May 14, 2024

Energy Focus Seeks Stability in Shaky Waters

Sales decline, losses shrink, gross margin improves but remains gross

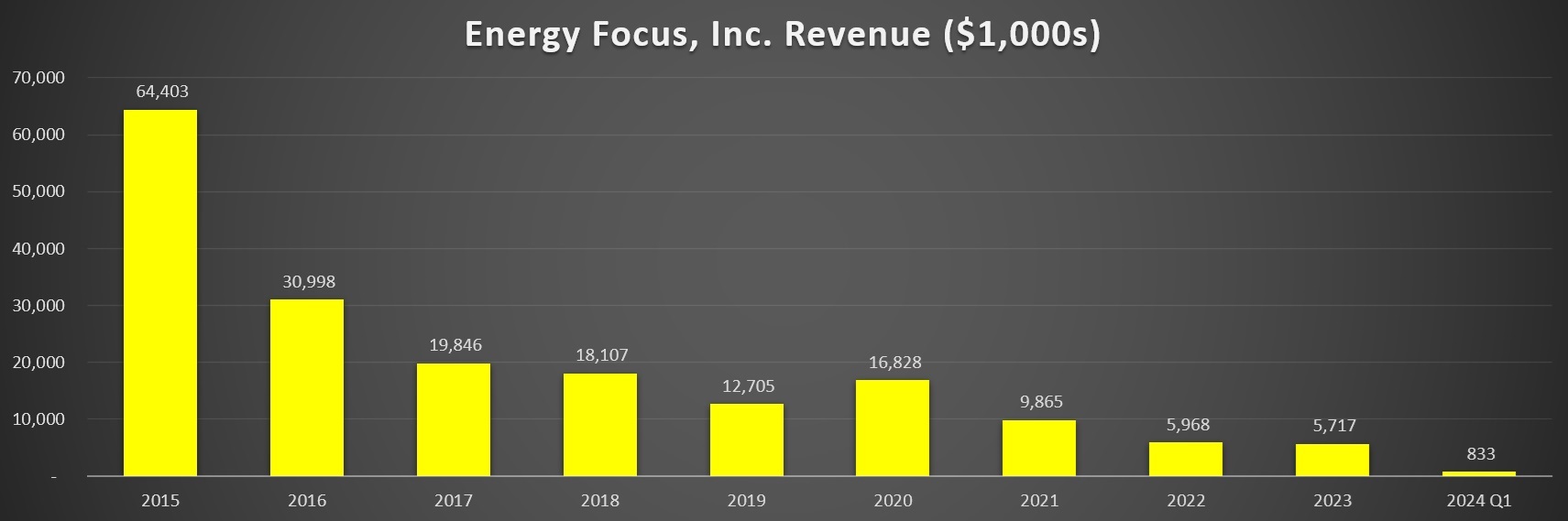

Energy Focus, Inc., an Ohio-based maker of energy-efficient lighting solutions, reported its financial results for the first quarter ended March 31, 2024. The company reported net sales of $833,000 in Q1 2024, marking a decrease of 10.4% compared to $930,000 in Q1 2023. The decline was primarily attributed to reduced sales in the military maritime sector and a slight decrease in commercial sales. This downturn is further compounded by a significant quarter-over-quarter drop of 65.2% from Q4 2023, driven by a $1.5 million decrease in military sales, despite stable commercial maritime sales.

The company's gross profit margin, while very low, improved significantly to 14.4% of net sales in Q1 2024, up from 1.8% in Q1 2023 and 3.1% in Q4 2023. The company attributes the improvement to successful cost reduction initiatives, particularly in freight in and out variances, and better management of fixed production costs and material usage. However, the operating loss decreased to $0.6 million from $1.2 million year-over-year, and net loss improved to $0.4 million, or $(0.09) per share, from $1.3 million, or $(0.58) per share in Q1 2023.

Cash Flow, Capital Management and Liquidity

Cash reserves decreased from $2.0 million at the end of 2023 to $1.0 million at the end of Q1 2024, primarily due to the payoff of a promissory note to Streeterville Capital. The company also undertook a private placement of common stock, which netted approximately $450,000, excluding offering expenses.

During Q1 2024, the company focused on reducing its financial obligations, evidenced by the payoff of the Streeterville note and the issuance of new equity to raise capital. These efforts reflect a strategic approach to managing debt and financing needs while trying to improve operational efficiencies and investment in product development.

Ongoing challenges

Quarter after quarter, Energy Focus continues to deal with numerous challenges including the following:

-

Declining Sales: The most immediate concern is the continuing decline in net sales, which decreased by 10.4% year-over-year and a stark 65.2% from the previous quarter. Such declines could signal underlying issues in product demand or competitive pressures, particularly in the military maritime segment, which saw a significant drop.

-

Cash Reserves: The company's cash position decreased significantly, from $2.0 million at the end of December 2023 to $1.0 million at the end of March 2024. While the reduction is primarily attributed to the payoff of the Streeterville note, this lower level of cash reserves could limit the company's ability to respond to unforeseen needs or invest in growth opportunities.

-

High Burn Rate: Related to the cash reserves, the company's rate of cash usage (burn rate) in operations is concerning, even though there has been an improvement in the net loss figures. Managing this burn rate effectively is crucial for sustaining operations without constant capital raises which could dilute existing shareholders.

-

Gross Profit Margins: Despite an improvement in gross profit margins from previous periods, the absolute level of gross margin at 14.4% remains low for a manufacturing company. This margin level might not be sufficient to cover operating expenses, leading to operational losses.

-

Dependency on External Financing: The reliance on external financing, such as the issuance of equity in private placements, points to potential difficulties in generating sufficient internal cash flows. This dependency can be risky if access to capital markets becomes constrained.

Energy Focus, Inc.'s Q1 2024 performance illustrates a company navigating significant operational challenges but showing signs of recovery in profitability margins. The strategic financial maneuvers, including managing debt and raising capital through equity, are critical as the company aims to stabilize its financial position and invest in growth areas. While sales have decreased, the improved gross margins and reduced losses are positive indicators. The management's forward-looking statements suggest a focus on market expansion, a worthy goal seemingly necessary for long-term growth.