June 27, 2024

Acuity Brands Reports Solid Performance Despite Revenue Decline

High order rates indicate strong demand; backlog issues to be addressed.

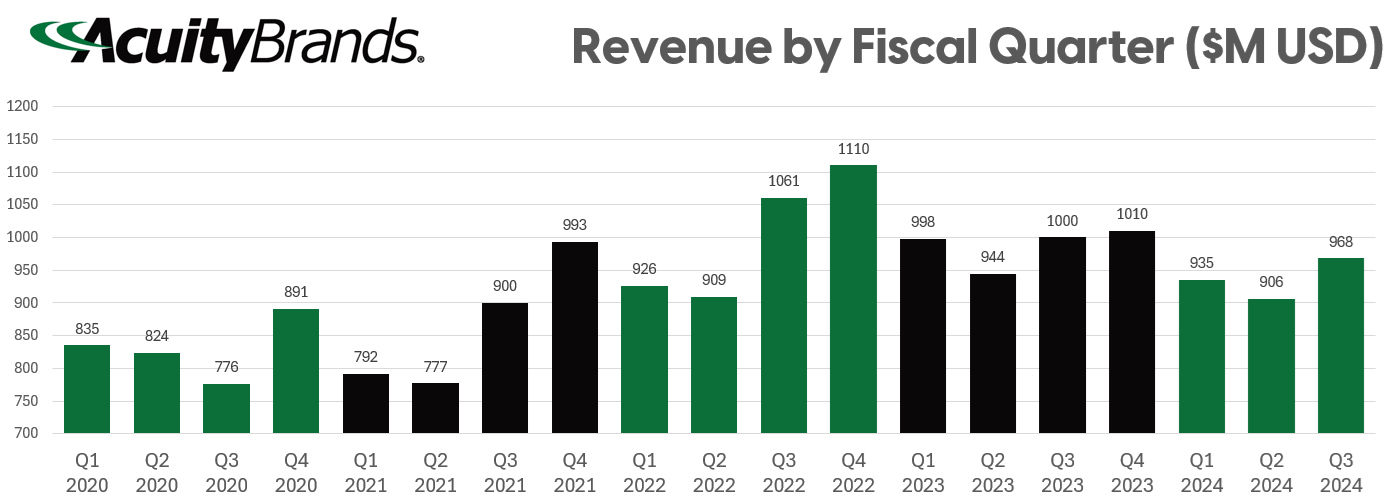

Acuity Brands, North America's largest lighting maker, reported a robust performance for the third quarter of fiscal 2024, ending May 31, 2024. Despite a 3.2% decline in net sales compared to the previous year, the company achieved significant profit margins and strong earnings per share (EPS) growth.

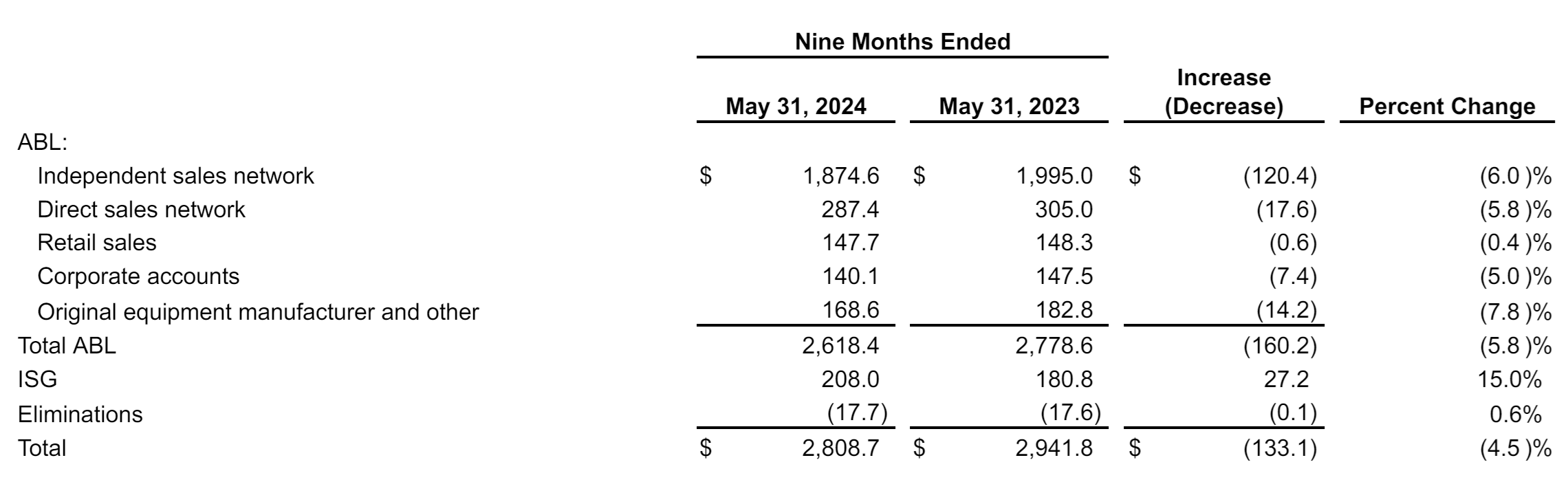

Acuity Brands posted net sales of $968.1 million for Q3 FY2024, a decrease from $1.00 billion in Q3 FY2023. The decline was primarily due to reduced sales in the Acuity Brands Lighting and Lighting Controls (ABL) segment, which saw a 4.5% year-over-year drop to $898.5 million. However, the much smaller Intelligent Spaces Group (ISG) segment partially offset this decline with a 15% increase in sales, totaling $75.7 million.

Gross profit for the quarter rose to $452.2 million, a 1.1% increase from $447.3 million in the same period last year. The gross profit margin improved to 46.7% from 44.7%, reflecting better cost management and product vitality.

Segment Performance

ABL Segment: Operating profit for ABL increased slightly to $151.5 million from $150.0 million, despite lower sales. The segment's operating profit margin improved by 100 basis points to 16.9%.

ISG Segment: ISG continued its strong performance with an operating profit of $12.5 million, up 45.3% from $8.6 million in Q3 FY2023. The segment's operating profit margin increased by 340 basis points to 16.5%.

Above: Year-to-date revenues by segment and channel. Independent sales agents have consistently accounted for roughly two-thirds of Acuity Brands' total sales in recent years.

Corporate Projects (which includes direct National Account business)

During the investor call, CEO Neil Ashe highlighted the strong performance in Acuity Brands' corporate projects segment. He noted, "This quarter was a good quarter for corporate accounts, which benefited from a large retail Relight project."

Ashe emphasized the attractiveness of the corporate accounts business, describing it as "streaky" due to its nature of securing large customers when they are ready, but highly valuable given Acuity Brands' unique position to serve this market effectively.

Made-to-Order, Design Select, Contractor Select:

During the investor call, CEO Neil Ashe emphasized Acuity Brands Lighting and Lighting Controls (ABL) segment's strategic focus on three key areas: Made to Order (MtO), Design Select, and Contractor Select. Ashe highlighted the MtO portfolio as a cornerstone of ABL's ability to deliver highly customized lighting solutions. "The majority of our products are made to order, which uses our entire portfolio to create limitless design options for our customers," Ashe explained. He illustrated this with the example of the Michigan Central Station restoration project, where Acuity Brands recreated the original 1912 lighting blueprints using modern LED technology.

Ashe also highlighted the importance of the Design Select program, which curates high-demand products with short lead times. "Design Select takes the limitless design options for made to order and curates them into an offering that delivers a highly productive approach to project design with ease of selection and service predictability," Ashe noted. This approach ensures that customers can access superior solutions quickly, meeting their timelines whether they need products in three weeks or three months.

The Contractor Select program, something Ashe highlights in every investor call, focuses on approximately 300 high-volume products designed for everyday lighting applications. These products are readily available and economically competitive, offering the best value for customers. "Our Contractor Select portfolio is very competitive from a price perspective, although not the lowest price, but the most competitive for the value," Ashe stated. This means customers receive high-quality, versatile products that deliver excellent performance and reliability.

Pursuing the Refueling Vertical Market

In a portion of the investor call that sounded similar to the vertically-focused discussions of LSI Industries quarterly earnings calls, Ashe mapped out Acuity Brands' strategic entry into the refueling and convenience store (C-store) market.

Ashe emphasized that this vertical presents a significant growth opportunity due to its size and relatively low competition. "This is a vertical where we have not broadly competed and earlier this week we announced that we have signed one of the leading independent sales agents positioning us well to compete in this established and growing market," Ashe explained.

Analyzing this further, Acuity Brands' new agent partnership is with Ohio-based Red Leonard Associates. The specialty agent offers a wide range of service station products beyond lighting, enabling Acuity Brands' to pursue projects that otherwise might not be on their radar. Notably, Red Leonard’s "Lighting and Signage" line card includes two brands – Acuity Brands and Cree Lighting.

Order Rates and Backlog: Refreshing Transparency

During the investor call, Ashe provided insights into Acuity Brands' order rates and backlog. He noted that the company experienced strong order rates, with orders exceeding shipments for the third quarter. This positive trend indicates robust demand for Acuity Brands' products, which Ashe attributed to the company's diverse portfolio and strategic market positioning. However, he also acknowledged that this success led to a buildup in backlog, which the company is working to address in the coming quarters.

Ashe candidly admitted that the production team missed its targets in Q3, a rare admission in investor calls where companies often attribute misses to external factors. He stated, "Our orders exceeded our shipments, which means we generated a backlog during the quarter…We didn't meet our daily production targets, and there are a handful of reasons for that, none of which are alarming.”

Any Mergers and Acquisitions on the horizon?

During the investor call, a question was raised about Acuity Brands' plans for mergers and acquisitions (M&A), given their substantial cash reserves and recent performance. CFO Karen Holcom emphasized the company's disciplined approach to capital allocation, stating that their first priority remains investing in organic growth within their existing businesses. She highlighted the company's commitment to driving internal growth before pursuing external opportunities.

CEO Ashe added that while the company is focused on organic growth, they also recognize the value of strategic acquisitions to enhance their portfolio and market presence. Ashe mentioned that Acuity Brands has a robust pipeline of small to medium-sized acquisitions, particularly in their Intelligent Spaces Group (ISG) segment. He elaborated, "We have opportunities to expand our addressable market in the things that we can control and in the manner in which we can control them." Ashe reiterated the company's disciplined approach, noting that any potential acquisition must align with their strategic goals, be well-integrated into their operations, and acquired at an appropriate valuation.

Product Mentions

During the investor call, Ashe and highlighted several key products.

Lithonia Frame: Introduced as a modern and sustainable alternative to traditional LED panels, the Lithonia Frame is designed for indoor applications, including commercial offices and K-12 schools. Its key features include flexibility of design with three size options, switchable technology for different lumen outputs and color temperatures, a lightweight design, and patented snap connections for quick assembly and ease of installation.

- Red Dot Award Winners:

-

Luminis Inline: Recognized for its product design, this high-performance lighting fixture produces an evenly distributed glow and offers multiple size and mounting options, making it suitable for various indoor environments.

-

Eureka Atoll: A high-performance ring fixture that produces an evenly distributed glow. It is notable for its elevated design and availability in multiple sizes and mounting options, suitable for use in commercial spaces and other indoor environments.

-

Cyclone Mochi: A contemporary dome streetlight designed for precision illumination, suitable for infrastructure projects where safety is a priority. Its innovative design offers multiple configurations and features a patented latch for easy maintenance access without compromising security.

-

-

Distech RESENSE Move: An advanced seven-in-one ceiling-mounted sensor capable of detecting occupancy and providing feedback on meter requirements in built spaces. This product was highlighted for its role in making spaces smarter, safer, and greener.

-

Atrius: Mentioned as part of Acuity Brands' cloud-based solutions, Atrius focuses on intelligent building management and ESG reporting, aiming to make spaces more efficient and sustainable. This product has received recognition for its capabilities in climate reporting and sustainability.

Ashe addressed the company's focus on revitalizing their core ABL lighting and lighting controls business. He stated confidently, "We are focused on returning the lighting business to growth; that will happen either this quarter or the next quarter."