May 6, 2024

NEMA Panel Predicts Improved Conditions in Six Months

Current conditions are reportedly shaky, but 73% of survey respondents expect better future conditions

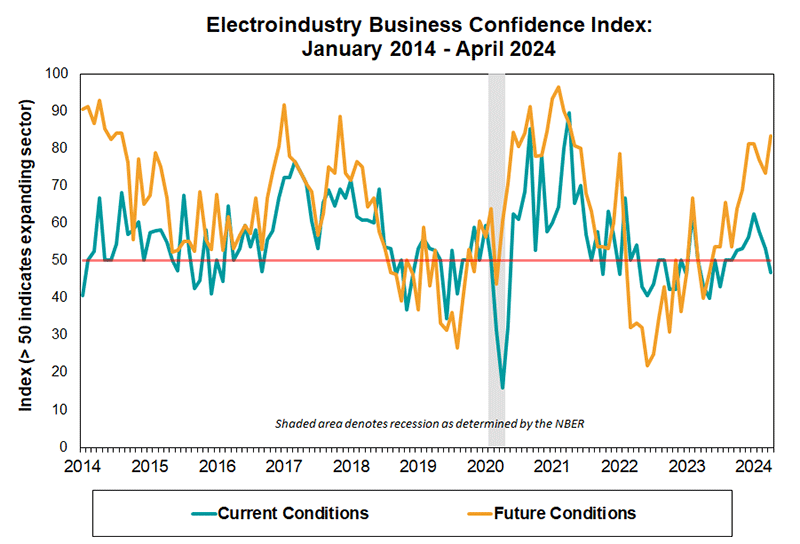

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting, electrical and medical imaging products.

In the latest NEMA industry survey, the current conditions component fell below 50 for the first time since July 2023, signaling contraction due to an increased share of respondents reporting worsening conditions. Despite mixed comments and concerns over rising energy prices and potential delays in interest rate cuts, stable demand for products and a surge in optimism for future conditions led to a 10-point increase to 83.3 for April's future conditions component.

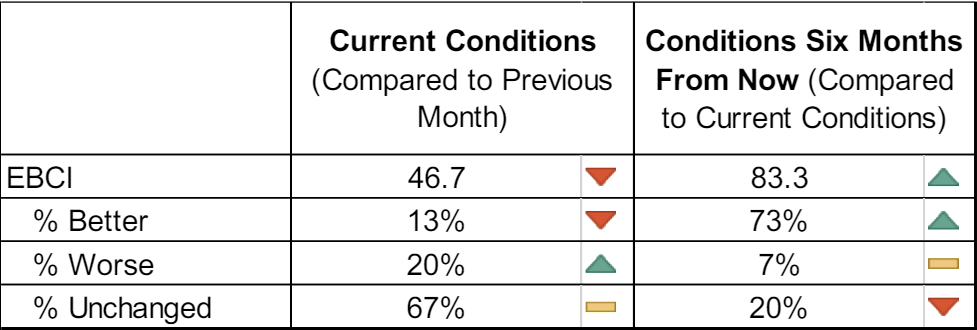

This most recent ECBI shows how makers of electrical equipment view current and future market conditions. Below are the details:

In the latest survey, 66 percent of panel members reported "unchanged" conditions, consistent with March’s findings. However, an increased share of respondents reporting “worse” conditions led to a decrease in the current conditions component to 46.7 points in April, down from the previous month’s 53.7.

This is the first time since July 2023 the current gauge dropped below the threshold value of 50, indicating a contracting electroindustry sector. Panel member comments were mixed but focused on stable or slight increases in demand for products while cautioning of likely delays in interest rate cuts and increasing energy prices.

The median value of responses regarding the reported magnitude of change in current conditions remained at 0.0, which is unchanged from last month. The mean also held steady at +0.2. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

In contrast to the current conditions component, the percent of respondents expecting to see “unchanged” conditions in six months declined in April while the proportion of those anticipating “better” conditions surged. The shift in expectations from unchanged to better led to a 10.0 point increase from the March reading to 83.3 for April’s future conditions component. Comments were mixed with some expressing expectations of improved demand in the residential market while others noted signs of slowing in certain sectors of the economy.

SURVEY RESULTS:

- Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

- A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

- Please note that survey responses were collected from the period of April 8-19, 2024.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)