August 18, 2022

LSI Continues to Show Growth and Strength

-

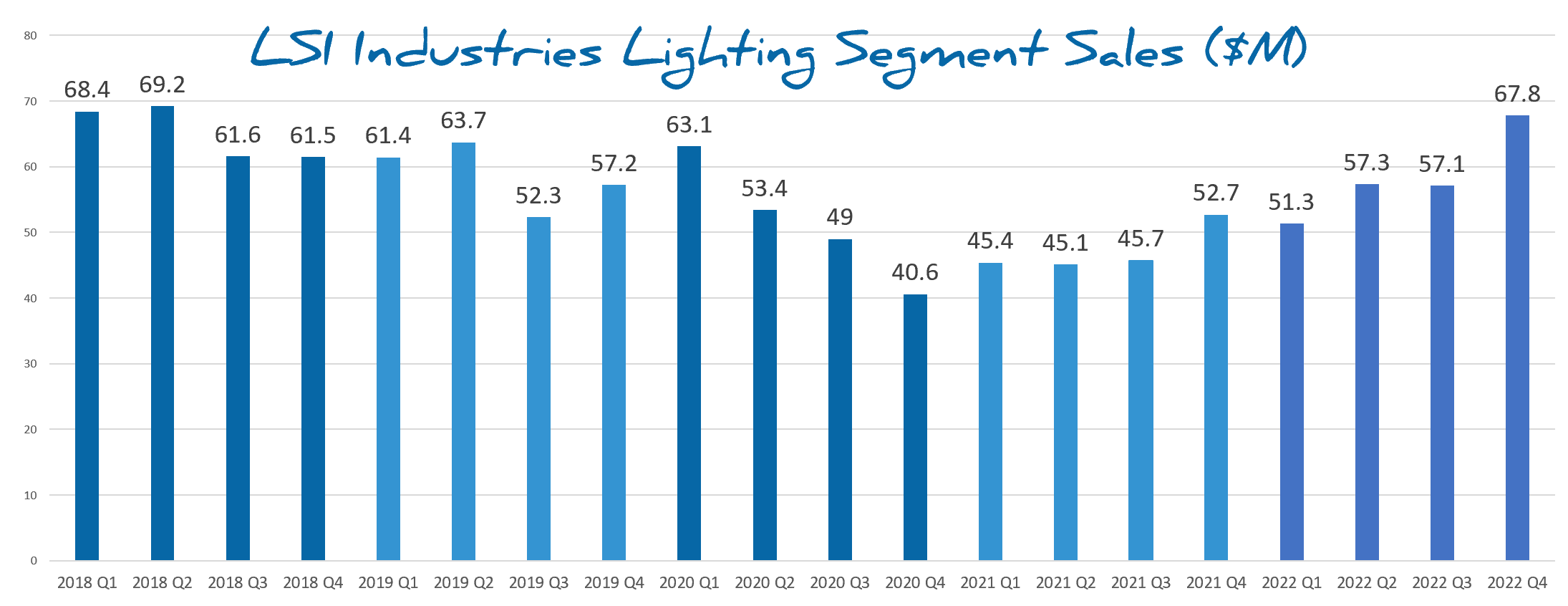

Lighting segment revenues return to pre-pandemic levels.

-

Best Lighting segment sales quarter since 2018.

-

Stock jumps 12% on early Thursday trading.

On Thursday, LSI Industries reported its financial results for its fourth quarter and full fiscal year ending June 30, 2022.

The company once again demonstrated strong growth momentum with both revenues and profits as it continues to diversify its business with increased emphasis on the Display segment of its business. The company is seemingly able to leverage its strong vertical market focus by getting both display and lighting projects at major grocery retailers, gas/convenient stores and quick-service food chains.

Overall sales for the company in 2022 were $455 million, up 44% compared to 2021. The lift includes the late-2021 acquisition of JSI Store Fixtures which was a $70 million company at the time. A year ago, LSI stated a goal to reach $500 million by 2025. After this impressive growth year, all the company needs is annual growth of 3.2% to get there, which will likely cause management to recalibrate and aim higher.

The profit line was favorable, too. Net income for the twelve months ended June 30, 2022, was $15 million, or $0.54 per share, compared to $5.9 million or $0.21 per share for the twelve months ended June 30, 2021.

The Lighting segment saw strong performance. For the quarter, Lighting sales were $67.8 million, the highest mark the segment has seen since Q2 of 2018. And for the year, sales were $233.5 million, up 29% and right in line with full-year 2019 sales. Is LSI’s COVID recovery complete? From a revenue standpoint, yes. Operationally, both LSI and the industry continues to face numerous COVID-induced challenges like supply chain, inflation and logistics.

At the end of 2017, Lighting comprised 72% of overall sales. Today the Lighting share is just over 50%.