May 16, 2024

Despite Revenue Revision, Orion's Recovery is Happening

Preliminary results miss the original $100 million goal, but company health and operations improve

It's not unusual for publicly traded companies to lower their financial outlooks throughout the year, and sometimes it can feel like CEOs are moving the goalposts, drawing negative scrutiny from analysts and investors. However, Orion Energy Systems' lowered 2024 revenue projections also seem to be offset by other promising signs of business recovery.

Midway through its 2024 fiscal year, Orion revised its initial revenue projection of approximately $100 million to a range of $90 million to $95 million. It appears the company will hit the low end of that range, with preliminary Q4 and full fiscal year results indicating revenue of $90.6 million, according to today's announcement.

Despite this adjustment, the news seems promising as Orion shifts its business model away from heavy reliance on a single major customer. In 2022, installations at Home Depot retail locations accounted for 49% of Orion's revenues. With those projects now complete and mostly in maintenance services mode, the company is expanding its revenue base beyond this one large end user. This diversification is crucial for Orion's growth and points to a recovery in both revenue and profitability.

Orion's broader revenue base suggests a more stable and sustainable business model, providing optimism for future performance. As Orion continues to diversify and execute on its strategic initiatives, it is better positioned for long-term success and improved financial health.

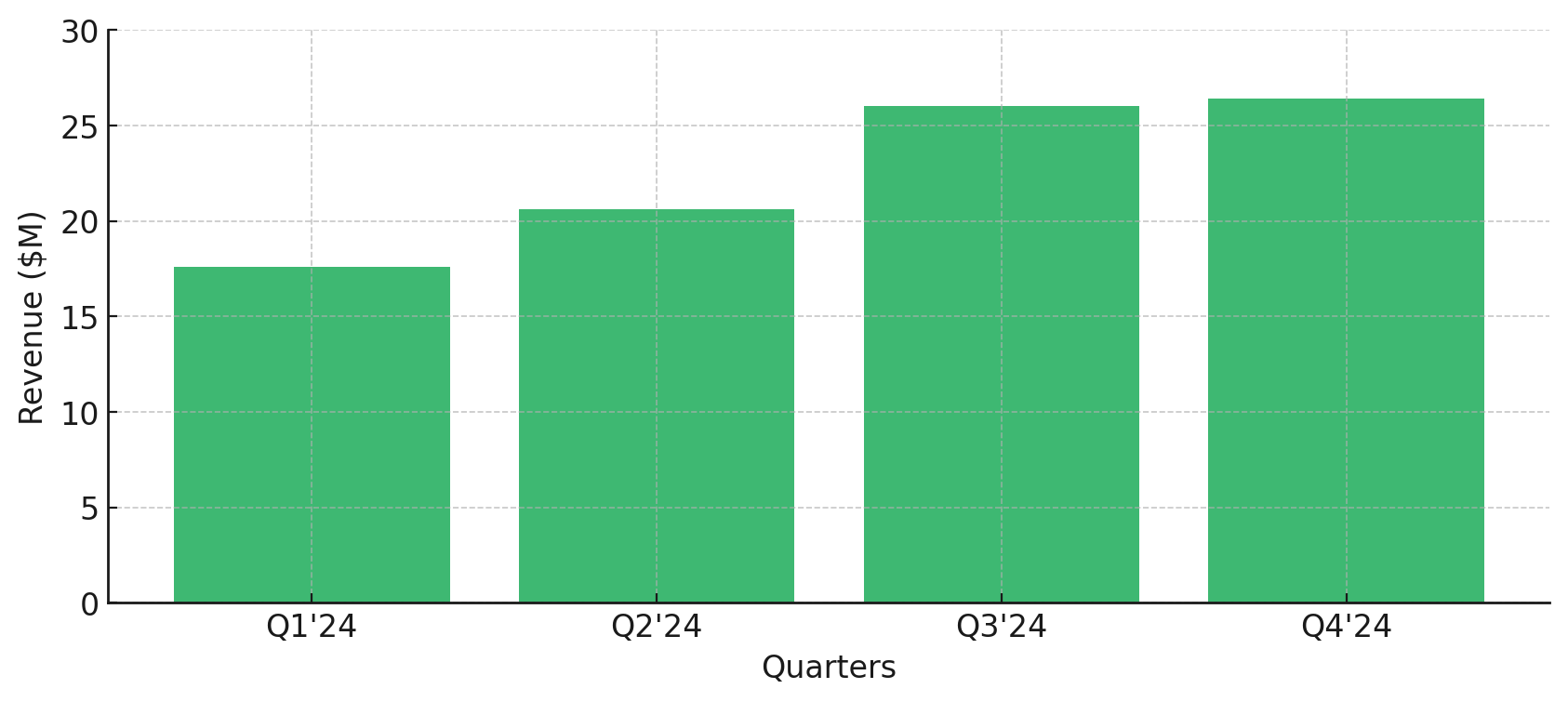

For its fiscal fourth quarter 2024, Orion reported preliminary revenue of approximately $26.4 million, an increase from $21.6 million in Q4 2023. For the full fiscal year 2024, the company achieved revenue of approximately $90.6 million, up from $77.4 million in FY 2023. This growth was driven by significant increases in several key areas.

For context, Orion generated $125 million in revenue in 2022, the last year of the Home Depot major projects.

Orion quarterly revenue FY2024

Comparing the preliminary Q4 2024 numbers to Q3 2024:

-

LED lighting revenue dipped 12% to $16.3M, down from $18.5M in Q3 2024.

-

EV charging solutions revenue increased to $4.9M, up from $2.8M in Q3 2024.

-

Maintenance services revenue increased to $5.2M, up from $4.6M in Q3 2024.

Notably, EV charging solutions preliminary revenue rose to $4.9 million in Q4 2024, marking a substantial growth for this segment. This is particularly significant as the EV segment stems from the acquisition of Massachusetts-based Voltrek in 2022, whose total revenues in 2021 were $4.8 million, primarily from projects in New England. The growing performance of the EV charging solutions segment highlights Orion's strategic acquisition and its ability to integrate and expand new business lines effectively.

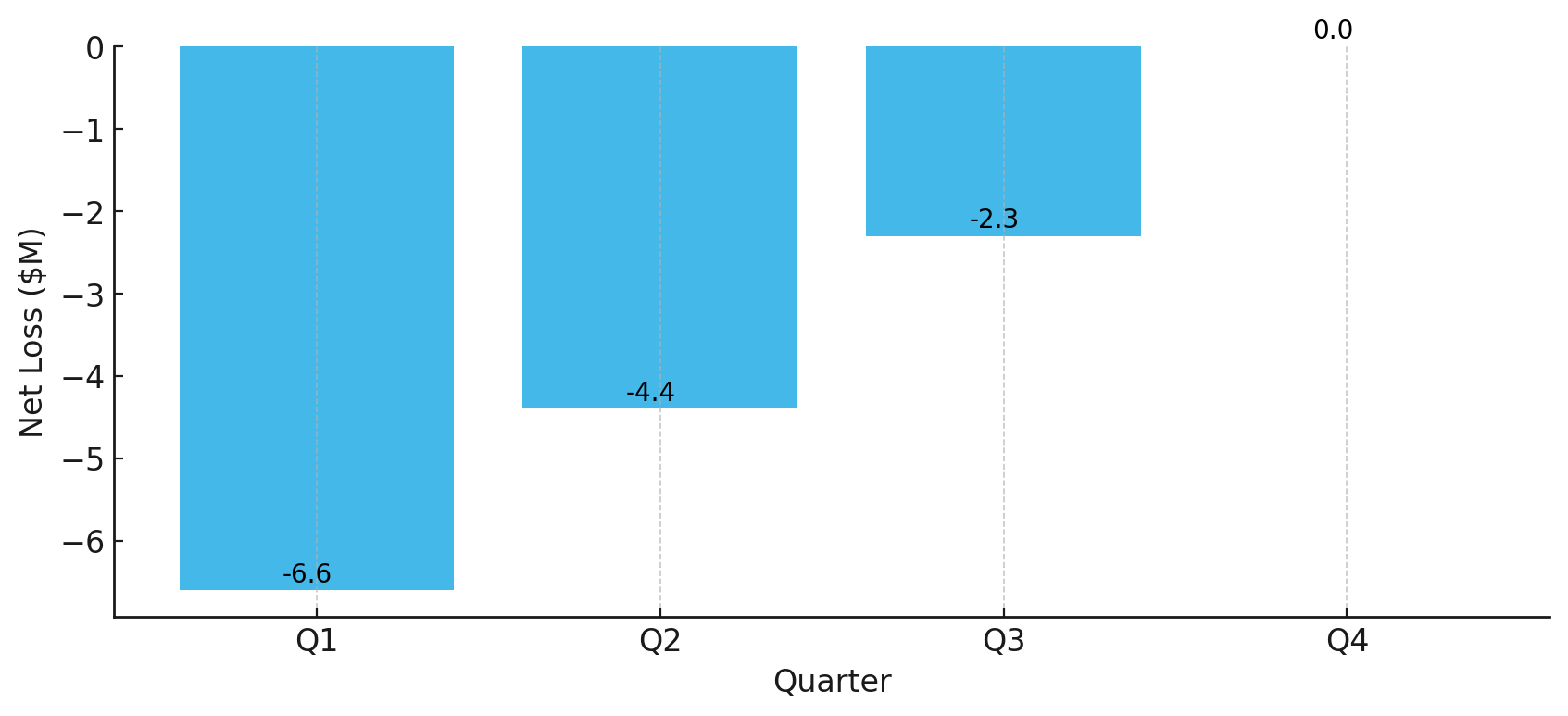

Profitability turnaround seems to be happening:

Orion Energy Systems has struggled with profitability in the last two fiscal years. Despite efforts to diversify and expand into new markets, the company reported significant net losses, reflecting ongoing challenges. While there has been some improvement in adjusted EBITDA, indicating progress in managing expenses and enhancing efficiency, the overall financial performance remains in the red.

FY 2024 Net Loss by Quarter

Today the company stated, "Orion expects to report slightly positive adjusted EBITDA in Q4’24 compared to negative adjusted EBITDA in Q4’23."

In FY 2023, Orion reported a net loss of $34.3 million, a stark contrast to the previous year's net income of $6.1 million. This downturn included a $17.8 million non-cash tax charge and a $4.0 million accrual for the Voltrek earnout. The first three quarters of FY 2024 continued this trend, with net losses of $6.6 million in Q1, $4.4 million in Q2, and $2.3 million in Q3.

The biggest takeaway that gives hope to investors is that the preliminary Q4 2024 results indicate a slightly positive adjusted EBITDA, hinting at a potential turning point for the company.

On Thursday, June 6, 2024, the company plans to announce its official Q4 and full-year results for the period ending March 31.