January 27, 2022

LSI's Lighting Rebound Continues

Can LSI continue the positive trend of performance improvement?

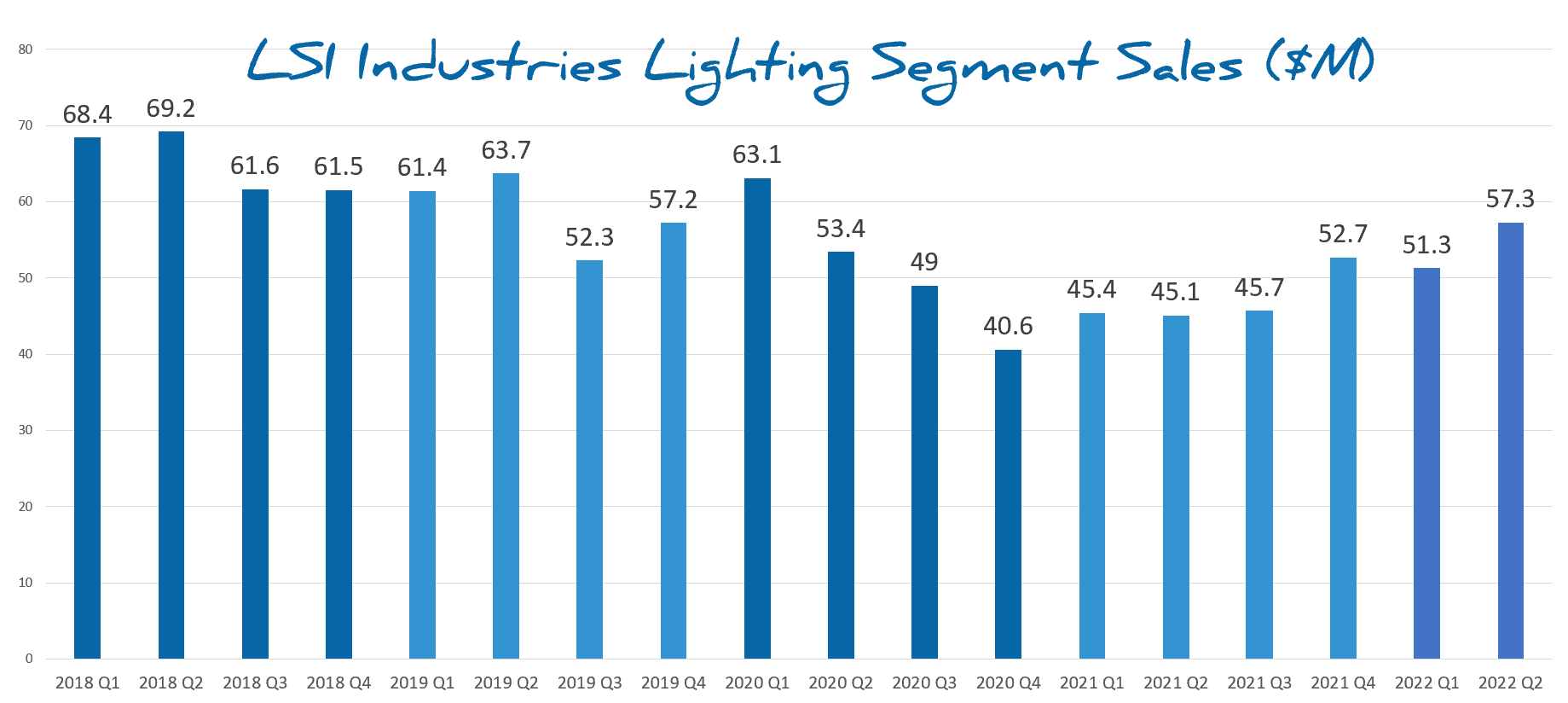

LSI Industries reported its second quarter 2022 financial results on Thursday. The overall business grew 19% year-over-year (organically) and the lighting segment saw a 27% increase with revenues of $57.3 million for the quarter.

During intraday trading, LSI Industries (NASDAQ: LYTS) stock is trading up over 15% (+$0.93) at $6.93. One year ago the stock was trading around $10.00 per share.

Here are some of the lighting takeaways:

Lighting segment sales were 52% of overall sales. The lighting share within LSI has been trending downward for years and it has been recently affected by the 2021 acquisition of JSI Store Fixtures, a $70 million company that became part of the Display business segment.

Lighting Rebound:

Like many companies, the Spring of 2020 was the most challenging quarter for LSI, dipping to a recent revenue low of $40.6 million. Generating 57.3 million in sales six quarters later is an admirable rebound. Good progress, but with more recovery to go, no victory laps just yet.

Still a way to go:

When LSI acquired Atlas Lighting Products in 2017, the companies had combined Lighting sales of $308 million. In the trailing twelve months, LSI’s Lighting segment has produced $207 million in revenue.

Other lighting commentary from Q2:

- LSI Lighting reported significant increases in both project business and sales through distributor stock.

- The increase in project business was broad-based, with increases in select target verticals such as warehousing, petroleum, parking, and automotive.

- Distribution sales increased 25% over prior year, as "distributors continue to steadily increase inventory levels."

- New products launched over the last twelve months were a major driver, with market adoption rates continuing to increase.

- The Lighting segment gross margin rate was 29.5% and operating income more than doubled from the prior year, reflecting effective price management and productivity, offsetting continued increases in input costs.

- Lighting quotation and order rate activity remains favorable with a fiscal second quarter book-to-bill ratio of above 1.0, a period when historical seasonality has order rates trending measurably below shipment levels.

- LSI reports that it exited the second quarter with a Lighting backlog more than 30% above the prior-year period.

LSI Industries 2022 Q2 Results »

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |