April 23, 2024

FTC Bans Non-Competes*: What You Need to Know

*Exclusions apply. New rule potentially increases the mobility of top company talent without implications.

On Tuesday, the United States Federal Trade Commission (FTC) announced a definitive final rule prohibiting noncompete agreements across the United States, a move aimed at enhancing market competitiveness and worker autonomy. FTC Chair Lina M. Khan highlighted the negative impacts of noncompete clauses on wages, innovation, and economic dynamism, noting that the abolition of these clauses could foster the creation of over 8,500 new startups annually.

The rule primarily targets existing non-competes, rendering them unenforceable post-effectivity, with an exception for less than 0.75% of workers who are senior executives. The rule change follows a robust public consultation where over 26,000 comments were received, overwhelmingly supporting the ban. The FTC has adapted the final rule in response to public feedback, eliminating the need for employers to formally rescind existing non-competes, instead requiring them to notify workers that such agreements will no longer be enforced.

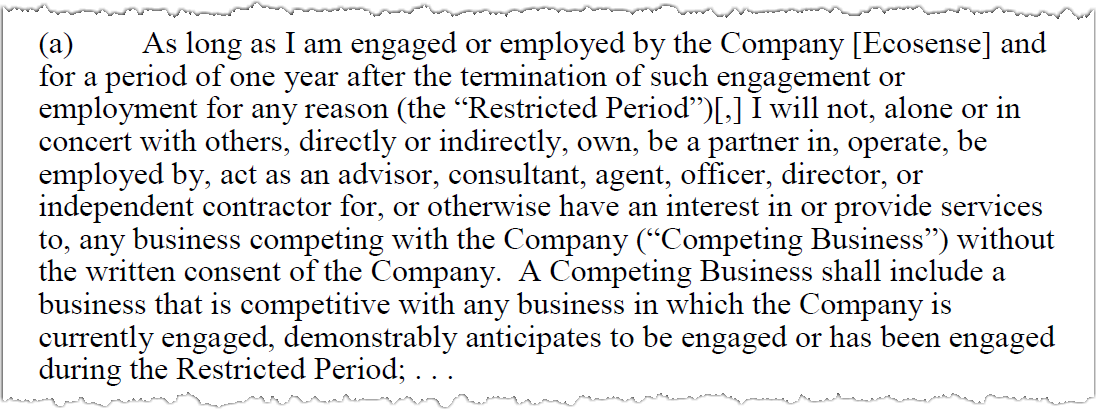

Above example: Excerpt from a past Ecosense non-competition agreement

Despite dissent from Commissioners Melissa Holyoak and Andrew N. Ferguson, the rule passed with a 3-2 vote and will take effect 120 days after its publication in the Federal Register.

Are you a Senior Executive? Good news & bad news:

The FTC defines “senior executives” based on an earnings test and a job duties test. In general, the term “senior executives” refers to workers earning more than $151,164 who are in a “policy-making position” as defined in the final rule.

Continuation of Existing Non-Competes: Senior executives with non-compete agreements established before the rule's effective date will find these agreements remain enforceable. This continuity can provide stability for both the executives and the firms, ensuring that existing agreements, which often include significant compensation and benefits, are honored.

Restrictions on New Non-Competes: Moving forward, companies cannot enter into new non-compete agreements with senior executives. This change means that executives joining a company post-rule or renegotiating their contracts won't be subject to non-compete clauses. This potentially increases the mobility of top talent, allowing executives to move between companies without restrictions, which could enhance competition and innovation within industries.

Legal and Financial Considerations: Existing non-competes might still be subject to legal scrutiny, especially if challenged on other grounds than the mere existence of the clause. Senior executives and employers may need to carefully consider the specific terms and enforceability of these clauses. Additionally, compensation packages tied to non-compete clauses might require restructuring to ensure they comply with the new rules while remaining attractive and fair.

Strategic Business Planning: Companies might need to revise their strategies for retaining top talent and protecting trade secrets and other confidential information. Alternative strategies, such as enhanced confidentiality agreements or longer vesting periods for stock options, might become more prevalent.

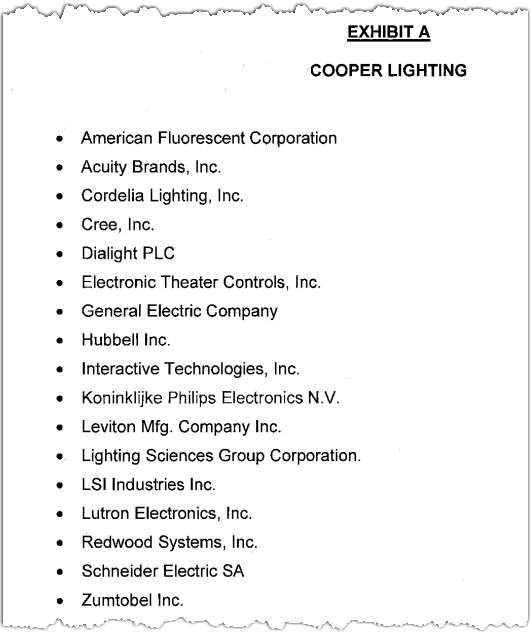

Above example: An excerpt from publicly available 2012 non-competition agreement issued by Cooper Lighting to an engineering manager blacklisted potential employers by name.

Non-competes as a term of a business sale:

The FTC's final rule allows non-compete agreements in the specific scenario of a business sale, where the non-compete agreement is made in good faith as part of a bona fide business transaction. This means that the non-compete can only be used to protect the buyer from competition by the seller to ensure the value of the acquired business is not undermined. Importantly, the rule has removed the initial requirement that the seller be a "substantial" owner of the business, which was previously proposed to be defined as owning at least 25% of the business.

This change was made in response to feedback that the 25% threshold was too high and did not reflect the reality of many business sales, where sellers might have significant influence and goodwill despite owning less than 25%. The final rule now covers any seller involved in a bona fide sale, without a strict ownership percentage requirement.

If you are already under a non-compete:

The FTC rule also includes another significant exception related to existing non-compete agreements. Specifically, it stipulates that the rule does not apply retroactively to non-compete clauses that were part of agreements made before the rule took effect if a related cause of action (like a breach) occurred prior to the effective date of the new rule. This means that non-competes established under previous laws will not be automatically voided if the conditions causing a legal dispute were already in place before the rule was implemented.

This provision addresses concerns about the rule’s retroactive application potentially violating due process or constituting an impermissible taking under the Fifth Amendment. The idea is to avoid impairing rights that were legally obtained under prior laws.

Your state laws could impact this:

The FTC has adjusted the preemption provision to specify that state laws are not preempted if they provide protections that are "substantially similar to or greater than" those provided by the federal rule. This means state laws can continue to operate alongside the federal rule as long as they do not conflict with it and offer equal or greater protection against non-competes.

Other Noncompete Alternates are Still In Play:

Under the new FTC rule, Non-Disclosure Agreements (NDAs), TRAPs and non-solicitation agreements are still lawful, provided they do not function effectively as non-compete clauses. The rule specifically addresses the potential for these types of agreements to be overbroad or onerous in a way that they practically prevent a worker from seeking or accepting other work or starting a business after their employment ends.

Non-Solicitation Agreements

Non-solicitation agreements restrict a former employee's ability to solicit clients, customers, or employees of their former company. While generally less restrictive than non-competes, in some cases, they can effectively prevent an individual from working in their field or starting a new business if they heavily rely on their established network. For example, if a significant portion of someone's business capacity relies on contacts or employees they cannot interact with due to a non-solicitation agreement, it could restrict their ability to work elsewhere or launch a new enterprise.

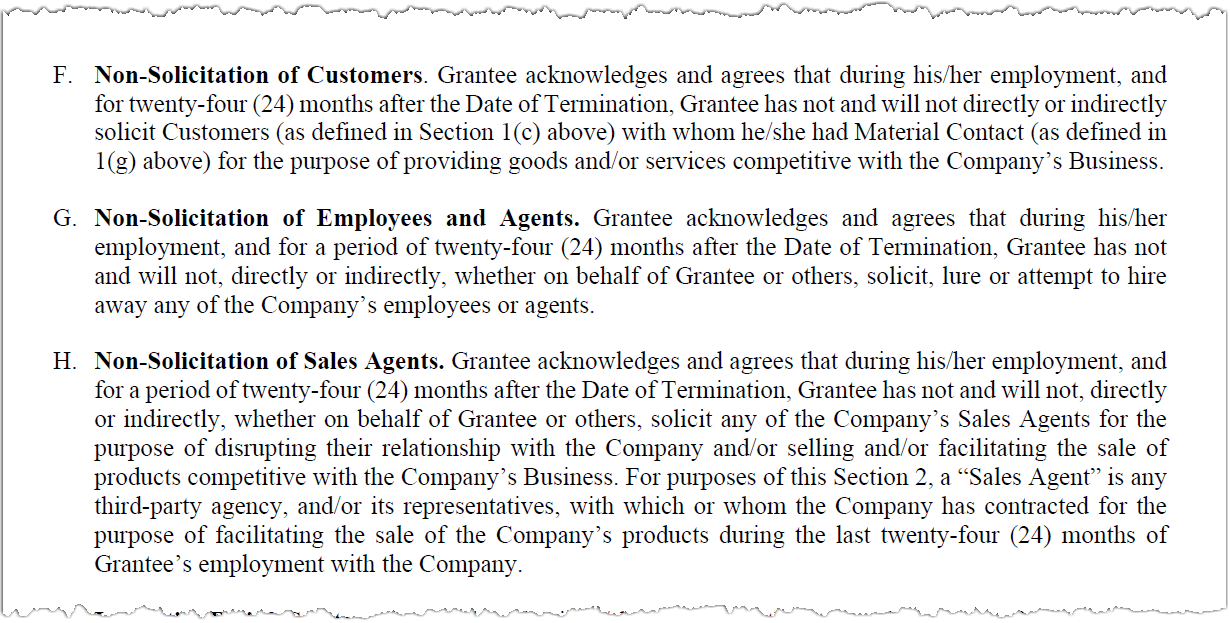

Above example: An excerpt of a past Acuity Brands non-solicitation agreement as part of an employee stock incentive program

Non-Disclosure Agreements (NDAs)

NDAs are contracts that prevent an individual from sharing confidential and proprietary information learned during employment. They are meant to protect sensitive business information. However, overly broad NDAs that restrict an employee from working in the same industry can, in practice, function like a non-compete. For instance, an NDA that prevents an employee from using industry-related knowledge in any other context could unfairly restrict the employee's employment opportunities in that field, akin to a non-compete.

Training Repayment Agreements Provision (TRAPs)

TRAPs are clauses in employment agreements that require employees to repay the company for training costs if they leave the job within a certain period. These can become de facto non-competes if the repayment terms are so severe that they financially coerce the employee to stay with the employer, rather than freely choosing to leave or seek other employment. For example, a TRAP that imposes a high financial penalty for not completing a set number of hours or years with the company can prevent employees from leaving due to the financial burden.

Overall, whether a specific NDA, non-solicitation agreement, or TRAP qualifies as a non-compete under the FTC rule will depend on the specific terms and how they function in practice.

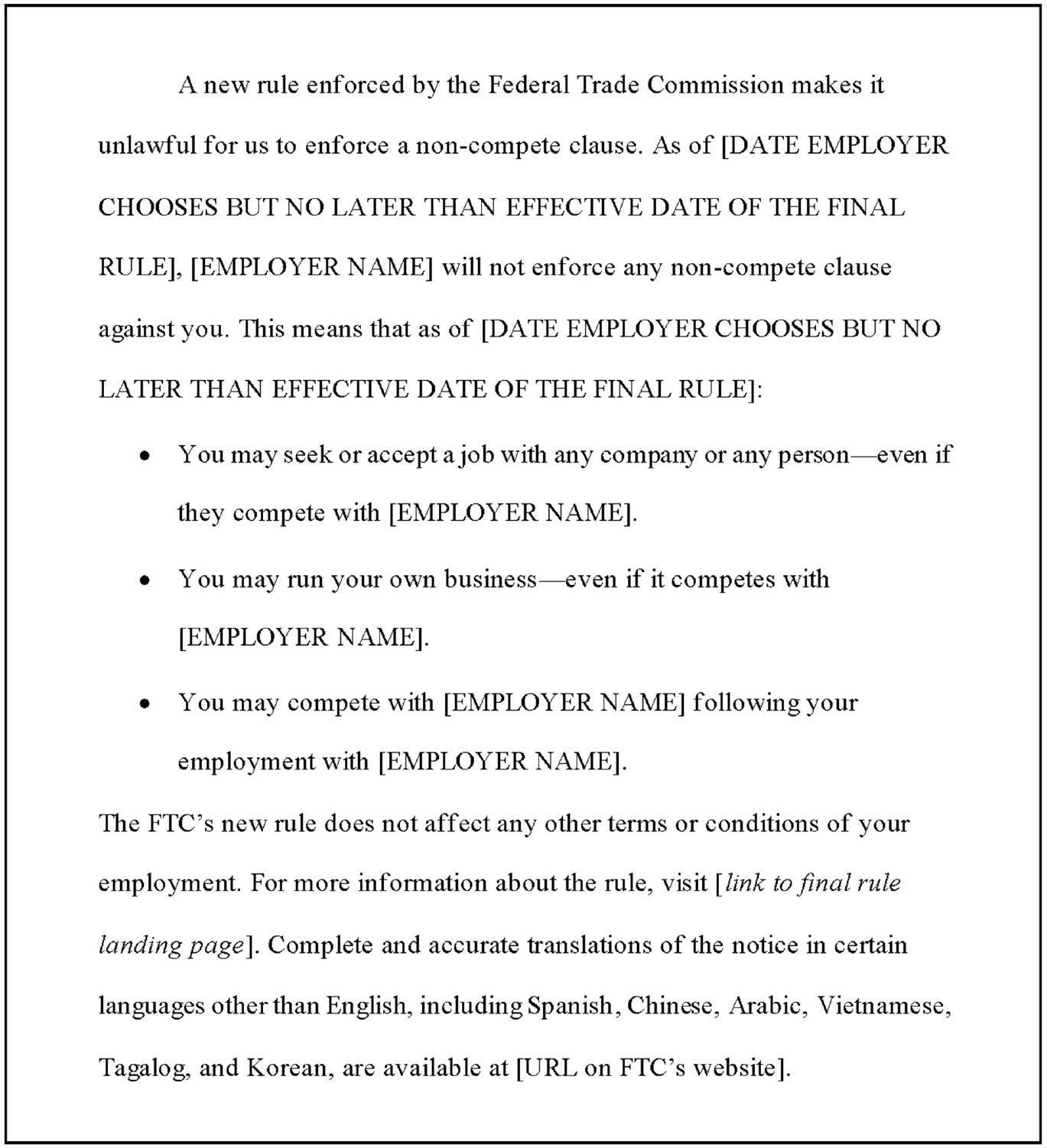

Employers are obligated to inform affected employees:

The FTC proposes that the specified model language below should serve as notification to the employee that their non-compete clause is unenforceable and will not be enforced.

The FTC projects that the new rule will not only spur a 2.7% annual increase in business startups, adding more than 8,500 new businesses each year but also boost worker earnings by an average of $524 annually.

The FTC's ban on noncompete agreements marks a significant shift toward promoting market competitiveness and employee freedom, potentially fostering an increase in new startups and enhancing worker earnings. While the rule introduces broad changes, tailored exclusions for senior executives and specific scenarios ensure that it respects existing legal frameworks and business practices.

Legal Disclaimer: This article provides a general overview of the FTC's final rule on noncompete agreements and is intended for informational purposes only. It does not constitute legal advice. The FTC final rule may have specific details and implications not fully addressed herein. Readers are advised to consult the actual text of the FTC final rule and/or seek legal counsel for thorough understanding and guidance regarding their specific circumstances.