January 9, 2023

Acuity Brands Starts 2023 with $1 Billion Quarter

Earnings call gets peppered with questions about commissions

ATLANTA, GA – Today, Acuity Brands reported its Fiscal Year 2023 first quarter performance for the period ended November 30, 2022. The company’s 8% sales growth over prior year was good news, but it ended its six-quarter streak of double-digit percentage revenue growth. So the company is still growing, but the pace of growth slowed down a smidge to start the new fiscal year.

In today’s earnings call led by Neil Ashe, Chief Executive Officer, and Karen Holcom, CFO and Senior Vice President, the executives described numerous factors that are contributing to the company’s growth – including indications that supply chain pressure is easing while the company may be eyeing acquisitions related to Distech Controls and Atrius.

Here are more takeaways from Acuity's published reports and earnings call:

-

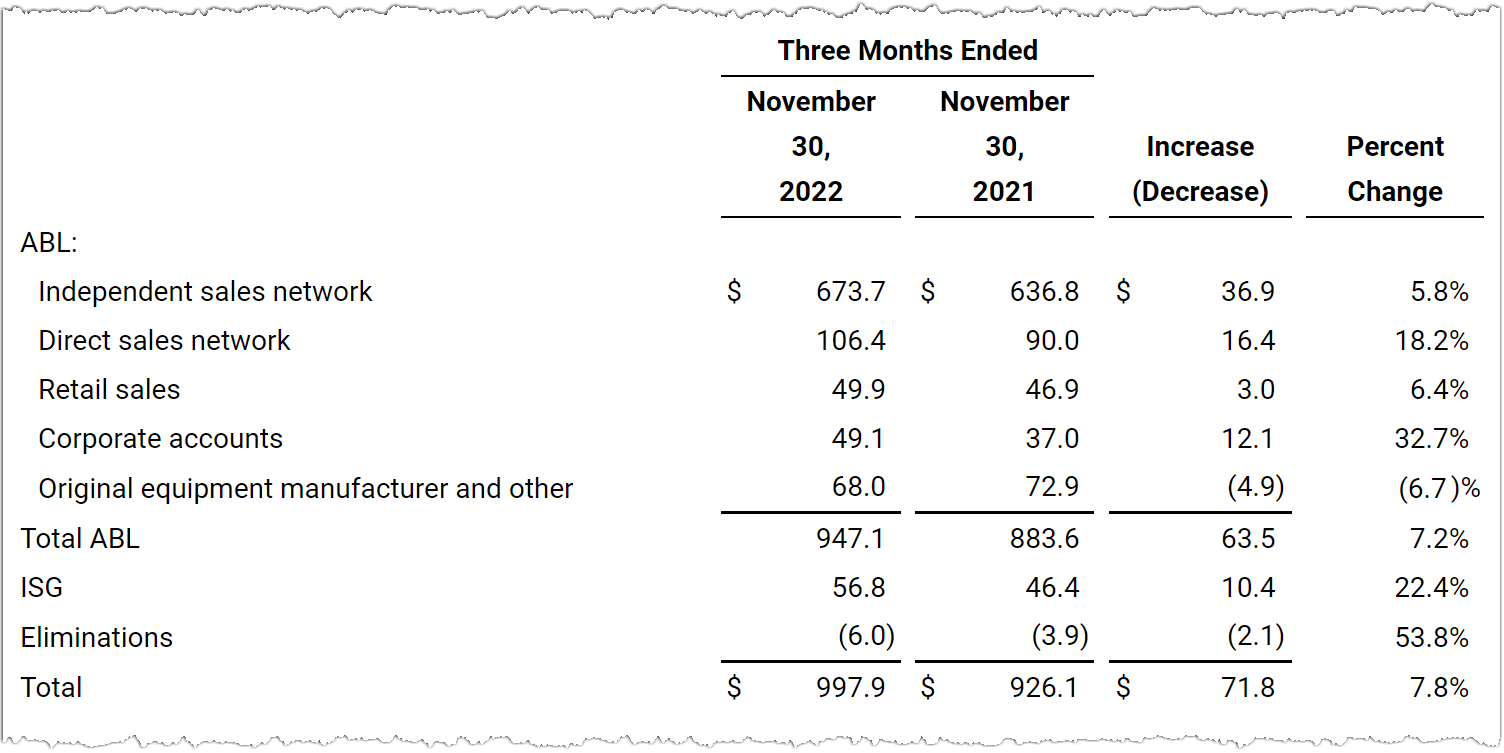

Acuity Brands Lighting and Lighting Controls (ABL) generated net sales of $947.1 million in the first quarter, up 8%.

-

Intelligent Spaces Group (ISG) generated net sales of $56.8 million in the first quarter, up 22%.

-

ABL operating profit as a percent of ABL net sales was 12.5% in the first quarter of fiscal 2023, a decrease of 200 basis points from 14.5%.

-

Acuity Brands' first quarter results beat Wall Street expectations causing an intraday trading stock price bump of over 6% to $180.00 per share.

Lots of talk about Commissions

Early in the earnings call, Holcom described multiple factors that impacted operating profits including “strategic decisions made for fiscal 2023 around commissions.” The brief mention garnered multiple questions from the analysts including Jeffrey Sprague of Vertical Research Partners whose first question raised the commissions topic for the fourth time during the earnings call when he asked, in part, “I feel like we’re beating a dead horse with this commission question…it sounds like you’re paying higher commissions today for potentially better sales in some future period. Is something else going on here…?”

-

The Acuity Brands executives explined that investments were made in direct sales force commissions so that Holophane may be better positioned for the anticipated growth in outdoor lighting business related to higher expected U.S. infrastructure spending.

-

Investments in increased commissions were made to secure certain project business.

-

In some cases, Acuity Brands is paying double commissions on existing business.

-

Recent agent changes in New York (Feb 2021) and Atlanta (Nov 2022) were mentioned multiple times as having an impact on commission expense. The topic was framed as "a net investment in commissions." We interpret the market-specific mentions to indicate that Acuity Brands is providing startup funding, bonuses and/or premium commissions to New York’s Illuminations Inc. and Atlanta’s Lighting Associates that would impact the company’s overall commissions expense for fiscal year 2023.

Ashe clarified that these commission impacts have a net impact on total commission dollars but are not indicative of a permanent change to the percentage of sales that Acuity Brands invests in commissions. Holcom added that the increased commission costs are expected to continue through the balance of the year at this level.

Shedding Winona Custom and Sunoptics cost $22 million

In late October, Acuity Brands sold its daylighting business, Sunoptics, to AES Industries. To date, inside.lighting's November 2022 article Acuity Brands to Discontinue Winona Custom is the only published media report that detailed Acuity Brands’ plans to discontinue its Winona Custom architectural lighting business.

Ashe explained that the businesses were no longer strategically relevant and that the company did not expect them to meet financial expectations in the future. Holcom elaborated on the financial impact explaining that Acuity swallowed $22 million in non-recurring charges related to impairments, severance, accelerated amortization and a loss on the sale of the Sunoptics business.

Ashe summarized, “We do want to get in front of changes we see in the marketplace… Sunoptics was an acquisition from about 2013 or so that just frankly wasn’t performing anymore. Our Winona Custom business was just that, a custom business, that we didn’t expect to perform in the upcoming environment.”

Backlog & Supply Chain

Acuity Brands’ expectation is that as component availability becomes more consistent, the company will continue to be able to reduce lead times. Ashe clarified that component availability is more consistent but not yet back to normal. This enables Acuity Brands to reduce lead times work through its backlog which Ashe estimates had peaked in the second or third quarter of fiscal year 2022.

Ashe mentioned that the 2021 OSRAM Optotronic acquisition caused Acuity Brands to develop a broader OEM channel and take more control of the company’s own supply chain.

Company Capital and M&A

Chris Snyder of UBS noted that Acuity Brands has invested significant capital over the last two years in stock buybacks and asked about the possibility of utilizing capital for future acquisitions. Ashe noted that Acuity Brands’ stock buyback strategy caused them to repurchase over 20% of the company at less than $140 per share. Acuity Brands stock closed Friday at $169.76.

Ashe elaborated, “As we look forward, we have a pretty solid pipeline of interesting opportunities most notably in areas where we can expand the addressable market of our Intelligent Spaces Group and we’re seeing acquisitions of all different sizes there.” Acuity Brands Intelligent Spaces Group currently comprises of Distech Controls and Atrius – and generated sales of $56.8 million in the first quarter.

Price Increases / Price Giveback

Ashe was asked about price increases being a recent tailwind and with supply chain pressure easing if customers would experience a price giveback. Ashe answered with general responses related to investing in product vitality and the company’s strategic approach to pricing based on market conditions.

Acuity Brands First Quarter Results »