November 29, 2021

"Discombobulated" Market Presents both Peril and Opportunity

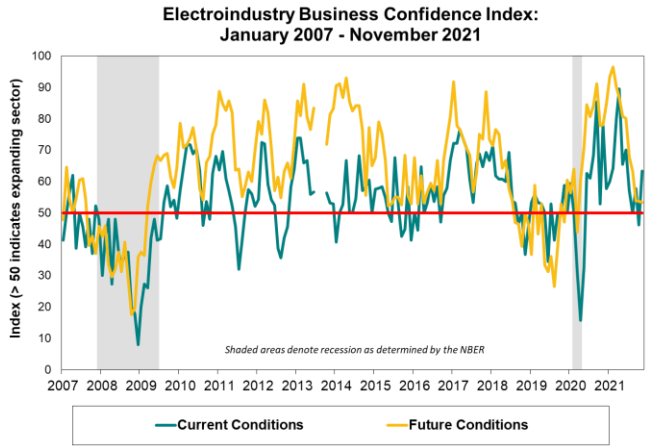

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

Below is the just-published November report:

Despite continuing supply and workforce concerns, current component bounced back in November

Reprinted with permission of the National Electrical Manufacturers Association (NEMA)

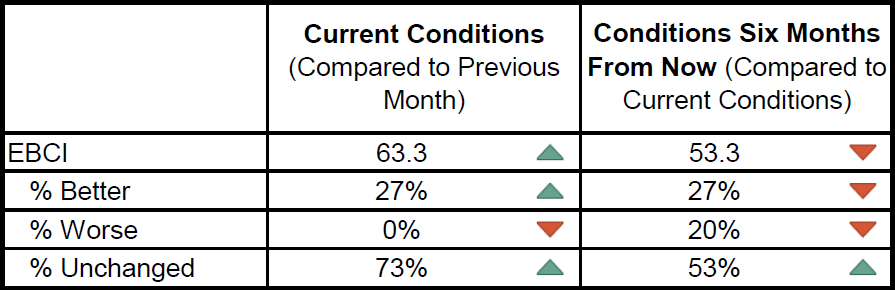

Buoyed by an uptick in the share of respondents who noted better conditions and a drop to zero reports of worse conditions in November, the current component reversed course from last month and hit its highest reading since June of this year. The gauge’s movement to well into expansion territory came in spite of commentary perhaps best labeled as cautious. The “broken record,” as framed by one commenter, of supply chain and hiring woes continued as the focus of discussion among respondents. Another comment described the “discombobulated and complicated market environment” presenting a mix of peril and opportunity.

The median reported magnitude of change in current electroindustry business conditions held steady at zero for the fifth consecutive month in November. The mean of the magnitude measure bounced back to +0.2 this month after slipping to zero in September. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Unlike the current component, which has seen substantial changes over the last few months, the future component barely moved for now the third month in a row, hovering low in expansion territory at 53.3. A modest majority of respondents indicated that their expectations for conditions in six months were unchanged from what they see now, as slight reductions in the shares of responses expecting either better or worse conditions in the near future failed to move the needle on the overall result. Comments suggested significant uncertainties about the economy’s direction outside the six month time period framed by the survey question.

SURVEY RESULTS:

- Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

- A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

- Please note that survey responses were collected from the period of November 10-19, 2021.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |