June 7, 2022

Orion Sets Sights on Being a $500 Million Company

Is that realistic? Three takeaways from Orion’s Fiscal Year 2022

Orion’s 2022 fiscal year ended on March 31, and the company’s just-reported results reflect the continuation of Orion’s three-year roller coaster ride that has seen rapid revenue acceleration coupled with big swings and fluctuation in Orion (NASDAQ: OESX) stock price. Revenues for the year increased to $124.4 million with $6.1 million in net profit.

Here are three takeaways from the company’s annual filing:

1. The Home Depot Account

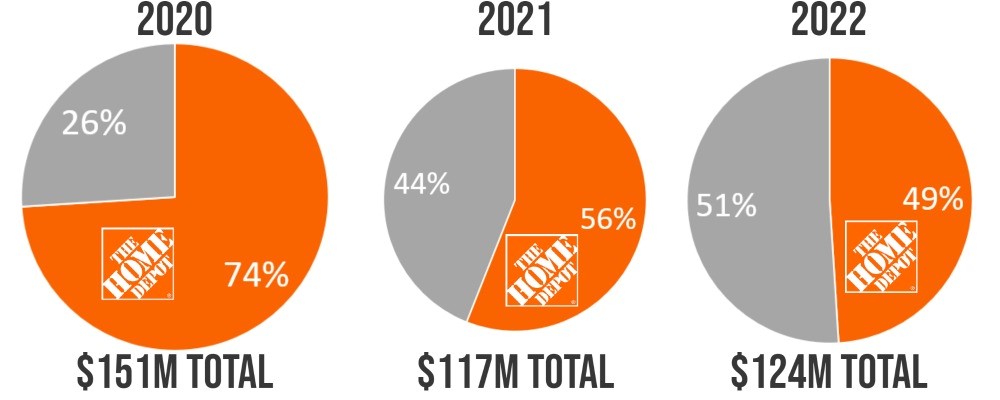

The company has been transparent about having one large retail chain (believed to be The Home Depot) as its number one customer. Just two years ago, lighting projects at The Home Depot stores represented 74% of Orion’s overall business. As the pace of projects slowed down in 2022, the pie chart shows a less scary, better diversified $61 million or 49% of total revenue tied to The Home Depot. Moving into 2023, the company is assuming approximately $25M in revenue from its largest customer.

The projected $25 million in 2023 sales to The Home Depot is "expected from a mix of projects for new facilities, exterior LED lighting, various lighting and electrical projects as well as maintenance services revenue."

2. Company Eyes $500 Million in Sales

Orion’s 2022 sales were $124.4 million. Approximately $63 million came from non-Home Depot business. Yet, the company seemed very bullish on its five-year growth potential stating, “Orion’s Board and management team remain committed to a long-term strategic plan that seeks to grow the business, via organic and external growth initiatives, to a $500M annual revenue business over approximately five years.”

In order for 2023 sales to simply break even with 2022, the company will need to continue its growth of non-Home Depot business and ratchet that up from $63 million to $99 million, or 57%. But in order for the company to get to $500 million by 2027, they will need more than that over time. A compound annual growth rate (CAGR) of 32.1% would be required to see Orion get to $500 million and quadruple its sales in five years.

Months ago, Orion acquired Stay-Lite Lighting, a lighting and electrical maintenance provider, to bolster its service revenue from turnkey installations and maintenance. The company’s stated strategic plan envisions double digit organic growth, augmented by more strategic acquisitions, business partnerships or other initiatives.

Aggressive Goals: A 32.1% CAGR applied to 2022 revenue.

|

FY 2022 |

$124.4 million (actual) |

|

FY 2023 |

$164.3 million |

|

FY 2024 |

$217.1 million |

|

FY 2025 |

$286.8 million |

|

FY 2026 |

$378.8 million |

|

FY 2027 |

$500.4 million (end goal) |

3. Is Insider Trading Activity a Tell?

In early 2019 Orion stock was trading at under $1.00. As Home Depot business injected immediate and exponential growth into Orion’s P&L, the stock hit $11 in early 2021. Today, the stock opened at $2.27.

Wall Street traders would likely describe Orion’s stock as low volume one. And its insider trading activity would likely be described as rather slow, too. But, remarkably, all Orion insider common stock transactions from September 2017 to June 2019 were all stock purchases. That buy-low, sell-high mentality paid off as all-but-one insider common stock transactions were stock sales from July 2019 to present.

Does the lack of insider purchases over the last three years indicate a challenging road ahead for 2023? When a good-probability line of sight to $200 million in two years or $500 million in five years emerges, we would expect more stock purchasing activity to ensue.