May 3, 2022

Contraction Ahead? NEMA Business Confidence Index Points to "Yes"

"Major headwinds still facing electrical manufacturers"

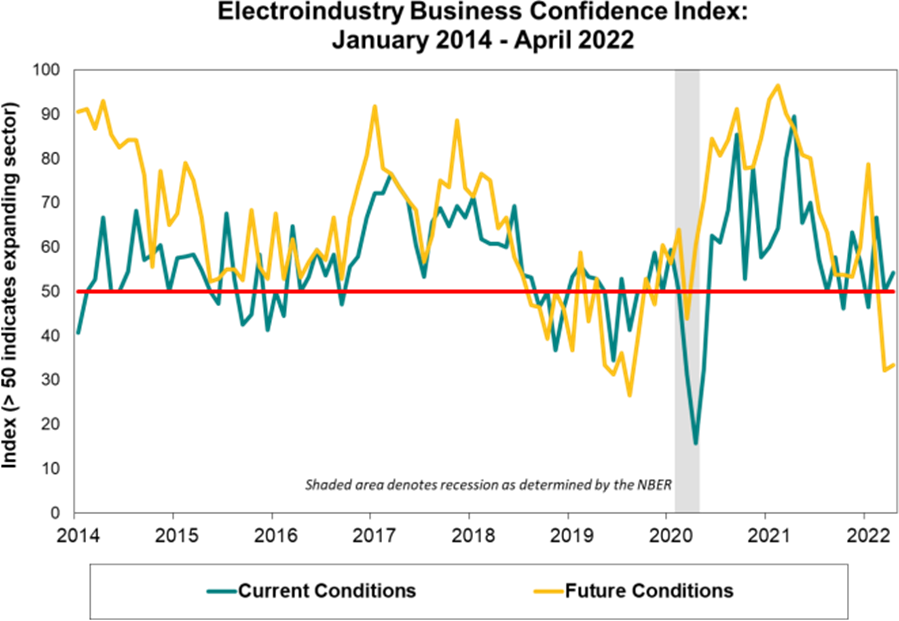

Each month, the National Electrical Manufacturers Association (NEMA) publishes the Electroindustry Business Confidence Index (EBCI). The index is based on surveys of senior managers at NEMA member companies – designed to gauge the business environment of the electroindustry in North America. Member companies include most of the ten largest lighting manufacturers in North America, along with other manufacturers of lighting and electrical products.

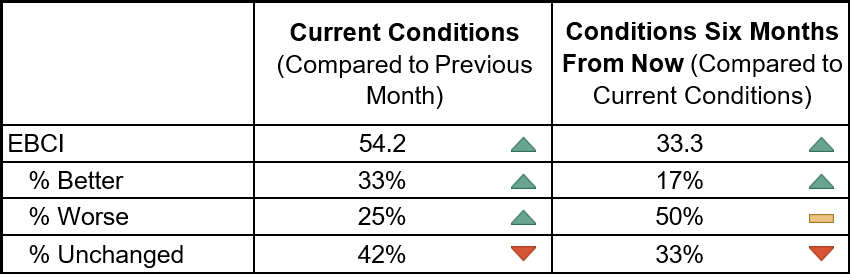

This most recent ECBI shows the number of negative sentiments recording the highest reading in many months. Below are the details:

Familiar headwinds leave current and future components little changed from March results

The situation on the ground was little changed since last month, but that left major headwinds still facing electrical manufacturers. Commenters mentioned concerns about inflation and supply chain problems that were further exacerbated by China’s lockdown of its largest city and one of its busiest ports, Shanghai, in an attempt to clamp down on rising COVID cases. The share of respondents that reported better conditions increased in April, but the proportion that noted worse conditions ticked up as well. The net effect was a modest shift from an overall “unchanged” reading of 50 in March to one of slow growth expansion at 54.2 in April.

Both the median and mean reported magnitude of change in current electroindustry business conditions held steady in April. The median score had slid to 0.0 in March, where it remained from April’s survey. Likewise, the mean value of the magnitude measure did not move in April from the +0.4 reading it registered in the previous Panelists are asked to report the magnitude of change on a scale ranging from –5 (deteriorated significantly) through 0 (unchanged) to +5 (improved significantly).

Mirroring the concerns they stated regarding current conditions, panel members expected supply chain problems, inflation, higher interest rates, and workforce struggles to remain as impediments to growth six months from now. The most common characterization of future business conditions was “worse,” but slight shifts in the share of respondents that expected better or unchanged conditions moved the topline reading imperceptibly from 32.1 in March to 33.3 in April’s results. Both month’s scores fell well below the level that implies expansion ahead.

SURVEY RESULTS:

Values reflect the percentage of respondents expecting "Better" conditions, plus one-half of the percentage of respondents expecting "Unchanged" conditions.

A score of 50 or higher suggests conditions appropriate to expansion of the electroindustry sector.

Please note that survey responses were collected from the period of April 11-22, 2022.

EBCI METHODOLOGY:

The EBCI indexes are based on the results of a monthly survey of senior managers at NEMA member companies and are designed to gauge the business environment of the electroindustry in North America (defined here as the United States and Canada).

The survey contains the following questions:

- How would you rate current economic conditions in North America, as they affect your business, compared to the previous month?

- Using the following scale, please describe the magnitude of change in economic conditions in North America this month compared to economic conditions last month? [Scale structured as follows: 5 (improved significantly), 4, 3, 2, 1, 0 (stayed the same), -1, -2, -3, -4, -5 (deteriorated significantly)]

- How do you expect economic conditions in North America, as they affect your business, to have changed six months from now?

Respondents are asked to indicate whether conditions are better, worse, or unchanged. The survey also provides space for respondents to comment on current conditions. These comments are included below the table containing the index levels.

The index value is the percentage of respondents expecting “Better” conditions, plus one-half of the percentage of respondents expecting “Unchanged” conditions, which follows the methodology used by the Institute for Supply Management (ISM; formerly the National Association of Purchasing Management) in the construction of their manufacturing index.

Reprinted by permission of the National Electrical Manufacturers Association (NEMA)