May 14, 2024

Insights from the Latest LED Adoption Report

No surprise, D.O.E. reports LED usage increase. Also, eye-opening insights into controls and energy consumption.

The U.S. Department of Energy's (DOE) Solid-State Lighting Program has released the 2020 U.S. Lighting Market Characterization report, the fourth in its series, with the previous edition based on 2015 data. This comprehensive 71-page document provides detailed estimates of the installed stock and energy use of general illumination lighting products in the United States.

The primary aim of the DOE's report is to present important technology distribution and energy consumption data needed for lighting research and development planning.

Despite the data period concluding in 2020, the report was only published on the DOE website in recent days – a normal “tape delay” practice for the DOE that often takes deliberate care and lengthy time to evaluate reams of data and publish findings.

Key questions addressed in this report include the number and types of lighting products installed across the U.S. as of 2020, the energy consumption of these light sources, and changes in U.S. lighting market characteristics between 2015 and 2020. The study categorizes lighting technologies into seven main groups—incandescent, halogen, compact fluorescent (CFL), linear fluorescent, high intensity discharge (HID), light-emitting diode (LED), and other. It evaluates 33 specific lighting product types, providing data on average wattage, operating hours, and total installed inventory. This valuable information is essential for understanding the current landscape and guiding future advancements in the lighting industry.

Here are some of the main takeaways:

LED Adoption: LED technology has seen a substantial increase in adoption across both residential and commercial sectors. In 2020, LEDs accounted for approximately 48% of all installed lighting units, up from 8% in 2015. This significant shift is primarily driven by the decreasing costs, increased efficiency, and superior performance benefits of LEDs. Federal and state regulations, along with various efficiency programs, have also played a crucial role in accelerating this transition.

As lighting people know, the widespread adoption of LEDs is indicative of a broader trend towards more energy-efficient lighting solutions, which not only reduce energy consumption but also offer longer lifespans and lower maintenance costs compared to traditional lighting technologies.

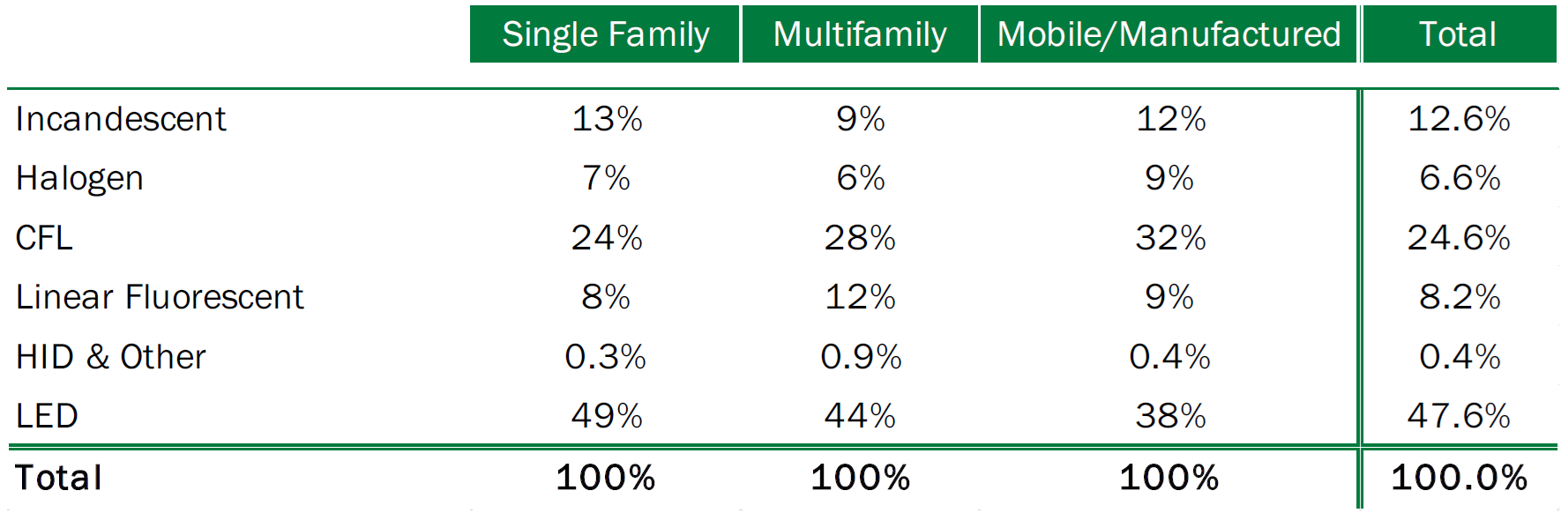

| Lamp Type | Residential (%) | Commercial (%) | Overall (%) |

|---|---|---|---|

| Incandescent | 12.6 | 0.9 | 10.2 |

| Halogen | 6.6 | 0.2 | 5.3 |

| Compact Fluorescent | 24.6 | 3.3 | 20.3 |

| Linear Fluorescent | 8.2 | 47.6 | 16.2 |

| High Intensity Discharge | 0.1 | 0.2 | 0.1 |

| LED | 47.6 | 47.3 | 47.5 |

| Other | 0.3 | 0.6 | 0.4 |

| TOTAL | 100.0 | 100.0 | 100.0 |

Distribution of Installed Units (%) by End Use Sector in 2020

Sector-Specific Insights:

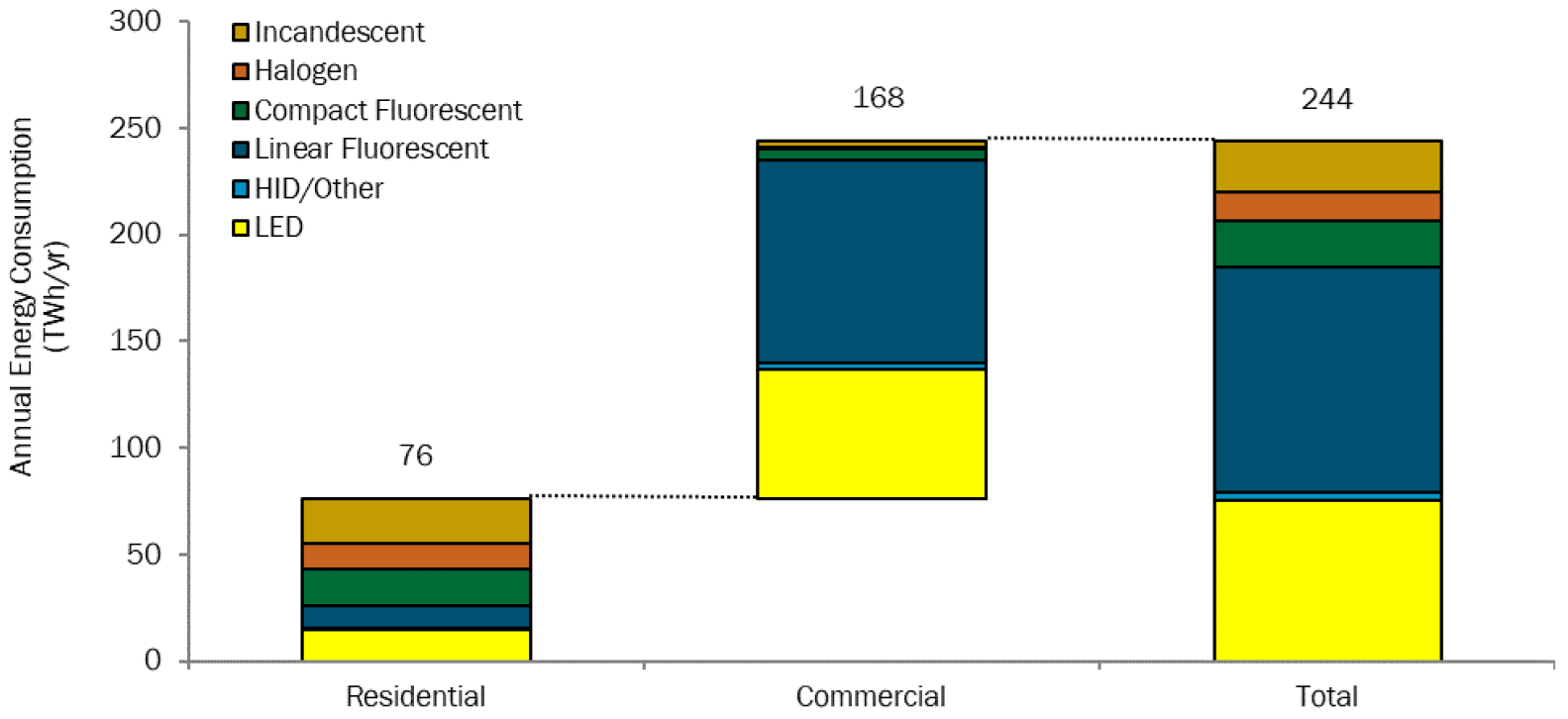

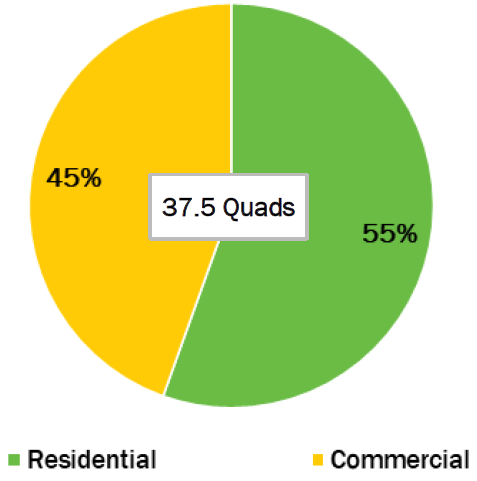

Commercial Sector: Although representing only 20% of the total lighting units, the commercial sector consumes a substantial 69% of the total lighting electricity. This significant energy consumption is primarily due to the longer operating hours and higher light output requirements typical of commercial settings, such as offices, retail spaces, and industrial facilities. Within this sector, LEDs and linear fluorescent lights dominate, each constituting a significant portion of the lighting inventory. The widespread adoption of these technologies is driven by their energy efficiency and suitability for various commercial applications, ensuring adequate illumination levels while minimizing energy costs.

U.S. Lighting Electricity Consumption by Sector and Technology in 2020, Source: DOE

Residential Sector: Comprising 80% of all installed lighting units, the residential sector shows a significant transition to LEDs, which now represent 48% of the lighting inventory. This shift highlights the growing consumer preference for energy-efficient lighting solutions. Despite this widespread adoption of LED technology, residential lighting accounts for only 31% of total lighting electricity consumption. This lower percentage is primarily due to the shorter operating hours of residential lighting compared to commercial applications, where lights are typically used for extended periods throughout the day and night. The data indicates that while the residential sector is leading in the number of installed units, its overall impact on energy consumption is less pronounced than other sectors, underscoring the efficiency and reduced energy use of modern LED technology.

Lighting Technology Distribution by Residence Type in 2020, Source, DOE

Energy Consumption: Longtime lighting people might remember when lighting products accounted for 25-40% of total electricity use. However, advancements in energy-efficient technology have reduced this figure considerably. According to the DOE, lighting now represents about 14% of the nation's total electricity consumption, totaling 244 terawatt-hours (TWh) in 2020. This reduction highlights the significant impact of modern lighting technologies on the overall energy landscape.

Residential and Commercial Source Energy Consumption in 2020, Source: DOE

The commercial sector, characterized by longer operating hours and higher light output requirements, consumes a substantial share of this energy. This sector's intense demand for lighting is driven by the need to maintain well-lit environments in offices, retail spaces, and other commercial establishments, highlighting the importance of energy-efficient lighting technologies in reducing overall consumption and costs.

Efficiency Gains: There has been a marked reduction in the average wattage per installed unit in both sectors. In the residential sector, the average wattage decreased to 22 watts, while in the commercial sector it decreased to 27 watts. This is attributed to the replacement of older, less efficient lighting technologies with LEDs.

More Insights:

Technology Distribution:

Incandescent and Halogen: Unsurprisingly, these traditional lighting technologies have seen a sharp decline. In 2020, incandescent and halogen lights combined accounted for just over 10% of the total installed units.

Compact Fluorescent (CFL): CFLs, once popular for their efficiency over incandescent bulbs, are also declining in favor of LEDs.

Linear Fluorescent: Still prevalent in the commercial sector, these lights are gradually being replaced by more efficient LED alternatives. In 2020, linear fluorescent lighting accounted for 48% of the total installed lighting in commercial buildings, down from 58% in 2015, indicating a steady shift towards LED adoption as businesses seek to reduce energy consumption and maintenance costs.

Lighting Controls Still a Large, Mostly Untapped Market:

Lighting Controls: Commercial buildings increasingly utilize lighting controls such as dimmers, daylighting systems, occupancy sensors, and energy management systems (EMS), but the DOE reports that 70% of commercial buildings do not utilize lighting controls – a growing number but yet another sign that the growth potential in commercial lighting controls remains huge.

Residential Sector: Lighting controls are less common with only 11% penetration, but when present, they are primarily dimmers used with incandescent, halogen, and LED lights.

Geographical Distribution:

Commercial Sector: LED adoption is significant across all regions, with notable penetration in office buildings, retail spaces, and warehouses. Education buildings show slower LED adoption due to budget constraints and maintenance ease with linear fluorescent lamps.

Residential Sector: The Northeast and West regions show higher adoption rates of LEDs compared to the Midwest and South. This could be linked to varying state-level incentives and regulations promoting energy-efficient lighting.

Steady LED Adoption Expected to Continue:

The U.S. lighting market continues to evolve with notable trends and observations. The continued decline in LED costs, coupled with their superior performance and energy savings, is a significant driver of their widespread adoption. This transition is further encouraged by federal and state incentives, which make LED lighting an increasingly attractive option for both residential and commercial consumers. The commercial sector, in particular, is seeing substantial benefits from the adoption of lighting controls. These systems, which allow for smarter, more energy-efficient lighting solutions, contribute significantly to overall energy savings by reducing electricity consumption.

Regulatory impacts also play a crucial role in shaping the lighting market. National and state regulations are pivotal in promoting the adoption of energy-efficient lighting technologies. Standards and incentive programs have been instrumental in accelerating the shift from traditional lighting technologies to LEDs. As these regulations continue to evolve, they are expected to further drive the adoption of energy-saving lighting solutions, underscoring the ongoing transformation within the U.S. lighting market.