April 3, 2024

Acuity Brands: Strong Profits Despite 4% Drop in Sales

Company portrays confidence that it will soon return to sustained revenue growth

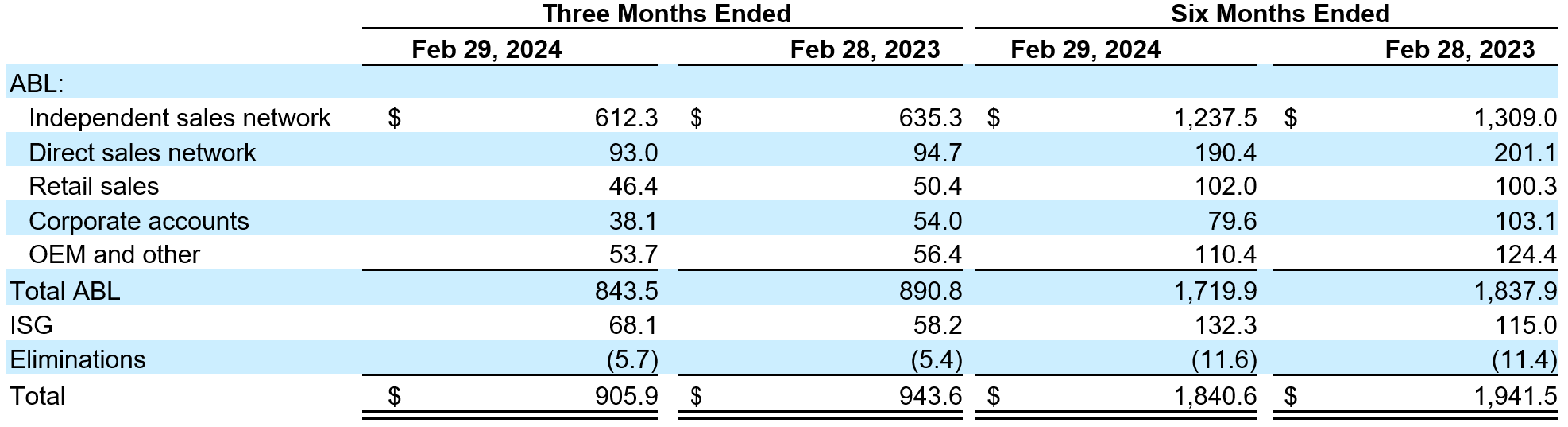

Acuity Brands reported its fiscal 2024 second-quarter results for the period ending February 29, 2024, revealing a mix of challenges and successes. Despite a slight decline in net sales, which dropped by 4% to $905.9 million compared to the previous year, the company showcased its operational prowess with increased operating profits and earnings per share (EPS).

In today's earnings call, Acuity Brands CEO Neil Ashe and CFO Karen Holcom displayed optimism. Ashe stated, “We feel confident where the lighting and lighting controls business is for this year and beyond.” Holcom reinforced the positive outlook by emphasizing, "We continue to execute well," and went on to showcase the company's dedication to improving its financial metrics and strategically allocating capital to drive value.

The Financial Results

Acuity Brands’ decrease in net sales was partially offset by a significant improvement in profitability metrics. Operating profit rose by 5.9% to $118.1 million, with a notable increase in operating profit margin by 120 basis points to 13%. Adjusted operating profit followed suit, climbing 6.1% to $140.1 million, and its margin expanded by 150 basis points to 15.5%. This margin expansion is indicative of the company's efficient cost management and operational execution.

Diluted EPS saw an 11% increase to $2.84, and adjusted diluted EPS also improved by 11% to $3.38, reflecting the company's ability to grow its earnings at a faster rate than sales. This could be a sign of robust cost control measures and operational efficiency.

The segment performance paints a mixed picture. The Acuity Brands Lighting and Lighting Controls (ABL) segment makes up the lion’s share of Acuity’s revenues – 93%. The segment experienced a 5.3% decline in net sales, yet managed to slightly increase its operating profit by 1.9%. The segment's operating profit margin also saw a 100 basis points improvement. This suggests that despite the sales downturn, ABL has been effective in maintaining profitability through cost management or operational efficiencies.

Cash flow and capital allocation also highlight Acuity Brands' financial health. Year-to-date, the company generated $292.6 million in cash flow from operations, albeit slightly lower than the previous year. The company also continued to return value to shareholders by repurchasing approximately 370,000 shares for about $68 million.

Contractor Select & Design Select

The official transcript of this morning's earnings call has not yet been published, but the Inside Lighting I-Team estimates at least twenty mentions of "Contractor Select" or "Design Select" throughout the 54-minute call. Acuity Brands appears to attribute a significant portion of its positive results to these programs, while acknowledging that the newer Design Select program is "just getting started."

Contractor Select encompasses around 300 popular products tailored for general lighting needs. These items, designed for resale, find their home on the shelves of retailers and electrical distributors. Design Select is a collection of short lead time project focused configurable products that enable customers to tailor their lighting solutions without long lead times.

During the Acuity Brands earnings call, the discussion regarding Contractor Select margins was specifically addressed by CEO Ashe. He mentioned that the company has successfully raised the margin of the Contractor Select portfolio to levels that are more consistent with the company's overall margin performance. This initiative reflects Acuity's strategic effort to improve profitability across its product lines, including those aimed at more economical, distributor, and retail-focused products.

Order Rates, Lead Times and Return to Revenue Growth

In the earnings call Ashe provided insights into the company's order rates, highlighting a positive trend. He mentioned, "The order rates in both our lighting business and our spaces business are growing year over year."

The company also highlighted its successful navigation back to normal sales lead times, which has set the stage for a return to revenue growth. Ashe emphasized that the company is well-positioned to grow, stating, "In our lighting business, we are back to typical lead times and absent the impact of sales from excess backlog last year, we would be experiencing sales growth." This statement highlights the company's recovery from the backlog-induced sales spike in 2023, which made year-over-year comparisons more challenging.

Lighting Controls

Ashe stated confidently, “Acuity Brands is one of the largest – if not the largest – controls player for lighting controls specifically.” Ashe went on to praise the quality of Distech Controls, a part of Acuity Brands' portfolio, stating, "I think it's fair to say our, our controls and sensors at Distech are perceived to be the highest quality in the marketplace."

M&A Mentions: Lots of cash

Looking at the balance sheet, Acuity Brands maintains a strong financial position with $578.9 million in cash and cash equivalents, a significant increase from the previous period. The company's total assets grew to $3.5 billion.

During the discussion about Acuity Brands' cash balance nearing $600 million, Karen Holcomb highlighted the company's strategic approach to capital allocation, underlining past successful acquisitions such as ams OSRAM’s Optotronic, KE2 Therm, and Current’s Arize horticultural line. These acquisitions were characterized as small yet strategic, emphasizing Acuity Brands' deliberate and focused approach to enhancing its product offerings and market position through targeted M&A activities.

Ashe expanded on the M&A landscape, specifically mentioning the Intelligent Spaces Group, which includes notable entities like Distech Controls and Atrius. This reference hints at potential future acquisitions that align with the ISG’s strategic focus.

The executives also discussed the company's shareholder return strategies, detailing the share repurchase program and the increase in the company dividend.

International Expansion

Ashe’s comments during the earnings call reveal Acuity Brands’ strategic focus on international expansion, particularly through its Atrius platform, a part of its Intelligence Spaces Group. By targeting markets like Australia, France, the UK, and more broadly in Europe, while also acknowledging the challenges in markets like Germany, Acuity Brands demonstrates a nuanced approach to growing its global footprint.

-

“So in Australia, we added SI (systems integrator) capacity. We'll be looking for ways over the course of … the next six to twelve months to figure out how to accelerate that expansion for ISG."

-

"We're expanding into more of Europe… the UK, and other markets."

-

“We released Atrius Sustainability and Atrius Energy in France."

Future Expectations:

Holcomb provided an update on the company's future financial guidance. She stated, "We now expect our 2024 adjusted diluted earnings per share range to be between $14.75 and $15.50." This announcement marked an upward revision of the company's full-year earnings per share (EPS) expectations.

Ashe typically avoids adjusting full year guidance each quarter. He explained that it’s the company’s preference define a revenue outlook at the beginning of the year, and then to execute against it. When pressed by analysts for full year guidance, Ashe explained “We did not change the revenue guidance. So we feel confident where we're then within that range."

Acuity Brands' fiscal 2024 second-quarter results exhibit a company facing slight challenges relating to revenue growth but countering them with effective cost management and operational efficiencies. The growth in operating profit and EPS, coupled with solid segment performance in ISG and a strong balance sheet, positions the company well for navigating future market conditions.