December 7, 2023

Court Approves Asset Transfer in Deco Lighting Bankruptcy

Debate over accused self-dealing is settled, but PQL trademark controversy adds new wrinkle

Los Angeles, CA — In a ruling at the United States Bankruptcy Court for the Central District of California, Judge Sheri Bluebond granted approval for the transfer of assets from the bankrupt Deco Lighting to ABS Capitol, one of its secured creditors. This decision in the Chapter 7 proceedings, overseen by U.S. Trustee Timothy Yoo, puts to rest previous discussions around potential conflicts of interest of Deco Lighting management.

The judge's order allows ABS Capitol, managed by Babak (Bob) Sinai and Siamak (Sam) Sinai, who are also two of the co-founders of Deco Lighting, to acquire the company's assets. This transfer, involving a cash-free transaction that forgives the debt owed by Deco Lighting to ABS Capitol, has raised questions of self-dealing due to the Sinai-to-Sinai connection.

Judge Bluebond addressed these concerns, emphasizing that the transaction was negotiated at arm's length between the trustee and ABS, dismissing the notion of a conflict of interest. She highlighted Yoo's independence in these proceedings, stating, "This is not a transaction between the debtor and the buyer. It's the proposed transaction between the buyer and the trustee who is disinterested."

However, the ruling came with significant caveats. The judge questioned the absence of an opportunity for overbidding on the assets, probing the trustee on whether any third party might be interested in purchasing them. Yoo defended the decision, citing the overwhelming debt and lack of substantial value in the assets. He also noted the logistical challenges in managing and selling the assets, spread across multiple locations.

The hearing also delved into concerns about legal fees claimed by Deco Lighting's attorneys, Ray Aver and Amy Mousavi, which the judge decided to reserve for later evaluation. She instructed that any claims against professionals employed by the estate for unauthorized payments should not be part of the sale to ABS and should be reserved for the estate.

Controversy: PQL Files Trademarks for trade names previously used by Deco Lighting

A secondary yet significant storyline involved PQL's recent actions in filing trademark applications for what is claimed to be Deco Lighting's intellectual property. This move by PQL, a Southern California lighting business and former business partner of Deco Lighting, has led to legal confrontations, including a cease and desist letter from Deco's intellectual property counsel.

In a partnership between Deco Lighting and PQL that involved PQL providing significant financing to Deco Lighting’s bankruptcy restructure, the companies had agreed to market select Deco Lighting products under the PQL brand. The recent trademark applications by PQL suggest a continued interest in marketing what has been known as PQL's architectural offerings. But the partners became adversaries when Deco Lighting abruptly shut down its business in June.

In a November 6 letter addressed to PQL's attorneys, U.S. Trustee Timothy Yoo highlighted the urgency of the matter, stressing the potential impact on the estate's asset sale. Yoo warned that PQL's actions in pursuing trademark applications for intellectual property believed to be held by Deco Lighting could negatively affect the estate's value and recovery for creditors. He underscored the prohibition by the Bankruptcy Code on actions that interfere with estate property and urged PQL to cease any such actions immediately.

Above: Excerpt from PQL trademark filing with the U.S. Patent and Trademark Office.

-

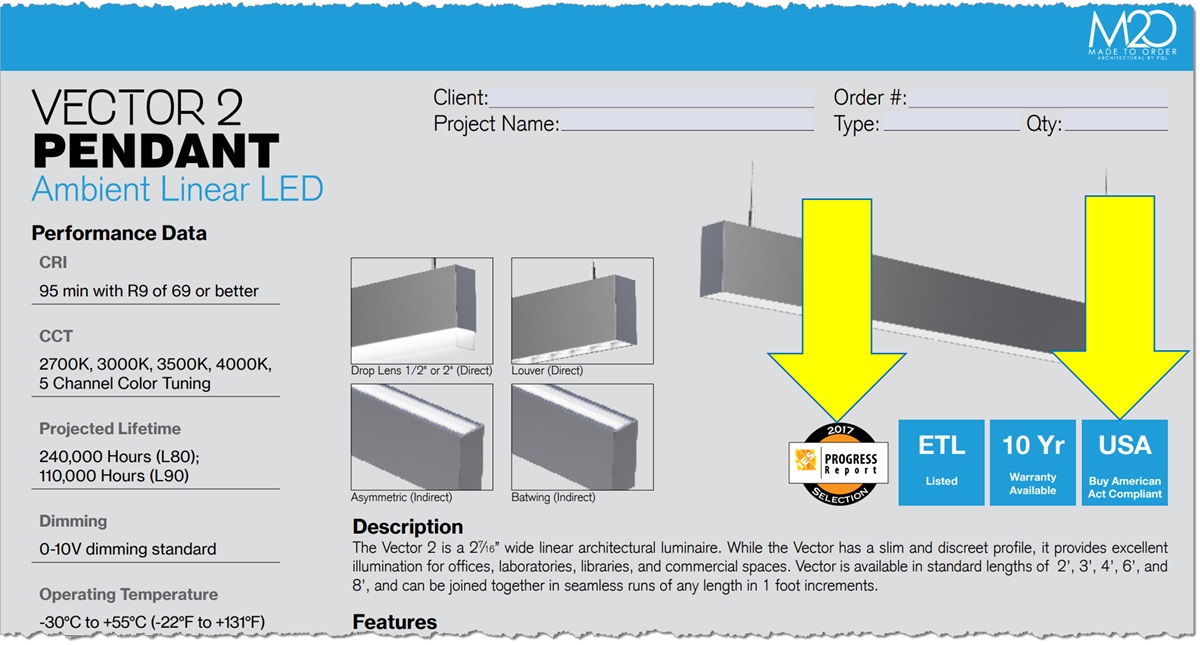

The Vector 2 trade name, initially used by Deco Lighting, was employed by PQL under a partnership agreement with Deco Lighting. The Vector 2 is now filed as a trademark for the PQL M2O (made to order) Architectural fixture.

-

PQL’s product specification sheet closely resembles the one on Deco Lighting's website, much like it did when the parties were partnering in recent years.

-

Both companies' spec sheets mention the Vector 2 Pendant's inclusion in the IES Progress Report in 2017, a recognition for the original Vector series, but not for the Vector 2 series. This situation raises questions about the transferability of IES Progress Report recognition to next-generation product families or to different manufacturers producing the same product.

Both companies' spec sheets mention the Vector 2 Pendant's inclusion in the IES Progress Report in 2017, a recognition for the original Vector series, but not for the Vector 2 series. This situation raises questions about the transferability of IES Progress Report recognition to next-generation product families or to different manufacturers producing the same product. -

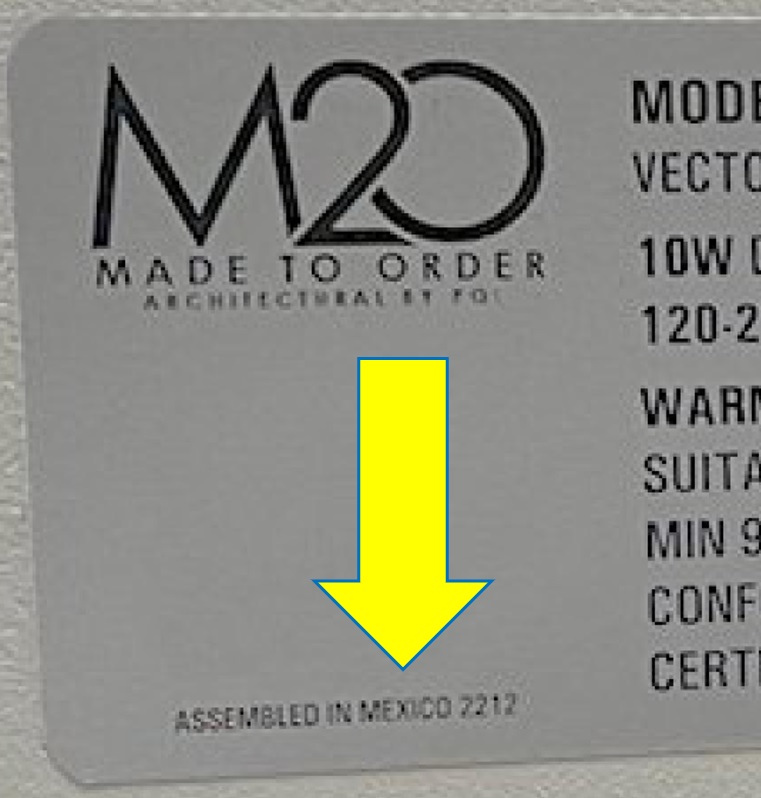

Additionally, each company claims "Buy American Act Compliant," despite PQL's product sample indicating assembly in Mexico.

-

PQL also filed trademark claims for GO-LED, SKYLER, CIRCA 2 and RONDE, all names of Deco Lighting product familes. We couldn't find any evidence that Deco Lighting filed trademarks for the trade names in the past, but Deco's usage of the trade names dates back to 2020 and earlier.

The controversy surrounding the trademark filings and the potential implications on the bankruptcy estate's value add yet another layer to an already intricate bankruptcy case.

Moving forward:

This ruling allows Deco Lighting's cofounders to recover the company's assets and establish a new version of Deco Lighting to launch into the market. Months ago, Bob Sinai expressed his intention to revive Deco, stating shortly after the court-ordered liquidation his ambition: “Deco Lighting will rise again and reclaim its position as a leader in the architectural lighting industry.” The dispute over trademarks suggests that Deco Lighting's management plans to reuse the trade names being contested.

The bankruptcy saga of Deco Lighting, starting almost four years ago, and the subsequent ruling signify the nearing conclusion of a prolonged ordeal.

The lighting industry may witness a range of reactions from the market regarding the expected relaunch of Deco Lighting, highlighting different market dynamics and perceptions of the Deco Lighting business compared to the company’s growth years in the 2010’s.