Architecture Billings Fall Sharply to Start 2026

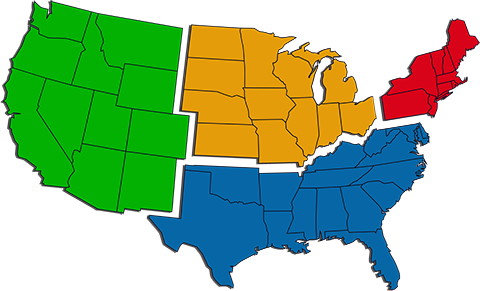

Southern U.S. holds steady as Northeast, Midwest and West contract

THE MOST RECENT REPORT: February 18, 2026

WASHINGTON – The AIA/Deltek Architecture Billings Index® (ABI) dropped to 43.8 in January, down from 47.1 in December, signaling a greater number of firms experienced a decline in billings compared to the previous month.

In January, inquiries for new projects dropped for the first time since April 2025, alongside a decline in newly signed design contracts, as client uncertainty persisted and new projects tended to be smaller in scale. Billings decreased across the country, except in the South, where they held steady. Firms in the Midwest, which saw growth in late 2025, are now experiencing declines again. Business conditions remained challenging across all specializations, with multifamily residential firms seeing a slower rate of decline but no billings growth since mid-2022.

"Overall economic conditions remain subdued, with revised 2025 employment data revealing smaller gains than anticipated and nonfarm payrolls increasing by just 130,000 in January 2026," said AIA Chief Economist, Richard Branch. "That said, construction employment was a bright spot, adding 33,000 jobs, including 25,000 in nonresidential specialty trades, signaling a positive shift after stagnant growth last year. Architectural services also showed resilience, with a net gain of 1,300 positions in 2025 despite early declines and a slight dip in December."

Key ABI highlights for January include:

- Regional averages: South (50.2); Midwest (46.3); West (46.3); Northeast (42.3)

- Sector index breakdown: multifamily residential (48.4); institutional (46.8); commercial/industrial (43.9); mixed practice (firms that do not have at least half of their billings in any one other category) (43.4)

- Project inquiries index: 49.3

- Design contracts index: 42.7

Regional and sector categories are measured as three-month moving averages and may not align with the national score.

Inside Lighting strives to accurately report certain data on the day it is reported by the AIA, but updates to past data with new three-month rolling averages might not be made. For official and most current reports, refer to the AIA ABI numbers. All ABI data is sourced from the AIA.

Interpreting the ABI:

The Architecture Billings Index (ABI) is a leading economic indicator of construction activity. It is produced by the American Institute of Architects (AIA) and it reflects the approximate nine-to-twelve month lead time between architecture billings and construction spending.

The ABI is based on a monthly survey of architecture firms that asks respondents to rate the level of their billings (or the amount of new design contracts) as either "increase," "decrease," or "no change" from the previous month. The results are then compiled into an index, where a score above 50 indicates an increase in billings, and a score below 50 indicates a decrease in billings.

The ABI is widely used in the construction industry, as well as by economists and analysts, to track the health of the construction market and to forecast future building activity. It is considered a leading economic indicator because changes in architecture billings often precede changes in overall economic activity, such as employment and GDP.

The ABI provides a snapshot of the demand for design services as well as an indication of the near-term outlook for the construction industry.

The survey panel asks participating architectural firms whether billings increased, decreased or stayed the same in the month that just ended. According to the proportion of respondents choosing each option, a score is generated, which represents an index value for each month.

- An index score of 50 indicates no change in firm billings versus the previous month.

- A score above 50 indicates an increase in firm billings versus the previous month.

- A score below 50 indicates an decrease in firm billings versus the previous month.

- NOTE: Index numbers cited for the last three reported months are preliminary.

- The regional and sector categories are calculated as a 3-month moving average, whereas the national index, design contracts and inquiries are monthly numbers.

Source: The American Institute of Architects (AIA)

National Architecture Billings Index

Source: The American Institute of Architects (AIA)

RELATED: Historical ABI Data 2008 - 2022 »

Don’t miss the next big ABI update…Click here to subscribe to the inside.lighting InfoLetter |

Regional Architecture Billings Index

(Three month rolling average)

Source: The American Institute of Architects (AIA)

Sector-Specific Architecture Billings Index

Three-month rolling average

Commercial/Industrial

Buildings related to commerce and industry. Office space, banks, retail, factories, etc.

Institutional

Schools, civic/government buildings, museums, hospitals, etc.

Multifamily Residential

Town homes, apartment complexes, condominiums, etc.

Mixed Practice

Firms that do not have at least half of their billings in any one other category.

Source: The American Institute of Architects (AIA)

Don’t miss the next big ABI update…Click here to subscribe to the inside.lighting InfoLetter |