October 10, 2023

Signify Acquires Key Assets of Douglas Lighting Controls

Product designs, patents and brand trademarks transfer to Signify in bankruptcy selloff

VANCOUVER, BRITISH COLUMBIA – In another important development following Atar Capital's abrupt March 2023 shutdown of Universal Douglas, Signify has purchased assets from the now-bankrupt Douglas Lighting Controls, Inc. As approved by the Supreme Court of British Columbia under Madam Justice Fitzpatrick, the transaction was facilitated by KPMG Inc., which acted as the trustee of the bankrupt estate of Douglas Lighting Controls.

Signify bought numerous assets of Douglas Lighting Controls, mainly patents, brand trademarks and product designs, for $250,000 USD. Additionally, as part of the agreement's financial terms, Signify is set to reimburse the seller for 50% of specific transaction costs, up to a maximum of $20,000.

Signify, when questioned about the motivations behind the acquisition, stated, “Signify has acquired intellectual property that extends our existing portfolio and will support our market leadership position.”

Signify's acquisition from Douglas Lighting Controls encompasses three main categories:

-

Product designs and accompanying assets: Signify has acquired a range of product-related assets from Douglas Lighting Controls, encompassing the designs for more than 1,400 part numbers. This includes mechanical designs, detailed product datasheets, PCB layouts, schematics, and software essentials, providing a comprehensive access to Douglas's product lineup and functionalities – along with the right to manufacture and sell those products.

-

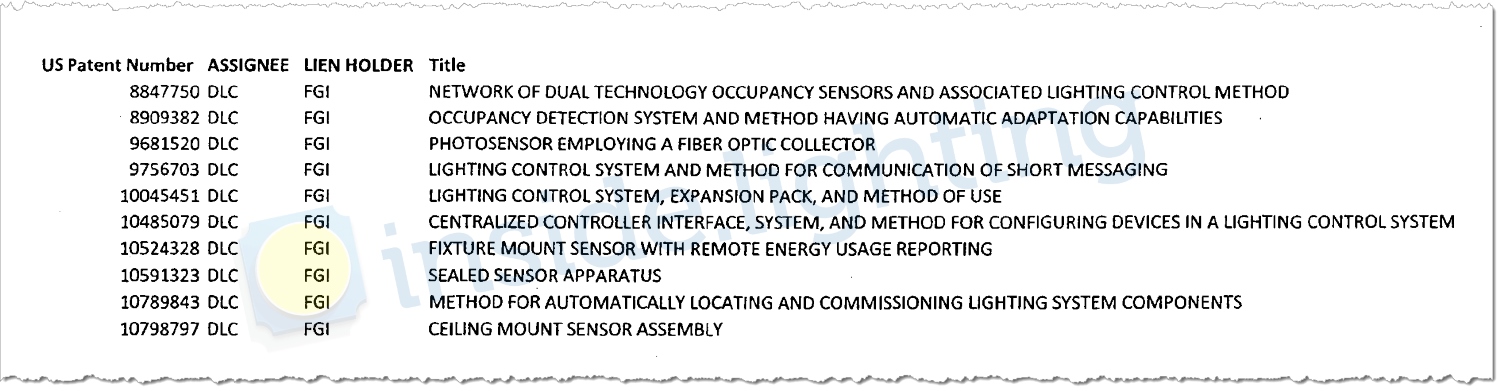

Patents: Signify has acquired a collection of ten patents held by Douglas Lighting Controls, all safeguarded under lien by FGI WorldWide, the largest creditor affected by the bankruptcy who was owed $8.9 million CAD. These patents primarily focus on innovative technologies and methodologies within the lighting controls domain, ranging from occupancy sensors to lighting control systems.

-

Trademarks: The acquisition includes the rights to the brand name "Douglas Lighting Controls", allowing Signify to potentially leverage the established brand identity of Douglas in its future endeavors.

Signify's future plans?

The purchase and sale agreement notably omitted any specific mention of equipment, raw materials, finished goods, product names, logos or internet domain names. This omission raises the question of whether the transaction is solely a play for patents, or if Signify intends to integrate the newly acquired products into one of its numerous existing brands that already produce lighting controls.

Signify did not respond to our specific inquiries regarding future plans for the product designs or the Douglas Lighting Controls brand. So, it's quite possible that the transaction was primarily driven by the acquisition of the ten Douglas patents to augment Signify's EnabLED licensing program. We might also witness future product rollouts inspired by Douglas's product designs, potentially paired with the Douglas branding trademark.

In its final fiscal year, Douglas Lighting Controls generated $25 million CAD in revenues.

No effect on other Douglas creditors

It's important to note that while this acquisition brings a multitude of assets under Signify's umbrella, the company is not taking on any liabilities or obligations of Douglas Lighting Controls or its affiliates.

Signify's acquisition of Douglas's assets stands separate from the financial obligations Douglas owes to its creditors. Despite the asset sale, numerous creditors, including 63 lighting agents, remain in a disadvantageous position. The reason behind this is that in a bankruptcy liquidation, assets are often sold to recoup some of the company's debts. However, after prioritizing secured creditors and covering administrative fees, often little to no funds remain to be distributed among unsecured creditors.

In Douglas's case, the proceeds from the sale to Signify will be insufficient to settle all outstanding debts, suggesting that many, like the lighting agents, will likely not receive any financial compensation — not even a single loonie — from the bankruptcy proceedings.

As more developments unfold, we will keenly watch Signify's next moves with its newly acquired assets.