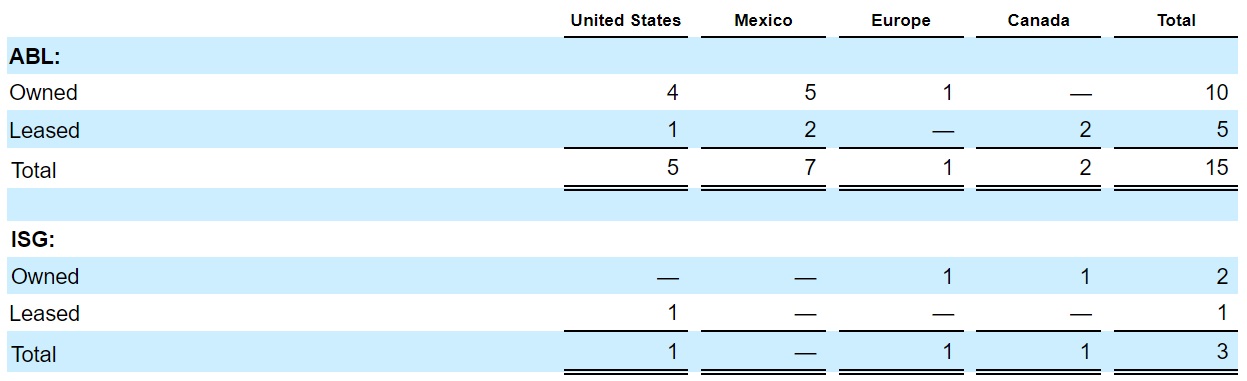

Upgrading Properties

Acuity Brands has made significant investments in their physical assets, as indicated in their recently filed annual 10-K report. The company, which operates through two main segments, Acuity Brands Lighting and Lighting Controls (ABL) and the Intelligent Spaces Group (ISG), has allocated substantial funds towards upgrading its property, plant, and equipment.

In fiscal 2023, Acuity Brands invested a notable $66.7 million in these areas, marking a noticeable increase from the $56.5 million invested in fiscal 2022. This escalation in expenditure underscores the company's commitment to enhancing its operational capabilities. The increased investment was primarily directed towards the acquisition of new and enhanced equipment, improvements in existing facilities, and advancements in information technology infrastructure.

The breakdown of the company's significant facility categories, as of August 31, 2023, reflects the strategic distribution of these investments across the ABL and ISG segments.

Shipping Costs Ease

Acuity Brands reported shipping and handling costs totaling $141.7 million in fiscal 2023, marking a 6.3% decrease from the $151.2 million incurred in fiscal 2022. This decline contrasts with the company's overall sales revenues, which dipped only 1.3% for the year. The data points toward a noncongruent relationship between the decrease in shipping costs and the slight reduction in sales revenues.

This indicates that logistics rates may have provided some relief and possibly that the company is finding efficiencies in its operations.

Data Breach Lawsuits

Acuity Brands explained that former employees have filed lawsuits following a data breach impacting personal information from the company's health plan.

The initial lawsuit was filed on Dec. 14, 2022, by a former associate in the U.S. District Court for the Northern District of Georgia. A second complaint followed on Jan. 25, 2023, by two other former associates. Both actions are putative class suits representing individuals whose data was compromised in October 2020 and December 2021 incidents.

Allegations in both complaints assert that Acuity Brands failed to safeguard associate information adequately. The claims include negligence, breach of contract, unjust enrichment, and invasion of privacy. Plaintiffs are seeking class certification, monetary damages, improved data-security measures, credit-monitoring services, attorneys’ fees, and other relief.

In a recent development, plaintiffs voluntarily dismissed these suits without prejudice in the Northern District of Georgia and refiled them in state court. Acuity Brands stated that it is formulating a response strategy to these legal actions.

Changes to CEO Severance Agreement

In his original 2020 employment agreement, Neil Ashe's annual bonus upon termination was determined by the greater of two calculations: 130% of his gross salary, prorated for the part of the year worked, or the annual incentive bonus based on company performance, also prorated.

The 2023 amendment revises how this bonus is calculated. Now, the calculation uses Ashe’s target annual incentive bonus instead of 130% of his gross salary. If the target bonus for the current fiscal year hasn't been set or has been reduced, the target bonus from the previous year is used.

This change seemingly favors the executive, Neil Ashe. By switching from a fixed percentage of his salary to his target annual incentive bonus, which would likely be much more substantial, Ashe potentially stands to gain a larger prorated bonus in the event of termination. This modification appears to provide a more lucrative safety net for Ashe.

Changes to subsidiary companies

In its latest annual 10-K report, Acuity Brands has indicated changes in its list of 39 Acuity Brands subsidiaries compared to the previous year:

-

Added to the 2023 roster are KE2 Therm Solutions, Inc. and KE2 Connect, LLC, both located in Missouri. These additions are part of the KE2 acquisition that transpired in May 2023.

-

However, two entities no longer appear as subsidiaries in Acuity Brands annual report:

-

AB BMS B.V., based in the Cayman Islands

-

Acuity Brands BMS B.V., located in Amsterdam, the Netherlands.

-