June 13, 2024

NEMA Survey Reflects Cautious Optimism Among Manufacturers

Elections, inflation, and tariffs contribute to mixed expectations among industry stakeholders

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting, electrical and medical imaging products.

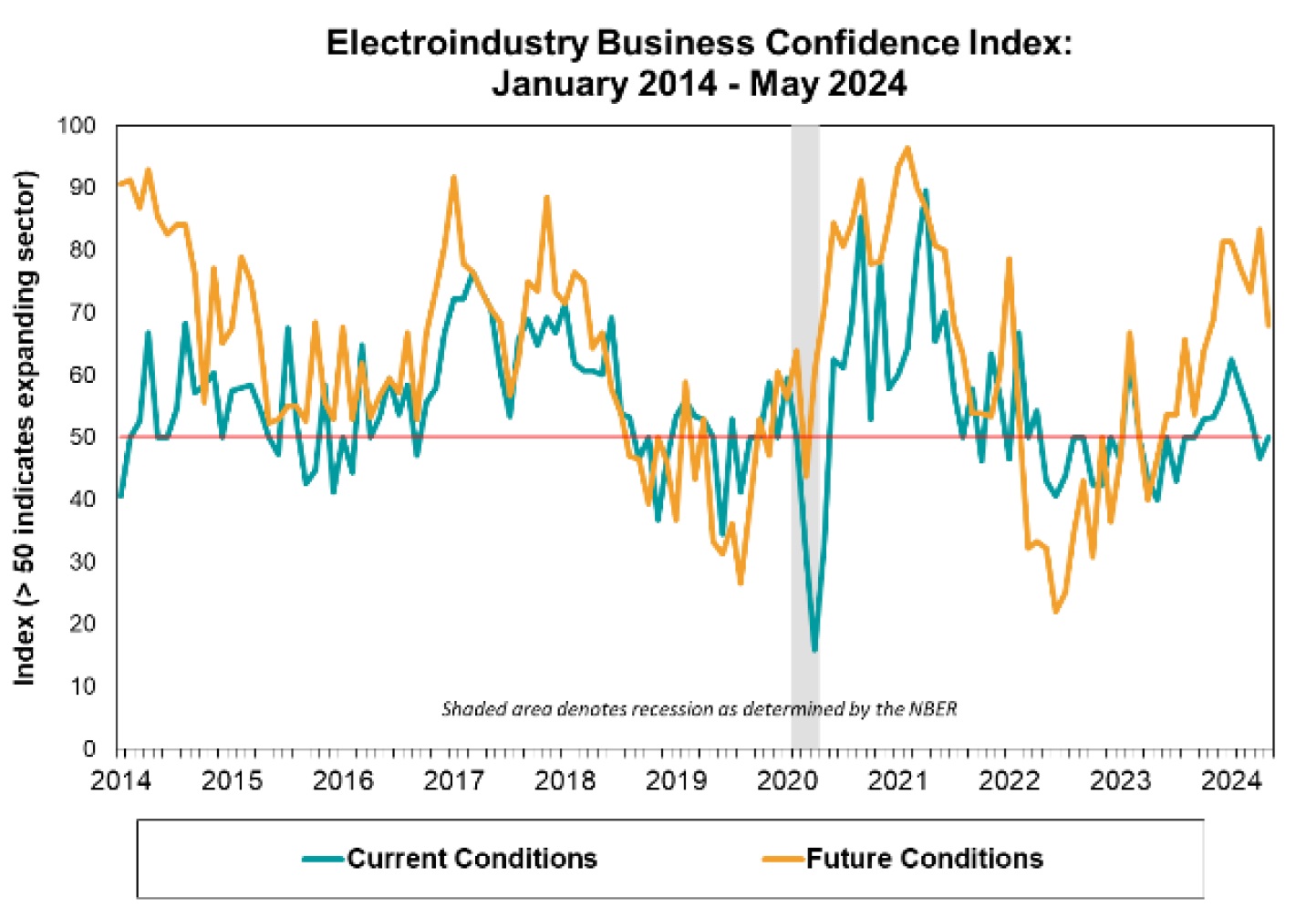

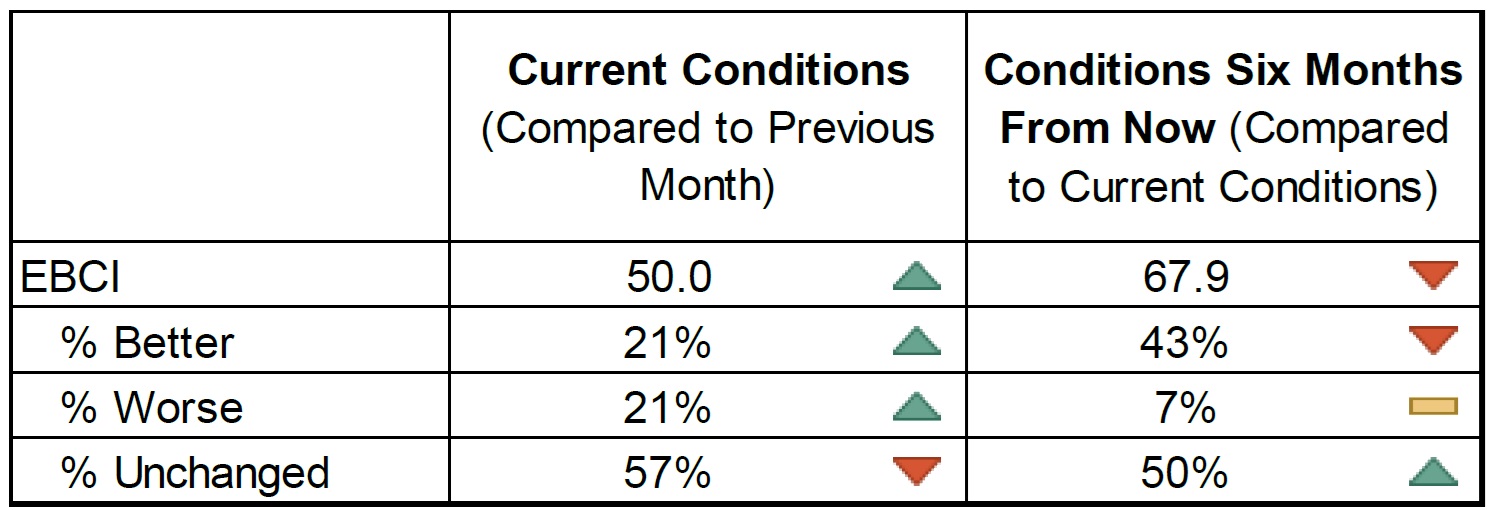

After a period of consistent growth, the industry’s current conditions index dipped to 46.7 points in April before rebounding to 50, indicating stable conditions. The future conditions index, which had peaked at 83.3 in April, eased to 67.9 in May, still suggesting expansion but at a slower pace. The survey, conducted by the National Electrical Manufacturers Association (NEMA), revealed that 43% of respondents anticipate better conditions in six months, while 50% expect no change, amid concerns about market uncertainty due to elections, inflation, and tariffs.

This most recent ECBI shows how makers of electrical equipment view current and future market conditions. Below are the details:

Following a six-month run of readings suggesting expansionary conditions, the current conditions component pulled back in April, dipping to 46.7 points. Boosted by a higher proportion of respondents who reported “better” conditions, the gauge of current conditions bounced back to reach the threshold score of 50, a result that suggested conditions remained essentially unchanged from the previous month’s.

Except for a three-month period of relatively robust readings near the start of the year, the current conditions barometer has mostly hovered in a region suggesting slow to flat growth for the last 12 months. Comments pointed to modest improvement in conditions mixed with the observation that “order rates have softened in the near term.”

The median value of responses regarding the reported magnitude of change in current conditions remained at 0.0, which is unchanged from last month. The mean also held steady at +0.2. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

After reaching a high for 2024 in April at 83.3 the future conditions index in May eased to 67.9. This was still above the threshold indicating an expansionary market and marked the 12th consecutive month of expected growth in the period six months ahead. Although few panel members indicated that they foresaw “worse” conditions ahead, half of the respondents reported anticipating that conditions will be “unchanged” in six months. Comments were mixed with some expressing expectations of increased sales in the fourth quarter while others mentioned market uncertainty around elections, inflation, inventory drawdowns, and tariffs.

SURVEY RESULTS:

- Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

- A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

- Please note that survey responses were collected from the period of May 13-24, 2024.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)