February 3, 2022

Supply Chain & Workforce Issues Throttle Industry Confidence

"Better" conditions are expected in six months

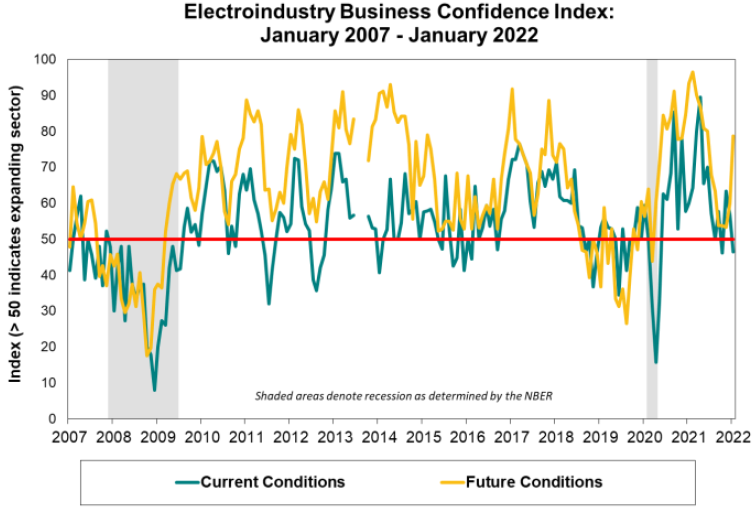

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

This most recent ECBI shows the number of positive sentiments decreasing slightly to prolonged supply chain and worker shortage issues. Below is the recently-published January report:

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)

Current conditions slide amidst supply chain and workforce concerns

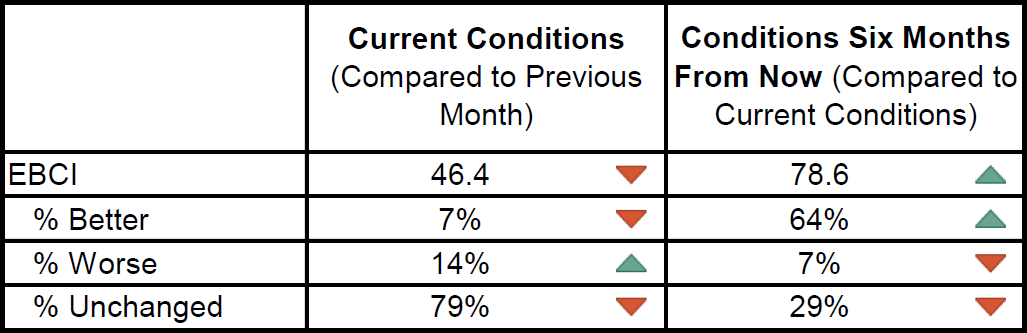

For the second time in four months, the current conditions component dipped below 50, suggesting at least a momentary decline in confidence from the EBCI panel. Although most panel members indicated “unchanged” conditions, the share of “worse” responses increased in January, pulling the gauge down to 46.4 this month from its December reading of 56.7. Many concerns shared by commenters involved supply side difficulties such as workforce and supply chain problems exacerbated by the Omicron-driven wave of SARS CoV-2 infections, but one comment alluded to weakening demand as well.

For the seventh consecutive month, the median reported magnitude of change in current electroindustry business conditions held firm in January at 0.0. Reflecting a more uniform distribution of the responses, the mean value edged down from +0.3 in December to +0.1 this month. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5

(improved significantly).

Reaching its most expansive level since June 2021, the future conditions component added nearly 20 points to the December reading, coming in at 78.6 this month. Hopes for improvements in the Covid situation, supply chain, workforce, and the inevitable churning seen in a national election cycle were reflected in a substantial increase in the share of participants expecting “better” conditions in six months. Last month a majority of respondents indicated that “unchanged” conditions were likely two quarters hence, but that share dropped to under one-third in this round of polling. The conditional nature of many comments suggested a soft optimism. So compared to the sluggishness of the current conditions reporting, changing future conditions were biased to the upside.

SURVEY RESULTS:

Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

Please note that survey responses were collected from the period of January 10-21, 2022.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |