March 4, 2024

NEMA Panel Expresses Cautious Optimism

Business confidence survey reveals a tempered but hopeful outlook

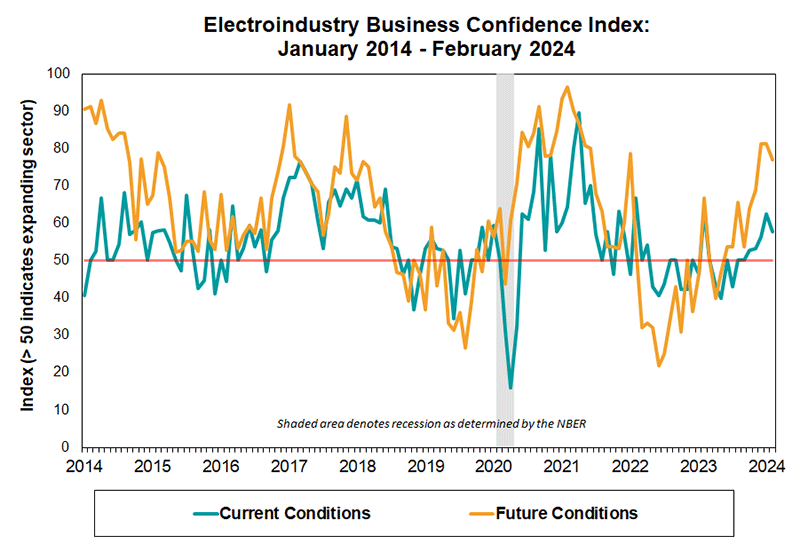

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting, electrical and medical imaging products.

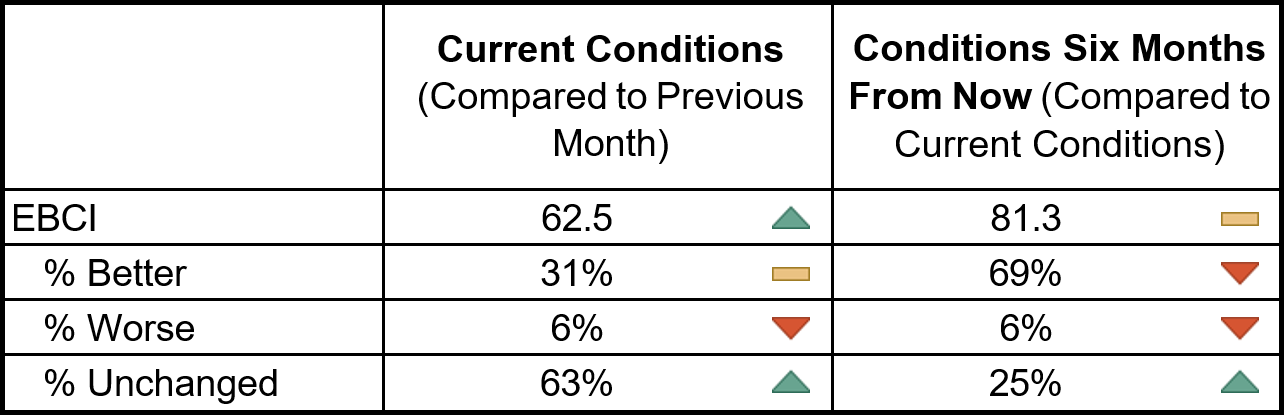

Despite a slight dip in the current conditions component to 57.7 points in February from 62.5, the EBCI panel's outlook remains cautiously optimistic, marking the second highest reading since February 2023. This shift, attributed to an increase in respondents reporting "worse" conditions, is balanced by stable expectations for the future, underscored by anticipated large data center projects and solid first-quarter orders. However, concerns about rising supply chain disruptions loom, tempering the overall positive sentiment.

This most recent ECBI shows how makers of electrical equipment view current and future market conditions. Below are the details:

The shift in the share of respondents reporting “unchanged” to “worse” conditions led to a decrease in the current conditions component to 57.7 points in February, down from the previous month’s 62.5. After having expanded for four consecutive months, the current conditions reading still stands at its second highest point since February 2023. Although the quantitative score declined, the member comments, similar to last month were mixed, largely reflecting stability. Panel members mentioned large data center projects in the coming months, and solid orders activity in the first quarter, but at least one respondent noted concern about rising supply chain disruptions.

The median value of responses regarding the reported magnitude of change in current conditions, which had hovered at +0.5 for the past two months, decreased to 0.0, where it sat for most of last year. The mean slipped from +0.3 last month to +0.2 this month. Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

The percent of respondents expecting to see “worse” conditions in six months increased from six to 15 percent in February. Although those anticipating that conditions will remain “unchanged” decreased, the majority of respondents who expect “better” conditions held steady, leading to a 4.4 point drop to 76.9 for February’s future conditions component. Some of the comments noted expectations for lower inflation and interest rates, and improvements in the residential markets in the second half of the year.

SURVEY RESULTS:

- Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

- A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

- Please note that survey responses were collected from the period of February 12-23, 2024.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)