January 17, 2023

7 Economic Indicators Lighting People Should See

Factors provide context on design, construction, markets, prices and hiring

The last three years have thrown some unexpected business challenges into the lives of lighting people. As supply chain challenges and spiking inflation of the last year or two have become less volatile, it’s still hard to predict how markets will stabilize in the year ahead.

Economic indicators are not perfect predictors of future business, but when evaluated with measured emphasis and in proper context they can help lighting people – and professionals in all businesses – evaluate short- and long-term market conditions.

We sometimes get asked about how a 1-month snapshot of construction activity or architectural design billings creates enough insights to matter. And the short answer is that one month of data is sometimes very helpful and sometimes it’s not too revealing. The real value is in tracking these economic indicators – perhaps batching them in 3-month or 6-month chunks – that may help us understand trends and forecast future business.

Part of the reason that inside.lighting doesn’t just simply copy, paste and publish the most recent Architecture Billings Index (ABI) press release is because we want to add more data and context – so our audience can see how design billings are trending nationally, regionally or by construction sector. We plot the ABI in recent context, dating back to 2021, as well as in historical context, going back 15 years before the Great Recession.

Based on recent volatile times and concerns for what 2023 may bring, we thought it would be a good idea to share a roundup of some leading economic indicators that may help lighting people assess their business and their specific markets – and possibly help us all plan intelligently for the unknowns in year ahead.

1. Architectural billings contract slightly

The Architecture Billings Index (ABI) is a leading economic indicator for nonresidential construction activity. Many lighting people pay attention to the ABI because today’s design billings are often correlated to lighting projects being purchased approximately 9-12 months down the road.

An ABI index score of 50 means status quo. No changes. Numbers greater than 50 indicate increasing billings while numbers below 50 mean decreasing billings.

The chart below indicates that all areas of the U.S., except the Southern U.S., are experiencing less and less design billings in recent months.

More info: inside.lighting's ABI Breakdown

2. Construction starts increase, but growth may wane

The Dodge Momentum Index, issued by Dodge Construction Network, tracks commercial and institutional construction starts.

“One of the key construction storylines for 2022 was the return of enthusiasm and optimism in prospects for nonresidential growth,” stated Richard Branch, chief economist for Dodge Construction Network. “While some of that will likely erode in 2023 as economic growth wanes, increased demand for some building types like data centers, labs, and healthcare buildings will provide a solid floor for the construction sector.”

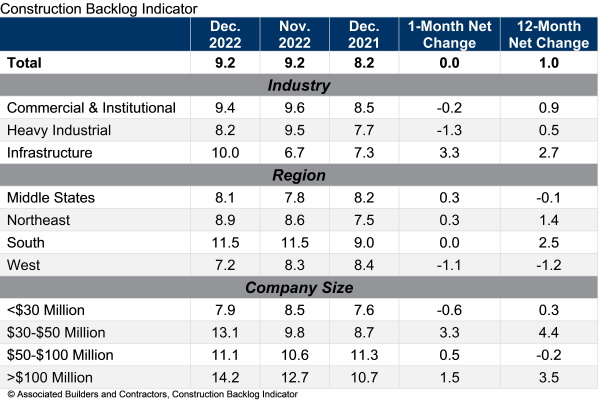

3. Rising construction backlog

Construction backlog remains at its highest level since the second quarter of 2019. This has been especially true in the South, which has been the case for many of the past several years.

“Contractors enter the new year with plenty of optimism,” said ABC Chief Economist Anirban Basu. “Backlog remains elevated, which means that, even if the economy were to enter recession this year, contractors would likely be insulated from significant harm. Rather than fixate on the possibility of a recession, many contractors remain focused on growth, with expectations for rising sales and staffing levels over the next half year. Even the reading on profit margins increased this month, perhaps reflecting an improved supply chain.”

4. Ongoing shortage of electricians could get worse

SHORT TERM: A recent article in Construction Dive indicates that some of the toughest positions to staff in 2023 are the most vital. A recent survey revealed that 79% of contractors are experiencing difficulty in hiring qualified electricians.

LONG TERM: As recently reported by Grist, the Bureau of Labor Statistics estimates 21% of electricians will reach retirement age during the next decade, while calls for services will increase 7%, leading to almost 80,000 job openings annually. A shortage of skilled labor could derail efforts to "electrify everything."

5. Semiconductor supply & demand

Recent months have seen a steady decline in global semiconductor sales.

In the Semiconductor Industry Association’s most recently reported month, November, sales into the Americas were up 5.2% compared to November 2021, while sales into China decreased sharply (-5.3%).

Global supply is increasing while demand is easing – which should bode well for makers of drivers, controls and other lighting-related electronics.

![]()

6. The price of copper has spiked in 2023

The construction industry is a major consumer of copper due to its use in electric wire & cable as well as plumbing pipe. Copper wiring and components are also important parts of assembled lighting and controls products.

In June 2022 the price of copper, which had risen steadily during the pandemic, dipped below $4 per pound and stayed there for the remainder of 2022, bottoming out at $3.21. Don’t look now, but as the calendar turned to 2023, copper prices are once again rising. Quickly. In the last two weeks, copper has increased $0.44 per pound.

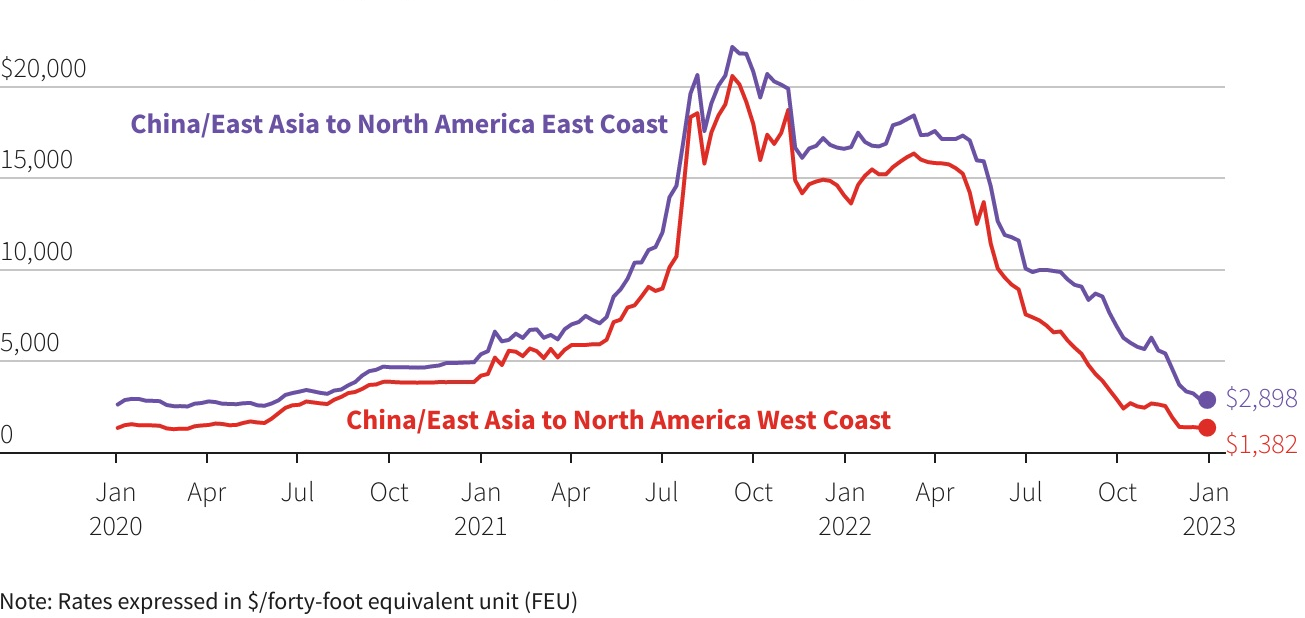

7. Some ocean shipment costs are collapsing:

A recent Reuters article states:

-

Prices in the most volatile segment of ocean shipping are collapsing.

-

Spot rates, which cover anywhere from 10% to 40% of ocean container shipments and are considered a key indicator of the industry's health, are in free fall.

-

There was a moment in time during late 2021 when containers from Asia to Los Angeles cost over $20,000. Today the cost is $1,382.

Source: Freightos / Reuters