April 16, 2024

Three Takeaways from Signify’s SoCal Expansion

What are the second-order effects of the expanded partnership between Signify and Forman & Associates?

In a significant expansion of business partnership, Signify, through its Genlyte Solutions business, has expanded its representation agreement with Los Angeles-based Forman & Associates, to now include the San Diego market, effective June 9, 2024. This transition to Forman concludes the representative relationship that Signify has had with The Lighting Element, a San Diego agency founded in 2016 with the Signify (previously known as Philips) brands as its anchor lines.

Forman & Associates, which currently represents Philips lamps and EvoKits and Advance components in the San Diego territory, will take on the rest of the Genlyte Solutions portfolio, which includes Interact connected lighting; Philips Dynalite; Color Kinetics; indoor luminaire brands Chloride, Day-Brite, Ledalite and Lightolier; and outdoor luminaire brands Gardco, Hadco, Lumec and Stonco.

Forman & Associates has long established itself as a skilled and adept agency in theatrical lighting and controls. Their long partnership with Color Kinetics, a Signify-owned brand, has been particularly beneficial, providing support to the film and entertainment industry in the Los Angeles area. This relationship has not only showcased Forman's capability in managing high-profile lighting projects but has also highlighted their integral role in the region's entertainment sector.

Over the past decade, Forman & Associates has strategically enhanced its portfolio and capabilities in general and architectural lighting. This deliberate expansion is exemplified by its partnership with the Genlyte Solutions, among other general lighting and architectural lighting brands. The agency's efforts to strengthen their lighting offerings outside of theatrical lighting and controls reflect a commitment to grow in alignment with industry demands and opportunities.

When major lighting lines make market movements, they oftentimes bring consequences. Here are three takeaways to consider when examining the subsequent effects in the Southern California lighting market.

1. What is next for The Lighting Element?

With the imminent transition of the Genlyte Solutions product lines, The Lighting Element, an eight-person agency based in San Diego, may possibly face significant challenges. When the Signify lines move away in early June, the agency will be left with fewer than 70 product lines. Despite this setback, The Lighting Element still maintains a portfolio with pockets of strength including certain Leviton lighting & controls brands and respected architectural brands such as Axis Lighting and Southern California's own Prudential Lighting.

In response to this realignment, The Lighting Element might need to seek out new partnerships to bolster its general lighting offerings. However, the most coveted major lines, represented by competitors like OCS, SDLA, and SCI Lighting Solutions — who are firmly allied with majors such as Current, Acuity Brands, and Cooper Lighting — seem securely bound to their existing relationships, seemingly leaving few opportunities for The Lighting Element to replace the lost business on a similar scale.

The agency's potential strategy could involve targeting midsize brands like LSI and Cree Lighting, which could enable them to continue servicing everyday projects for schools and offices and remain competitive in specification work. Despite the current hurdles, The Lighting Element's resilience and adaptability will be crucial as they navigate this transitional period seemingly without a clear, immediate substitute looming for the lost Genlyte Solutions representation.

2. Multi-Territory Lighting Reps: L.A. to San Diego

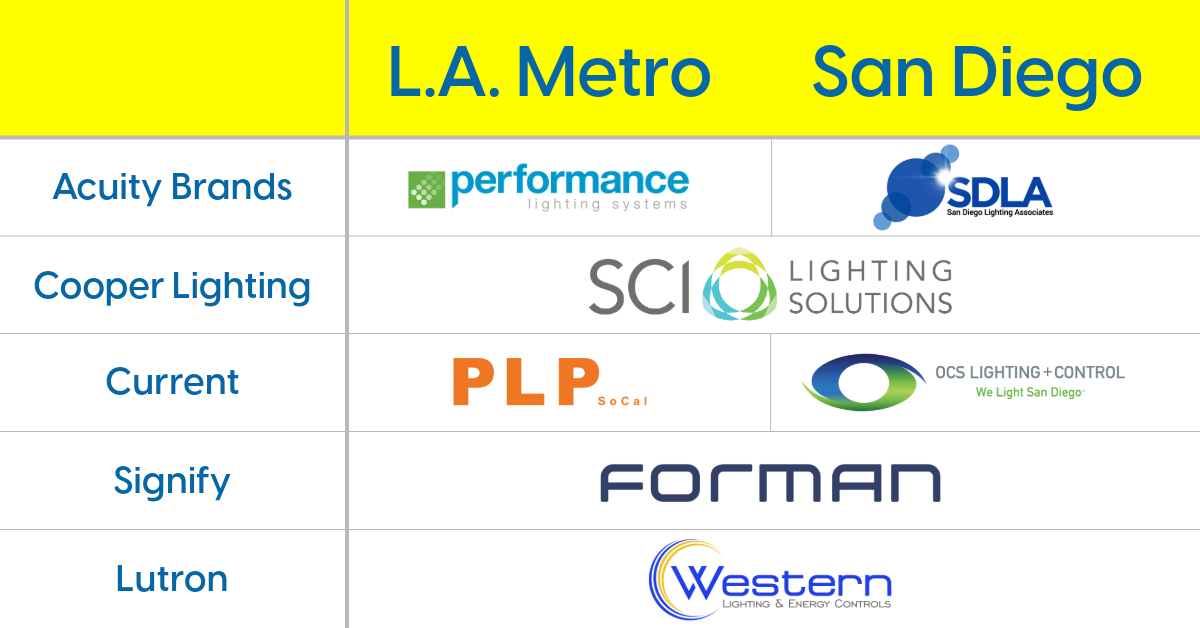

Forman & Associates has expanded its reach within Southern California, now serving as a representative for Signify's Genlyte Solutions across major metro areas including Los Angeles, Orange County, and San Diego. While Forman had already been in the San Diego territory, the new Signify partnership there positions Forman among other prominent multi-territory representatives such as SCI Lighting Solutions and Western Lighting & Energy Controls, both of whom have been managing a broad coverage across these regions for well over a decade.

In contrast, some major agencies remain focused on more localized market approaches. For instance, Performance Lighting Systems and SDLA, which represent Acuity Brands, as well as PLP SoCal and OCS Lighting & Control, representing Current, maintain more specialized regional focuses.

3. Signify and Forman form closer bond, amid recent market speculation to the contrary

Months ago, industry circles in Southern California were abuzz with speculation that ALR, the largest lighting agent in Northern California, was planning to expand its operations into the Southern California market. ALR had recently expanded north into Oregon, and one of the largest agents in the country was thought to be eyeing Southern California. This expansion was speculated to include strengthening ALR’s partnerships with major lighting manufacturers such as Signify and possibly Lutron. Such a move would have posed a significant threat to Forman & Associates' longstanding relationship with Signify, potentially severing their ties.

Contrary to these speculations, Signify has now reinforced its commitment to Forman & Associates by expanding their partnership. This strategic decision not only strengthens Forman’s position in the Southern California lighting market but should also put to rest the speculation about ALR's potential market encroachment.

Signify's decision to expand Forman & Associates' representation into San Diego signifies a shift in the regional lighting industry's dynamics. This move consolidates Forman's footprint across major metropolitan areas, positioning it alongside other key multi-territory agents, and potentially reshapes the competitive landscape, especially for smaller agencies like The Lighting Element, now facing new challenges. Industry stakeholders will closely watch how these changes influence business strategies and market alignments in the broader Southern California lighting sector.