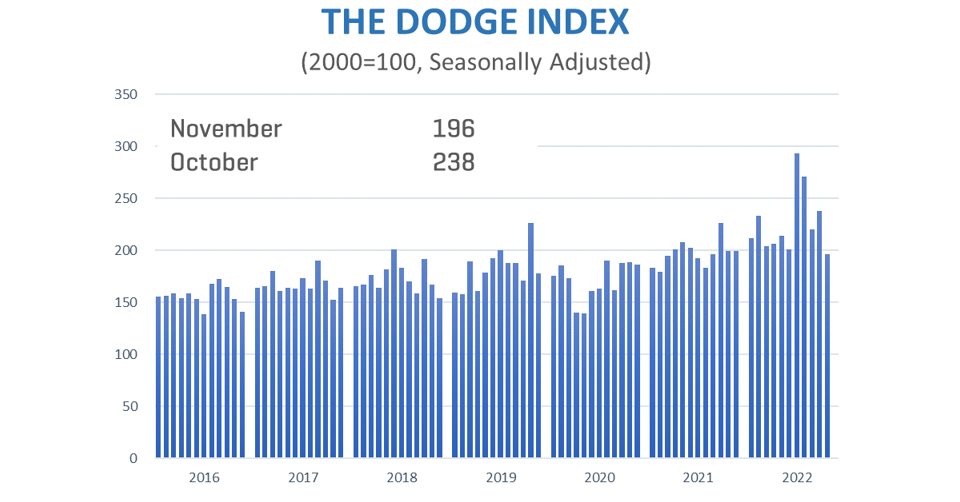

December 21, 2022

Construction Starts Dip 18%, Still +14% for the Year

$500+ million projects get rolling in North Carolina, Missouri and California

HAMILTON, NJ — Total construction starts fell 18% in November to a seasonally adjusted annual rate of $926.3 billion, according to Dodge Construction Network. During the month, nonresidential building starts lost 25%, nonbuilding shed 21%, and residential starts dropped 5%.

Year-to-date, total construction starts were 14% higher in the first 11 months of 2022 compared to the same period of 2021. Nonresidential building starts rose 36% over the year, residential starts were down 1%, and nonbuilding starts were up 16%.

“Month-to-month volatility in construction activity continues to reign supreme as uncertainty mounts over the economy in 2023,” said Richard Branch, chief economist for Dodge Construction Network. “Higher interest rates and fear of recession are first and foremost on the mind of most builders and developers, and potentially restraining starts activity. However, as some material prices head lower and more public dollars come into the market for infrastructure and manufacturing projects, the year is ending with a fair bit of momentum. Next year will be a challenge, but nothing like the sector faced during the Great Recession.”

Nonresidential building starts fell 25% in November to a seasonally adjusted annual rate of $361.6 billion. In November commercial starts fell 33%, institutional starts were 12% lower, and manufacturing dropped 69%. Within the entire nonresidential building sector, the only categories to show a gain on a month-to-month basis were healthcare, public buildings, religious, and recreation starts. Through the first 11 months of 2022, nonresidential building starts were 36% higher than the first 11 months of 2021. Commercial starts grew 25%, and institutional starts rose 19%. Manufacturing starts were 160% higher on a year-to-date basis.

The largest nonresidential building projects to break ground in November were the $1.1 billion Harbor-UCLA Medical Center in Torrance, CA, the $800 million Project Velvet Meta data center in Kansas City, MO, and the $500 million Eli Lilly manufacturing campus in Concord, NC.

Residential building starts fell 5% in November to a seasonally adjusted annual rate of $346.5 billion. Single family starts lost 9%, while multifamily starts gained 1%. Through the first 11 months of 2022, residential starts were 1% lower when compared to the same time frame in 2021. Multifamily starts were up 26%, while single family housing slipped 12%.

The largest multifamily structures to break ground in November were the $345 million 601 N. Central Ave. mixed-use building in Phoenix, AZ, the $350 million YMCA of Middle Tennessee residential tower in Nashville, TN, and the $250 million Halletts Point (Building 3) in Astoria, NY.

Nonbuilding construction starts fell 21% in November to a seasonally adjusted annual rate of $218.1 billion. The only category to post a gain for the month was utility/gas which rose a mere 3%. Highway and bridge starts fell 32%, miscellaneous nonbuilding was 30% lower, and environmental public works fell 7%. Through the first 11 months of the year, total nonbuilding starts were 16% higher than in 2021. Highway and bridge starts were 25% higher, environmental public works were 17% higher, and utility/gas plants were up 11%. Miscellaneous nonbuilding starts were 2% lower on a year-to-date basis.

The largest nonbuilding projects to break ground in November were the $678 million 577MW Fox Squirrel solar farm in Madison County, WI, a $522 million coastal resilience project near the Brooklyn Bridge in Brooklyn, NY, and the $465 million 300MW White Rock wind project in Anadarko, OK.

Regionally, total construction starts in November fell in all five regions.

Watch Chief Economist Richard Branch discuss November Construction Starts.

Dodge Construction Network leverages an unmatched offering of data, analytics, and industry-spanning relationships to generate the most powerful source of information, knowledge, insights, and connections in the commercial construction industry.

The company powers four longstanding and trusted industry solutions—Dodge Data & Analytics, The Blue Book Network, Sweets, and IMS—to connect the dots across the entire commercial construction ecosystem.

Together, these solutions provide clear and actionable opportunities for both small teams and enterprise firms. Purpose-built to streamline the complicated, Dodge Construction Network ensures that construction professionals have the information they need to build successful businesses and thriving communities. With over a century of industry experience, Dodge Construction Network is the catalyst for modern commercial construction. To learn more, visit construction.com