February 22, 2024

C&I Building Starts Dip Slightly to Begin 2024

Large projects get rolling in Utah, Texas and Michigan

Amidst persistent high interest rates, building starts weaken, while nonbuilding starts show growth.

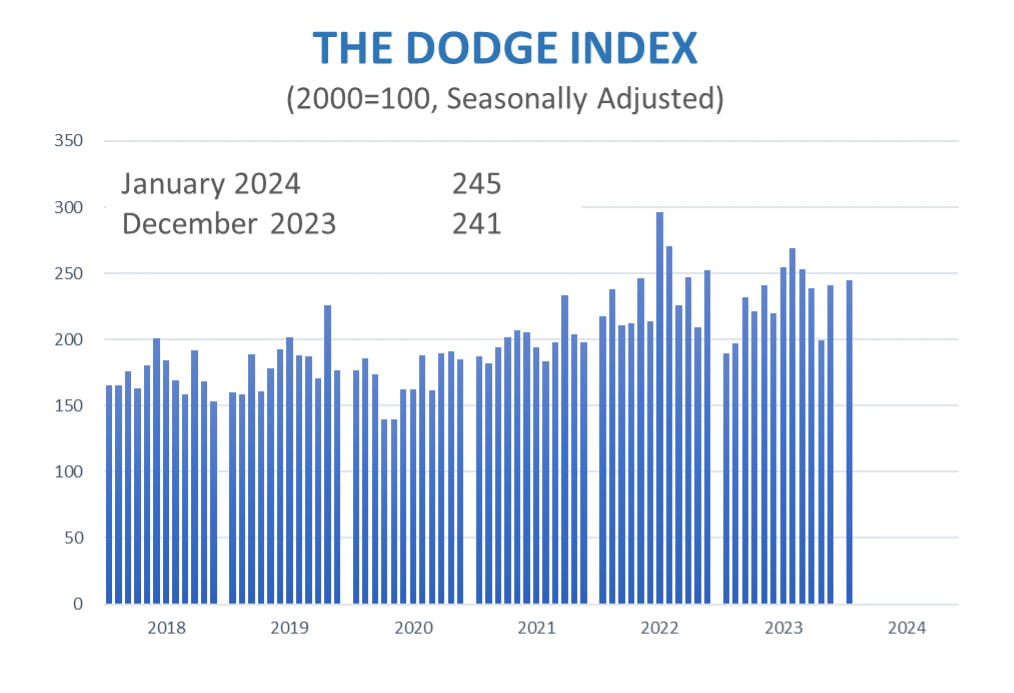

BEDFORD, MA — Total construction starts grew 1% in January to a seasonally adjusted annual rate of $1.16 trillion, according to Dodge Construction Network. Nonbuilding starts rose 9% during the month, while nonresidential building starts fell 2% and residential starts were flat.

For the 12 months ending January 2024, total construction starts were down 1% from the 12 months ending January 2023. Nonresidential building starts were down 5% while residential starts were 8% lower, with nonbuilding starts up 17% on a 12 month rolling sum basis.

“Construction starts are struggling to make headway in the new year,” said Richard Branch, chief economist for Dodge Construction Network. “Construction starts will continue to struggle early on in 2024 as higher interest rates and tight credit standards are slowing down projects moving through the planning cycle to start. The Federal Reserve is expected to cut rates later this year. That will move some of these projects in the planning queue through to start and provide for a more stable rising trend in construction activity in the second half of the year.”

Nonresidential

Nonresidential building starts lost 2% in January to a seasonally adjusted annual rate of $483 billion. Commercial starts were 14% lower with hotel starts the only category to post a gain. Institutional starts were 1% lower with both education and healthcare down, while manufacturing starts rose 26%.

For the 12 months ending January 2024, nonresidential building starts were 5% lower than the previous 12 months. Manufacturing starts were down 20%, commercial starts were 10% lower, and institutional starts were 9% higher for the 12 months ending January 2024.

The largest nonresidential building projects to break ground in January were the $5.5 billion Texas Instruments fabrication plant in Lehi, Utah, the $2.6 billion Terminal B construction at George Bush Houston Airport in Houston, Texas, and the $1.0 billion BlueOval battery plant in Marshall, Michigan.

Residential

Residential building starts were flat from December to January at a seasonally adjusted annual rate of $393 billion. Multifamily starts improved 6% while single family starts lost 3%.

For the 12 months ending January 2024, residential starts were 8% lower than the previous 12 months. Single family starts were 8% lower, while multifamily starts were 7% lower on a 12 month rolling sum basis.

The largest multifamily structures to break ground in January were the $1.5 billion One Beverly Hills tower in Beverly Hills, California, the $447 million Olara Condominium tower in West Palm Beach, Florida, and the $330 million The Exchange at Spring Hill Station in Tysons, Virginia.

Nonbuilding

Nonbuilding construction starts in January rose 9% to a seasonally adjusted annual rate of $280 billion. Environmental public works starts rose 38%, while highway and bridge starts improved 9% and miscellaneous nonbuilding starts gained 4%. Utility/gas starts lost 35% in January.

For the 12 months ending January 2024 total nonbuilding starts were 17% higher than the 12 months ending January 2023. Highway and bridge starts were 11% higher, while environmental public works starts gained 10%. Utility/gas starts were 36% higher, while miscellaneous nonbuilding starts jumped 18% during the 12 months ending January 2024.

The largest nonbuilding projects to break ground in January were the $610 million Nelson Wastewater Treatment facility in Mission, Kansas, a $517 million wastewater treatment plant in Ewa Beach, Hawaii, and the $473 million I-10 bridge in Pensacola, Florida.

Regionally, total construction starts in January rose in the West, but fell in all other regions.

January 2024 Construction Starts