March 21, 2022

It’s Been a Rough Year for Energy Focus, Inc.

CEO is out as sales dip to $9.9 million. Company loses $7.9 million.

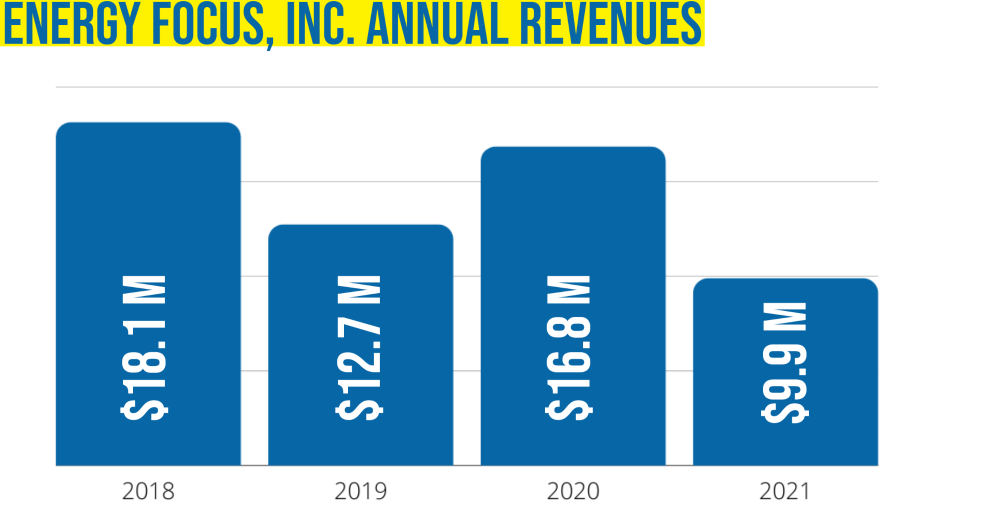

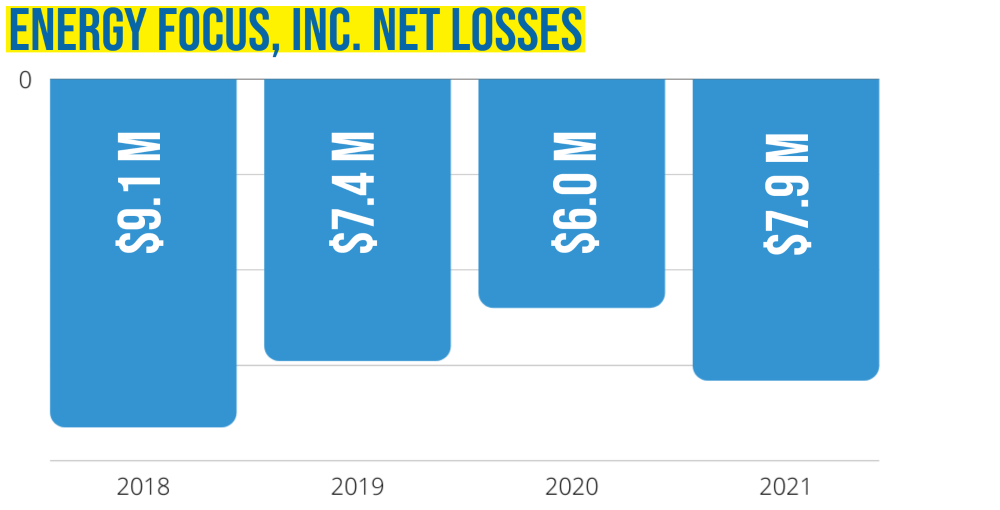

With very few publicly traded lighting companies, it is often hard to detect when lighting makers are thriving, holding steady or struggling financially. With the recent release of its 2021 financials, Ohio-based Energy Focus Inc. (NASDAQ:EFOI) has revealed that it continues to realize multimillion dollar net losses while sales revenues take a big step backwards.

The Energy Focus product line is comprised mostly of linear LED lamp products for commercial, industrial and military applications. As part of a COVID pivot, the company also launched two UV-C disinfection products during the pandemic.

Looking for a new, permanent CEO

Earlier this year, the company announced that CEO James Tu would be leaving the company. As part of a separation agreement, Tu will continue to receive his base salary of $23,666.67 per month for a period of six months. The company announced that board member and experienced venture capitalist, Stephen Socolof, would serve as Interim CEO while the search for a permanent CEO is underway.

Sales are way down

Energy Focus generated 2021 net sales of $9.9 million, down 41.4% from 2020. The company explains that the retraction is due to "continued fluctuations in timing of military orders and government funding availability, ongoing COVID-19 related business challenges for customers, and supply chain and logistics delays."

Net losses continue to mount

Energy Focus ended yet another year with net losses – but the trend of smaller losses was reversed with a whopping -$7.9 million in losses on $9.9 million in sales. The cost of sales was an eye-popping $8.2 million, which allowed for just 17% gross profit.

Stock value has been hammered

Energy Focus, Inc. (NASDAQ:EFOI) started the year trading at $4.27 per share. Today, the stock opened at $1.35 per share. Ouch.

With $2.7 million of cash on hand and $14.4 million of total assets, the company must find a way to turn around these negative financial trends. The industry and the markets will be watching to see who the company appoints as CEO and how s/he maneuvers through the challenges.

Get the next big lighting story in your inbox...Click here to subscribe to the Inside Lighting InfoLetter |