April 4, 2023

Acuity Brands Delivers Solid Quarter: CEO Praises Lighting Agents

Company delivers strong earnings, but concerns may arise from order rate slowdown

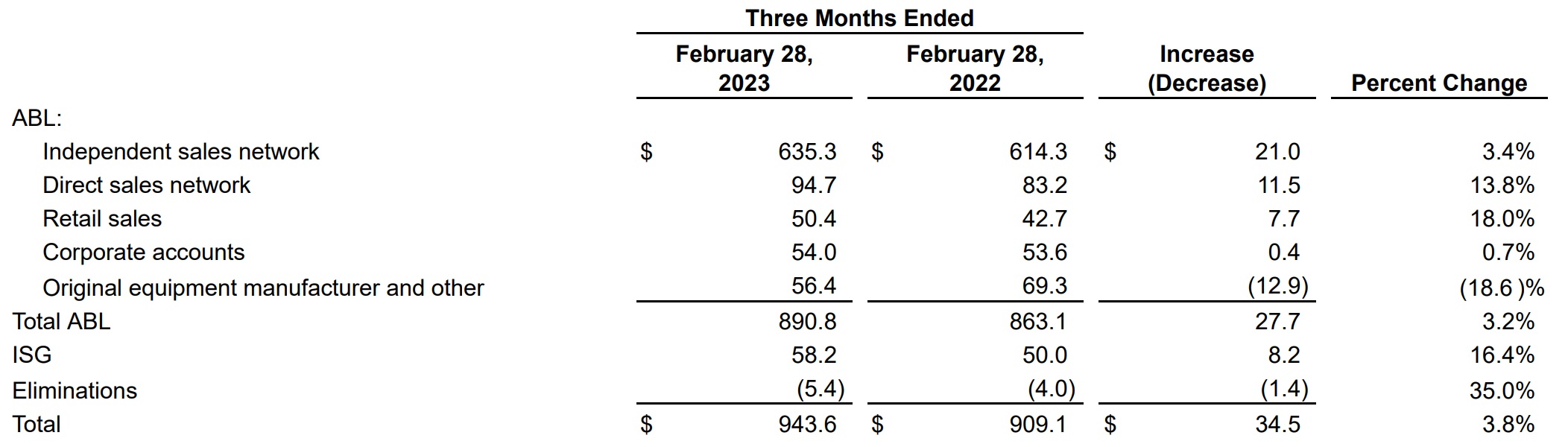

ATLANTA, GA – Today, Acuity Brands reported its Fiscal Year 2023 second quarter performance for the period ended February 28, 2022. The company’s $944 million in quarterly sales was 4% higher than the prior year, but the top line was just shy of Wall Street expectations. On the profit side, the company delivered with operating profit of $111.5 million for the second quarter, an increase of $9.2 million, or 9%, compared to the prior year.

In early intraday trading on Tuesday, Acuity Brands (NYSE: AYI) stock was trading at $169.38 a drop of $13.96 from yesterday’s close – or -7.6%. The sluggish trading day is connected to missing the Wall Street revenue consensus while also possibly projecting a softening market evidenced by a “slowing in the order rate.”

In today’s earnings call led by Neil Ashe, Chief Executive Officer, and Karen Holcom, CFO and Senior Vice President, the executives described numerous factors that are contributing to the company’s growth – including indications that supply chain pressure is easing while the company is facing a softening in order input, due, in part, to compression of lead times.

Independent Sales Agents

Ashe kicked off today’s earning call discussing the Acuity Brands independent agent network which usually delivers a little over two-thirds of all company revenues. Two weeks ago, Acuity Brands hosted NEXT 2023 its annual sales conference in Atlanta. Ashe described it as a great event, where the company brought together its network of independent sales agents, shared the strategic vision for Acuity Brands and introduced new products.

"Stated simply, we have the best agency network in the industry. To give you an idea of their scope, we have about 80 agents in North America, and they have about 50 employees per agency. In other words, we have over 4000 local sales and sales support people working for us every day throughout North America."

"While our agents are independent, they're exclusive to us for key controls, and do not represent the other majors. They're generally the largest in their market, and we are their most important partner. Our partnership works very well. With our product vitality and service efforts, we make products that deserve to be chosen, and our independent sales agents ensure that they are chosen."

— Neil Ashe, Chief Executive Officer, Acuity Brands

Slowing of Order Rate

Ashe commented “During the quarter, we began to see a slowing in the order rate for our project business. While we continue to work through our extended backlog.” Ashe attributes this to two factors: the first being the compression of lead times, which have been reduced by about 30% since their peak in the fourth quarter of fiscal 2022. As lead times have compressed, projects that would have been ordered later have already been processed.

The second factor Ashe mentioned pertains to electrical distributors. He explained that distributors manage project businesses, which are correlated to the observed softening. Additionally, distributors purchase inventory for resale, largely coming from Acuity's Contractor Select portfolio. This segment of the business has grown beyond the company's other sectors.

Looking ahead, Ashe expressed concern over mixed signals in the market. On one hand, there is economic turmoil, and tightening C&I lending rates revealed by the federal loan survey cause apprehension. However, parts of Acuity's business focused on everyday products, such as the Contractor Select line, continue to perform well.

Overall, Ashe emphasized that Acuity Brands is prepared to adapt to market fluctuations, whatever they may be, and will continue to focus on their C&I projects.

Expanding outside of North America

We took note last quarter when Ashe discussed expanding sales in continents outside of its North American stronghold. Today he reiterated the strategy to expand Distech Controls geographically, “Today, we sell our controls primarily in the US, Canada and France. And we are expanding our presence in the UK and in the future, in Asia. As we enter new markets, we are identifying and recruiting the highest quality S.I.’s (system integrators) as our partners.”

Product & Brand Mentions:

-

The nLight AIR System Input Device (rSI) converts analog device outputs (0-10V) and dry contact outputs to wireless, nLight AIR broadcasts to control intelligent luminaires and other lighting control devices.

-

The nLight AIR rPOD Micro is a battery-powered wall switch that features an ultra-thin design and far-reaching wireless range.

-

A-Light, Eureka, and Luminis won a total of eight GOOD DESIGN Awards from The Chicago Athenaeum which recognizes products and industry leaders in design and manufacturing

-

Distech & Atrius comprise Acuity Brands’ Intelligent Spaces Group (ISG). Holcom detailed ISG performance, “Sales in the second quarter of 2023 were $58 million, an increase of $8 million, or 16% versus the prior year, primarily as a result of the growth in Distech. During the quarter, both Distech and Atrius, delivered growth across new and existing customers.”

Ashe wrapped up the earnings call stating : “We're pleased with our performance so far this year. We are in control of what we can control and we're confident about our ability to deliver no matter the market conditions or our customer requirements.”