June 14, 2024

Signify Adds More Clarity to its New Divisional Structure

Updated financials. Commercial and consumer LED lamps now categorized separately. OEM numbers stand alone.

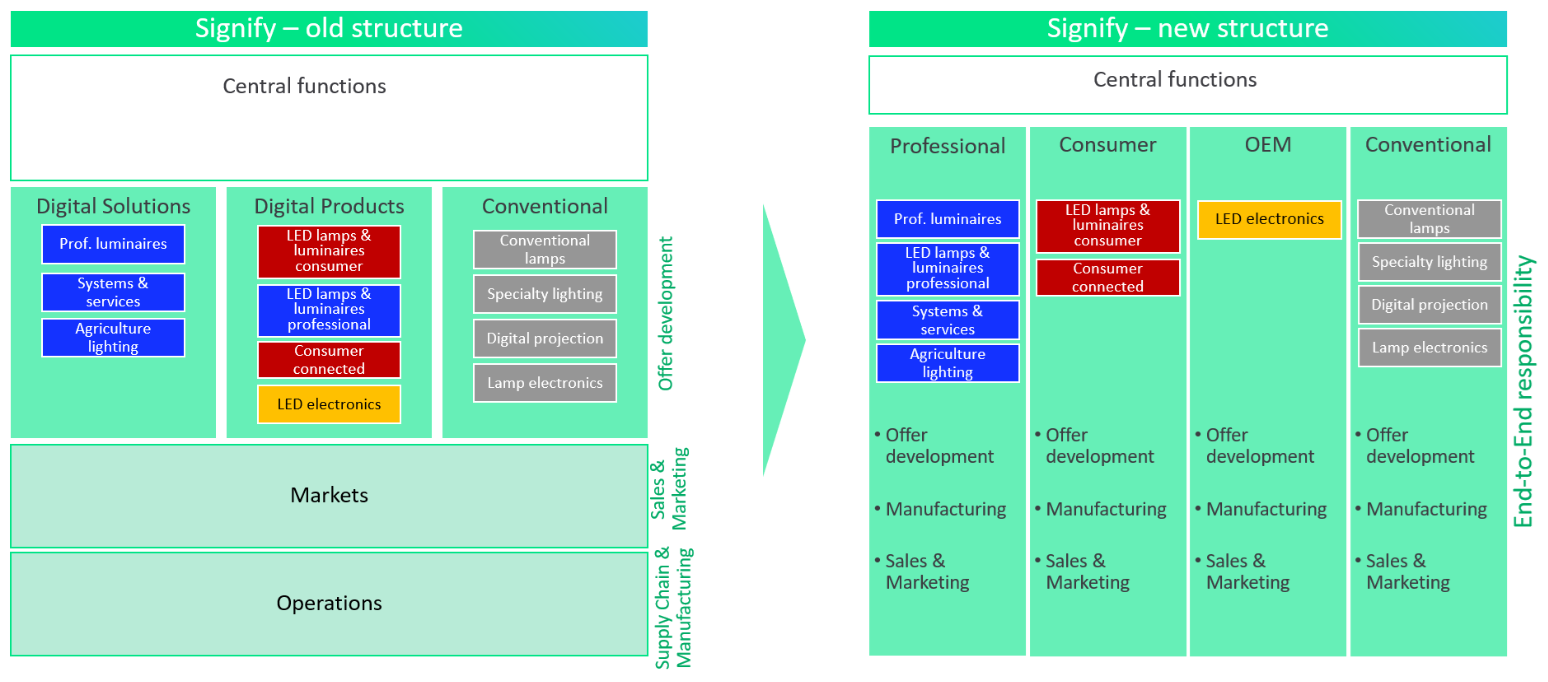

In late 2023, Signify, the Netherlands-based lighting giant with annual revenues of approximately $7.1 billion, announced a significant reorganization of its business structure to align more closely with customer channels.

This restructuring effort, while providing enhanced clarity to its business operations, also introduced complex challenges. These include the reclassification and reassignment of revenues and costs to the new divisions, all under the scrutiny of public company trading regulations and amidst the complexities of managing currency exchanges across the dozens of countries where Signify and its subsidiaries operate.

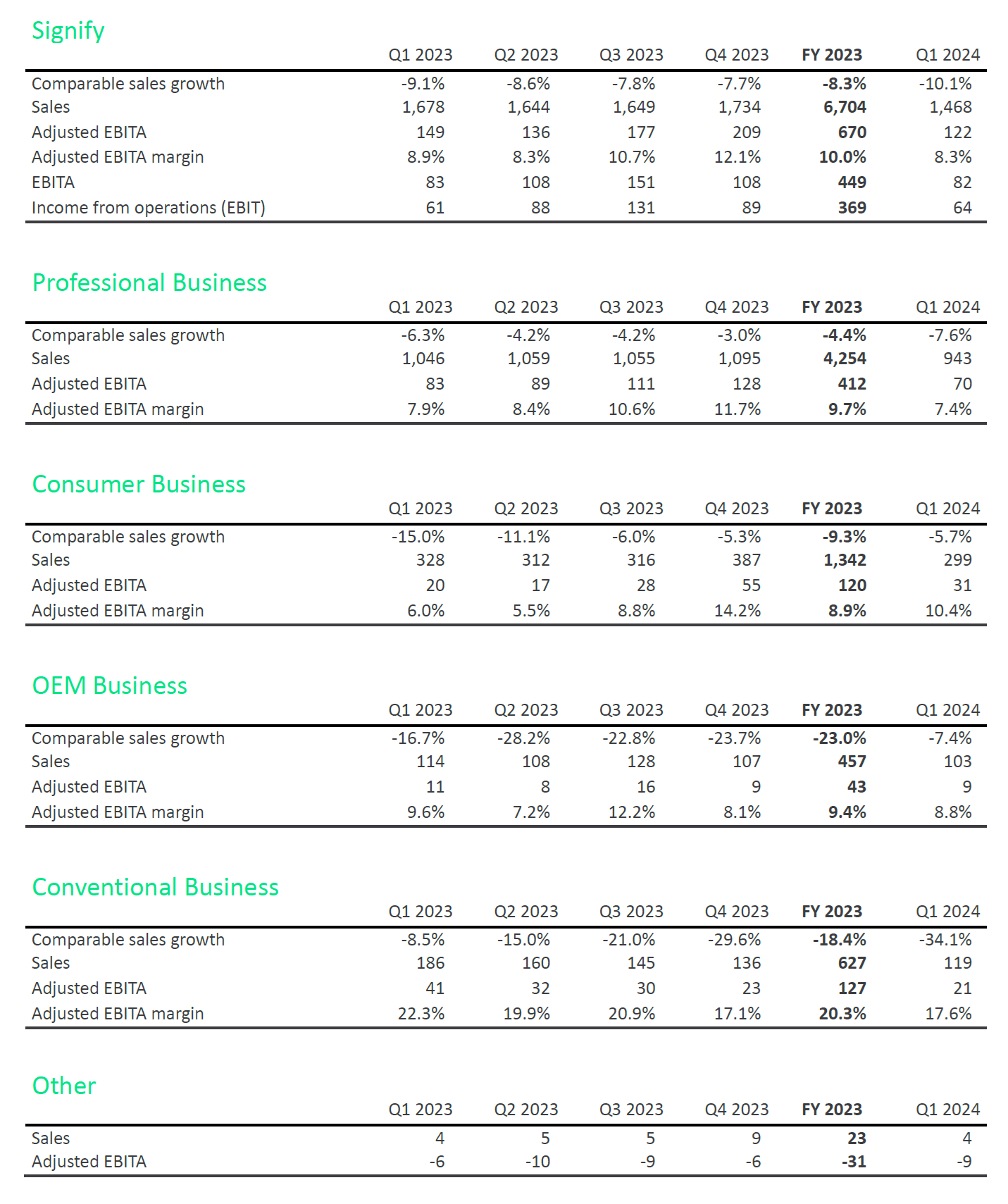

During the first quarter of 2024, Signify disclosed that it would temporarily withhold certain financial metrics due to the reorganization. The company promised to resume detailed reporting from April 1, 2024, marking the start of its second quarter. To facilitate a clear comparison of financial performance year-over-year, Signify retroactively applied the new structure to its 2023 financial reporting. This adjustment was aimed at ensuring that financial details could be accurately assessed on a consistent "apples to apples" comparison basis.

Under the revamped structure, certain operational business activities previously categorized as central functions are now being allocated directly to specific divisions. This reassignment is intended to provide greater financial transparency and accountability. The restructuring also affects how products are categorized:

-

OEM products, such as drivers and other electronic components, now stand as a separate division, ensuring clearer financial delineation.

-

Additionally, the commercial LED lamps and luminaires division has been separated from the consumer lamps and luminaires, aligning under the umbrella of the Professional business segment.

As Signify nears the close of its second quarter on June 30, 2024, it has begun the process of restating its finances, filling in previously omitted details mainly division breakdowns of EBITDA and profit margin numbers that were previously omitted.

Below is the division-by-division breakdown of the “fill in the blanks” financials provided by Signify today:

The Professional business offers LED lamps, luminaires, connected lighting systems and services to customers in the professional segment. The Professional business is the combination of the former Digital Solutions division and Professional LED lamps and luminaires, which was formerly part of the Digital Products division.

Reflecting this shift and the reallocation of central costs to the businesses, the Professional business recorded sales of EUR 4,254 million with an Adjusted EBITA of EUR 412 million and an Adjusted EBITA margin of 9.7% for the year 2023. In Q1 2024, the Adjusted EBITA margin decreased from 7.9% to 7.4% year on year.

The Consumer business offers LED lamps, luminaires, and connected products, including Philips Hue and WiZ, to customers in the consumer segment. The Consumer business was formerly part of the Digital Products division alongside Professional LED lamps and luminaires and the OEM business.

Reflecting this shift and the reallocation of central costs to the businesses, the Consumer business recorded sales of EUR 1,342 million with an Adjusted EBITA of EUR 120 million and an Adjusted EBITA margin of 8.9% for the year 2023. In Q1 2024, the Adjusted EBITA margin improved from 6.0% to 10.4% year on year.

The OEM business offers lighting components to the industry. The OEM business was previously part of the Digital Products division and is now set up as a standalone business.

Reflecting this shift and the reallocation of central costs to the businesses, the OEM business recorded sales of EUR 457 million with an Adjusted EBITA of EUR 43 million and an Adjusted EBITA margin of 9.4% for the year 2023. In Q1 2024, the Adjusted EBITA margin decreased from 9.6% to 8.8% year on year.

The Conventional business offers special lighting, digital projection, and lamp electronics. The Conventional business is similar to the former Conventional Products division.

Following the reallocation of central costs to the businesses, the Conventional business recorded sales of EUR 627 million with an Adjusted EBITA of EUR 127 million and an Adjusted EBITA margin of 20.3% for the year 2023. In Q1 2024, the Adjusted EBITA margin decreased from 22.3% to 17.6% year on year.

'Other' represents amounts not allocated to the businesses and now mainly includes costs related to ventures, exploratory research and audits. Following the implementation of the new structure, part of the central costs has been reallocated to the four vertically integrated businesses. As a result of the reallocation, 'Other' Adjusted EBITA for 2023 reduced from EUR -86 million to EUR -31 million.