January 24, 2024

LSI Industries Lighting Segment Reports 3% Revenue Dip

Despite sales decline, LSI upholds solid financial health and improved gross margins

LSI Industries Inc. (Nasdaq: LYTS), a major player in commercial lighting and display solutions, today announced its financial results for the second quarter ended December 31, 2023. Despite navigating through some market challenges and double-digit decline in overall sales revenue, the company has upheld solid financial performance in key areas.

Financial Highlights, LSI Industries (entire business):

Net Sales: LSI's net sales recorded a dip to $109 million, a 15% decrease from the prior year's $128.8 million, attributed to market volatility and strategic industry consolidations.

Net Income: The company's net income stood at $5.9 million, translating to $0.20 per diluted share. Adjusted for one-time items, the net income slightly increased to $6.4 million, or $0.21 per diluted share.

Gross Margin: Year-over-year, LSI's gross margin improved by 240 basis points to 29%, reflecting a disciplined pricing strategy and cost management.

Profit: With an Adjusted EBITDA of $11.1 million, LSI maintained a margin rate of 10.1%, consistent with the previous year.

Cash Flow: The company reported a robust free cash flow of $7.3 million in the quarter, contributing to a trailing twelve-month figure of nearly $44 million.

Debt Reduction: LSI has impressively reduced its net debt to Adjusted EBITDA ratio to 0.4x from 1.3x year-over-year, signifying strong cash generation and fiscal prudence.

Kroger and Albertsons

President and Chief Executive Officer James Clark indicated that the pending FTC approval of the proposed merger between the second and third-largest grocery chains in the United States has led to a temporary slowdown in project activity within LSI Industries' grocery vertical.

The reference is to the proposed merger of Kroger and Albertsons. The Federal Trade Commission (FTC) is currently reviewing the $25 billion deal, which has led to a temporary slowing of project activity within LSI's grocery vertical. The FTC has approved final orders requiring divestitures in similar cases, such as the merger of Northeast Supermarkets Price Chopper and Tops Market Corp, where the parties were required to sell 12 stores as a condition of the merger. The decision on whether to approve the Kroger and Albertsons merger is still pending.

Lighting Segment:

Sales Performance:

-

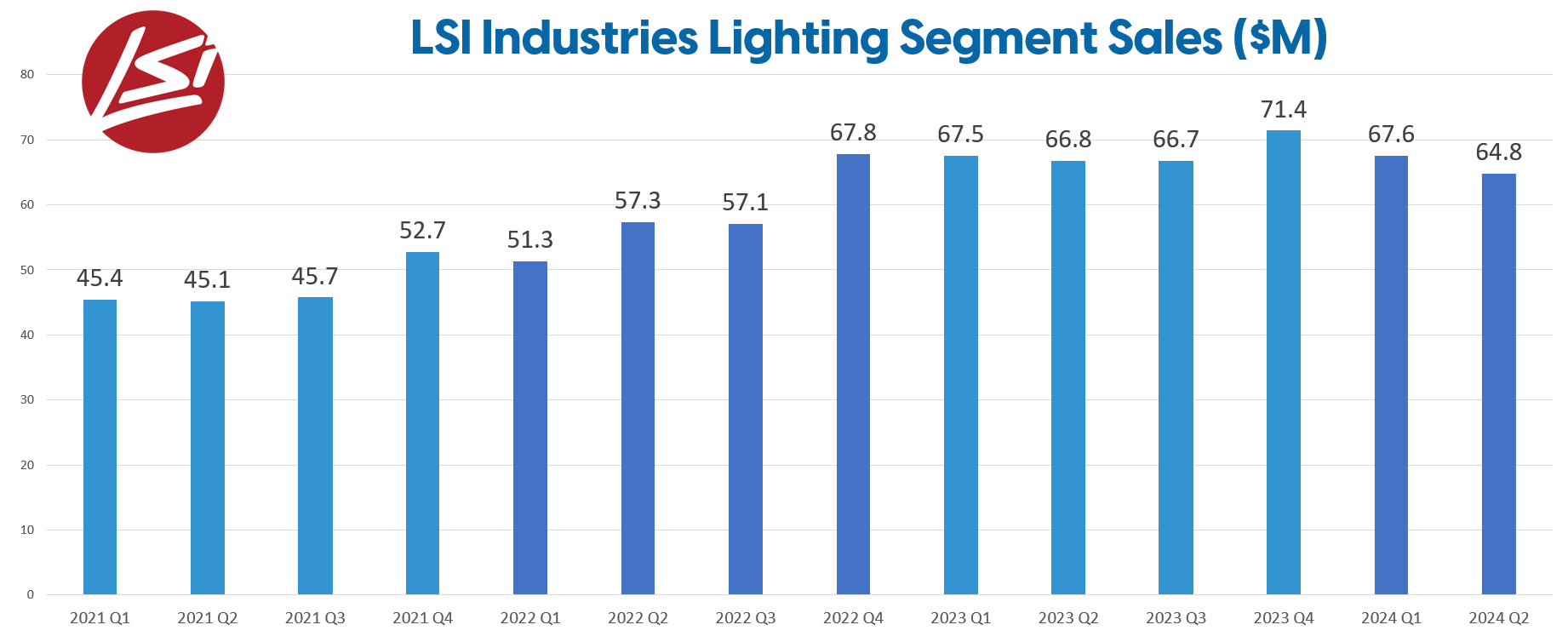

The Lighting Segment of LSI Industries reported net sales of $64.8 million in the second quarter of fiscal 2024.

-

This figure represents a 3% decrease from the previous year, indicating a slight contraction in the segment's revenue.

Order Growth:

-

Orders in the Lighting Segment showed a positive trend, with a reported increase of 10% year-over-year.

-

This growth in orders highlights the segment's strong market demand and potential for future revenue growth.

Margin Improvement:

-

One of the most notable achievements in the Lighting Segment is the significant improvement in its adjusted gross margin rate, which escalated to 35.0%.

-

This is the highest rate achieved in over a decade, marking a substantial enhancement in the segment's profitability.

-

The improvement in gross margin was attributed to several factors, including stable pricing, a higher-value sales mix, and ongoing cost and operational improvements.

Executive Comments:

|

"In the second quarter, our cross-selling initiative positioned LSI to secure refrigerated display case project wins with two national refueling/c-store (convenient store) chains that currently use our lighting solutions. Each program represents multi-million-dollar sales on an annual basis. In both the QSR (Quick Service Restaurants) and Grocery verticals we have secured customer projects to provide indoor and outdoor lighting, in addition to existing display case and print graphics activity." James Clark, President and Chief Executive Officer

|

-

Clark emphasized the segment's success in securing high-value vertical market applications. A notable example is the selection of LSI as the lighting supplier for a high-end luxury automotive brand, reflecting the segment's focus on delivering specialized, value-added solutions.

-

Clark highlighted the importance of proprietary lighting specifications developed in collaboration with the automotive customer, underscoring LSI's commitment to meeting unique customer requirements and enhancing the customer experience in dealership environments.

The Lighting Segment of LSI Industries, despite a marginal decline in sales, showed robust order growth and a remarkable improvement in profitability. The segment’s focus on high-value, specialized market applications, as evidenced by its dealings with luxury automotive brands, positions it well for future growth. The improved margin performance, highest in over a decade, speaks to effective pricing strategies and operational efficiencies.