January 8, 2026

Acuity Squeezes Out Growth in “Tepid” Lighting Market

Lighting revenues rise 1% as leadership touts world-best performance

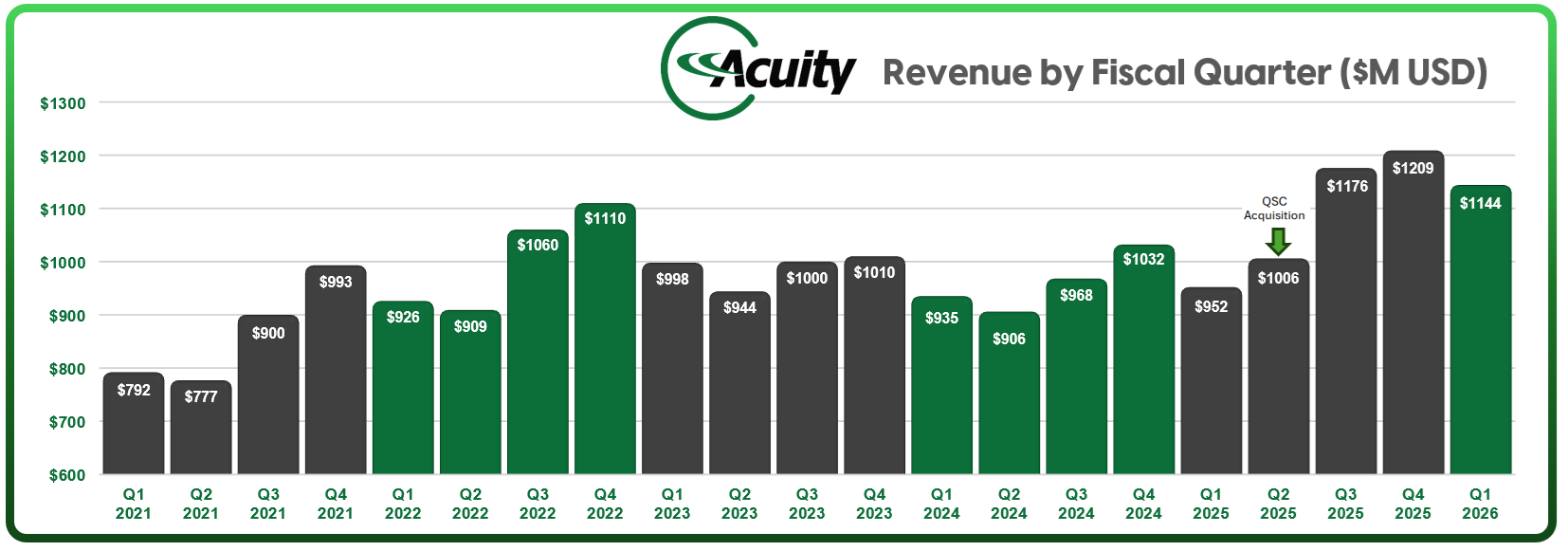

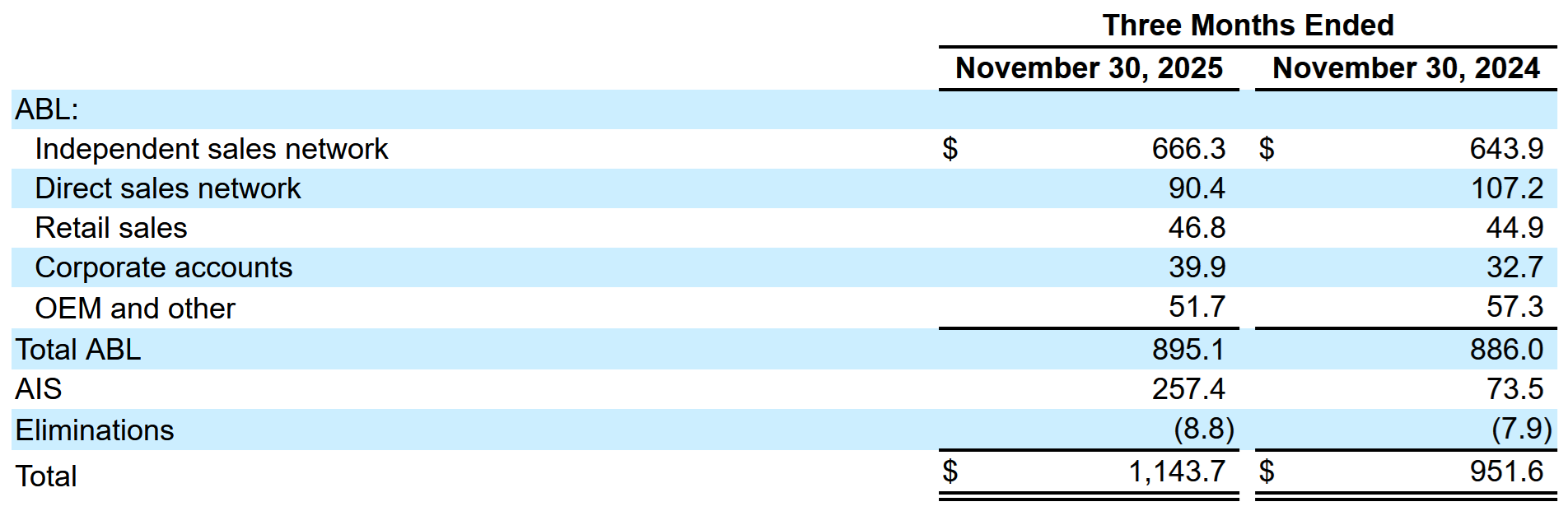

In a lighting industry where “flat sales” have become the new “pretty good,” Acuity did what few in the lighting space could: post a gain. For the three-month period ending November 30, 2025, Acuity grew total revenues 20% year-over-year. But strip away the 9-figure contribution from newly acquired AV company QSC, and what remains is a 1% increase in Lighting segment sales — $895.1 million compared to $886.0 million in the first quarter of last year.

Despite hitting a record high of $380.17 earlier this week, Acuity shares fell $55 in early trading, or 15%, after the company kept its full-year outlook unchanged. Adjusted earnings per share rose to $4.69 from $3.97 a year earlier, modestly ahead of expectations, but with revenue largely in line and no upward revision to guidance, the results appeared to confirm what the market had already priced in.

Acuity's 1% lighting segment growth won’t make headlines on Wall Street, either. But in the industry’s current state of slow churn and cost-cutting, even modest gains can be telling. Notably, Acuity’s Lighting revenues didn’t just hold — it’s possible they continued to take market share. Whether that’s due to channel shifts, competitors’ struggles, or strategic moves in key verticals like convenience store/gas station retail, the data points to quiet but meaningful traction.

CEO Neil Ashe, never one to miss an opportunity to frame the company’s position, said plainly on the earnings call, “ABL (Acuity Brands Lighting) is clearly the best performing lighting business in the world.”

That might strike some as bravado, but in a “tepid lighting environment” — his words, not ours — it’s hard to argue.

Lighting Segment: Growth That Doesn’t Glow

Despite the 1% revenue bump in Acuity Brands Lighting (ABL), the segment’s gross margin dipped slightly—from 45.9% to 44.8% year-over-year. That 110-basis-point decline, while worth noting, isn’t a red flag. In fact, Acuity's margins remain well above where they were just a few years ago, a testament to the company’s disciplined pricing strategies and operational structure. If anything, the modest pullback likely reflects temporary shifts in product mix or input costs — not a reversal of the broader margin gains Acuity has methodically built over the past five years.

Also conspicuous: a 15.7% year-over-year revenue drop in the company’s direct sales network, down to $90.4 million from $107.2 million. Acuity made no mention of this in the earnings release. Whether it’s a structural channel shift or simply a blip remains unclear, but it's worth watching.

Intelligent Spaces: From Rounding Error to Center Stage

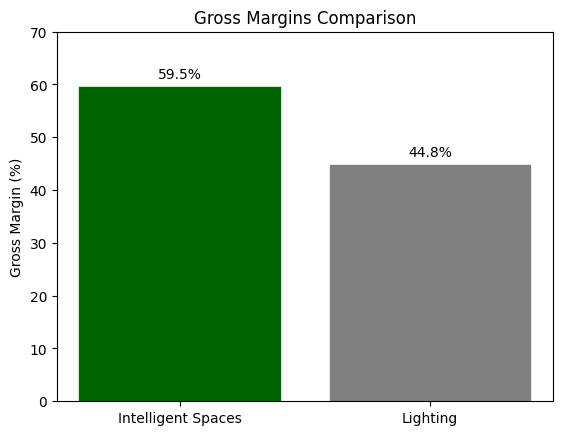

If you're still wondering why Acuity continues to double down on its Intelligent Spaces segment, here's your answer: margins.

When Acuity first broke out Intelligent Spaces as its own reporting unit a few years ago, the segment accounted for just 6% of total sales. This quarter? It represented 22%. That shift isn't just about volume — it's about value. Lighting may still be the backbone of the business, but Intelligent Spaces is quickly becoming the brain.

The financial rationale is straightforward. Gross margins in Intelligent Spaces reached 59.5% in the first quarter — significantly higher than the 44.8% posted by the core Lighting business. That 15-point spread tells you everything you need to know about where Acuity sees the future. Lighting is a mature category with tough input costs and stiff competition. Intelligent Spaces, by contrast, offers premium pricing, software-adjacent scale, and stickier customer relationships.

Yes, the $257 million in segment revenue this quarter includes three months of QSC results that last year didn’t include. No, the company didn’t break out how much of that came from QSC versus legacy operations. But in this case, the lack of detail isn’t the headline. The bigger story is the segment's growing strategic weight. Intelligent Spaces isn’t just padding the income statement — it’s reshaping the company's identity.

Confidence, Convenient Stores, and Cree Lighting

During the call, Ashe referred multiple times to a “tepid lighting environment,” a phrase that was oddly comforting in its accuracy. Yet in that same breath, he pushed the company’s strategic narrative forward. He highlighted growth in the convenience store and gas station market — where Acuity is now bundling under-canopy lighting with refrigeration controls from the AIS portfolio.

Acuity’s growing focus on the c-store and gas station vertical isn’t accidental — it’s a calculated move into territory long associated with LSI Industries and Cree Lighting. Even before Cree Lighting’s financial troubles became public, Acuity had already signed on with several of the company's specialty petro agents in this space, raising eyebrows across the channel.

On the earnings call, an analyst — without mentioning LSI by name — pressed Ashe on why Acuity hasn’t pursued the signage market as others have. Ashe dismissed the notion, stating plainly that this vertical market is a narrow slice of the business and signage doesn’t seem to be a strategic priority for the company.

The Tariff Reversal Test

One of the more candid moments came in response to a question about possible tariff price reductions if the Supreme Court revisits Section 301 tariffs on Chinese imports.

Ashe offered an anecdote — equal parts economic realism and rhetorical shrug:

“If we were to somehow realize a benefit from the tariff, like a refund, who would we give it to? So as you push that down the slide... we would have to assume that, if we did, the distributor would give it to the contractor, and that the contractor would give it to the building owner. I just don’t think that seems reasonable.”

— Neil Ashe, CEO, Acuity, Inc.

Translation: Don’t expect price rollbacks.

With additional context, Ashe stressed that he was not making a legal prediction, but said Acuity’s working assumption is that the outcome would leave market conditions largely unchanged, even in the event of an adverse ruling.

A Debt Burden Looms

Beneath the strong EPS figures — $3.82 GAAP, $4.69 adjusted — another number stood out: $8.4 million in net interest expense. That’s a $12.4 million swing from the $4 million in net interest income posted in Q1 last year.

Why the change? The cost of acquiring QSC. Though Acuity repaid $100 million in term-loan debt during the quarter, long-term debt still sits at $797 million. That’s not an existential threat, but it represents real financial drag — especially if organic growth remains muted.

Guidance: No Surprises, No Revisions

Acuity reaffirmed its full-year guidance of $4.7 to $4.9 billion in net sales, with low single-digit growth expected in the ABL segment.

Acuity appears to be betting that a steady hand — plus strategic diversification — will earn investor confidence even when core markets remain subdued.

Acuity is expected to remain the number one lighting company in North America for the foreseeable future — a position CEO Neil Ashe clearly relishes and one the company is structurally built to defend. But the story doesn’t end with lighting. Intelligent Spaces is no longer a side hustle; it’s the company’s most promising platform for growth. With higher margins, broader use cases, and more durable revenue streams, the segment is fast becoming Acuity’s engine for long-term value creation. Lighting may keep the lights on. Intelligent Spaces is where the returns live.