January 22, 2026

LSI Reports Stable Sales Amid Lighting Segment Surge

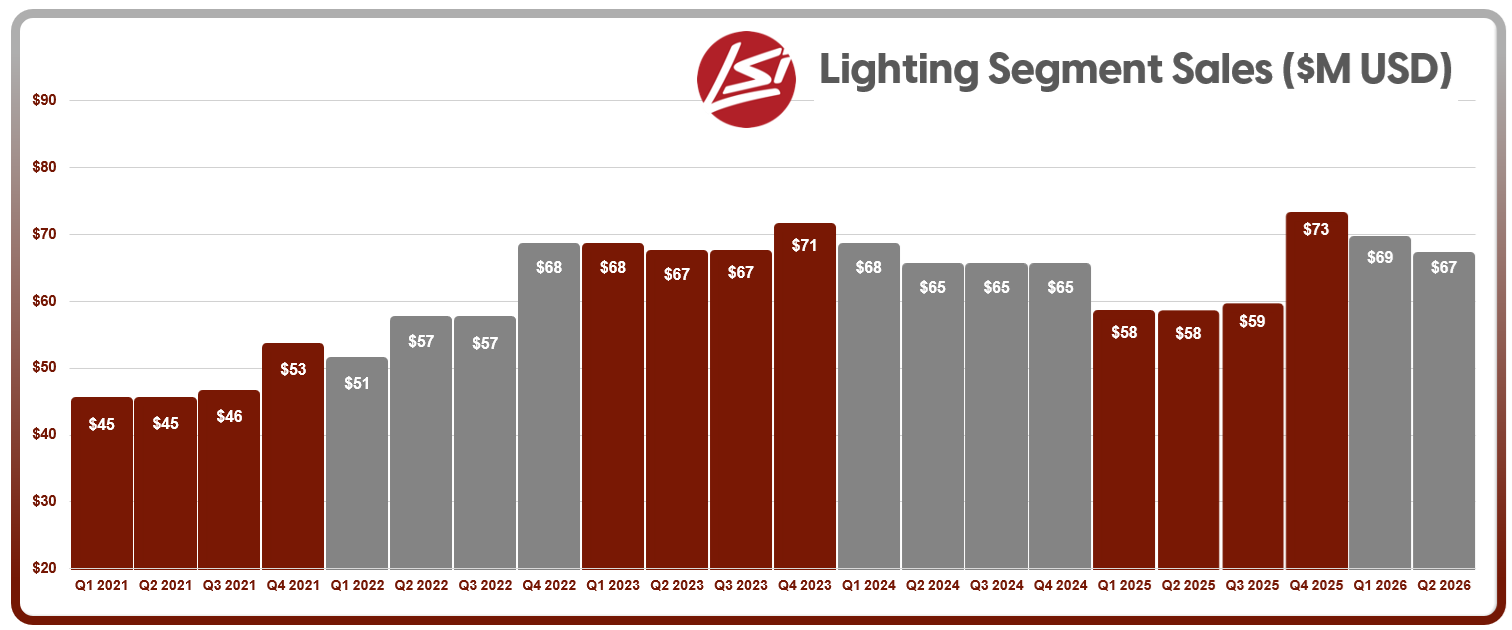

Lighting has logged three straight quarters of double-digit growth

In a quarter where top-line revenue stayed flat, LSI Industries' lighting business continued to shine. The Cincinnati-based manufacturer reported $147.0 million in net sales for its fiscal second quarter ending December 31, 2025 — a near match to the same quarter last year. But the static headline number hides a significant split beneath the surface: LSI’s Lighting segment posted a 15% sales increase, while Display Solutions fell 10%, dragged by soft comparisons and shifting customer cycles.

Lighting now makes up 45% of LSI’s total revenue, contributing $66.7 million this quarter. Display Solutions, at $80.3 million, accounts for the remaining 55% — a balance that reflects the company’s broader shift over the past five years, when lighting was once the dominant force. Still, the Lighting segment has logged three straight quarters of strong performance: 15% growth this period follows 18% growth in Q1, making it a consistent bright spot for the company.

Momentum Fueled by Projects, Accounts, and Margin Gains

According to LSI CEO James Clark, multiple factors are powering the lighting rebound. “Large project shipments doubled from the second quarter last year,” he said. “Our increased emphasis on national account opportunities continues to generate new customers and sustainable business.” One such account conversion led to a multi-million-dollar order that will hit in Q3 — a shot in the arm for a segment that had previously struggled with delayed projects.

Margin performance added to the good news. Adjusted EBITDA margin in lighting expanded by 70 basis points year-over-year, reflecting a mix of price discipline, improved productivity, and better project pricing. Meanwhile, lighting orders closed the quarter up 10% from last year, with a book-to-bill ratio over 1.0x — an indicator of sustained demand heading into the second half of fiscal 2026.

Contrast that with Display Solutions, where orders were down 2% and organic sales fell 17%, excluding the boost from the March 2025 acquisition of Canada’s Best Holdings. While the display side of the business still brings in more revenue, it’s lighting that’s been carrying the growth baton for consecutive quarters.

Strip out the Canada’s Best contribution — $6.3 million in Q2 — and LSI’s organic net sales were actually down 5% year-over-year. This nuance matters: without that acquisition, the entire company would’ve posted a decline. But the Lighting segment, operating on its own steam, has managed to accelerate regardless.

Peaks, Plateaus, and What Comes Next

It’s worth noting that while the year-over-year gains are impressive, lighting sales have ticked down sequentially since reaching a record high of $72.7 million in Q4 of fiscal 2025. That peak, fueled by a surge in delayed project releases, now serves as a benchmark — and a challenge — for the quarters ahead.

Still, Clark remains confident. “We anticipate continued year-over-year revenue growth in our Lighting segment,” he said, pointing to a healthy backlog and growing demand in key verticals. The company’s “Fast Forward 2028” strategy emphasizes further integration, customer penetration, and margin control — a roadmap that increasingly hinges on the lighting segment’s performance.