March 25, 2024

Eye-Opening Takeaways from Energy Focus Annual Report

Struggling lighting maker derives 48% of total sales from two customers

In an examination of Energy Focus, Inc.'s recently filed annual report for the fiscal year ending December 31, 2023, key insights emerge concerning the stuggling company's financial health and operational strategies. The report, filed last week, sheds light on the company's declining sales, operational challenges, and strategic dependencies, offering a comprehensive view of its current state and future outlook. Here are four key takeaways:

Sales and Losses Trend

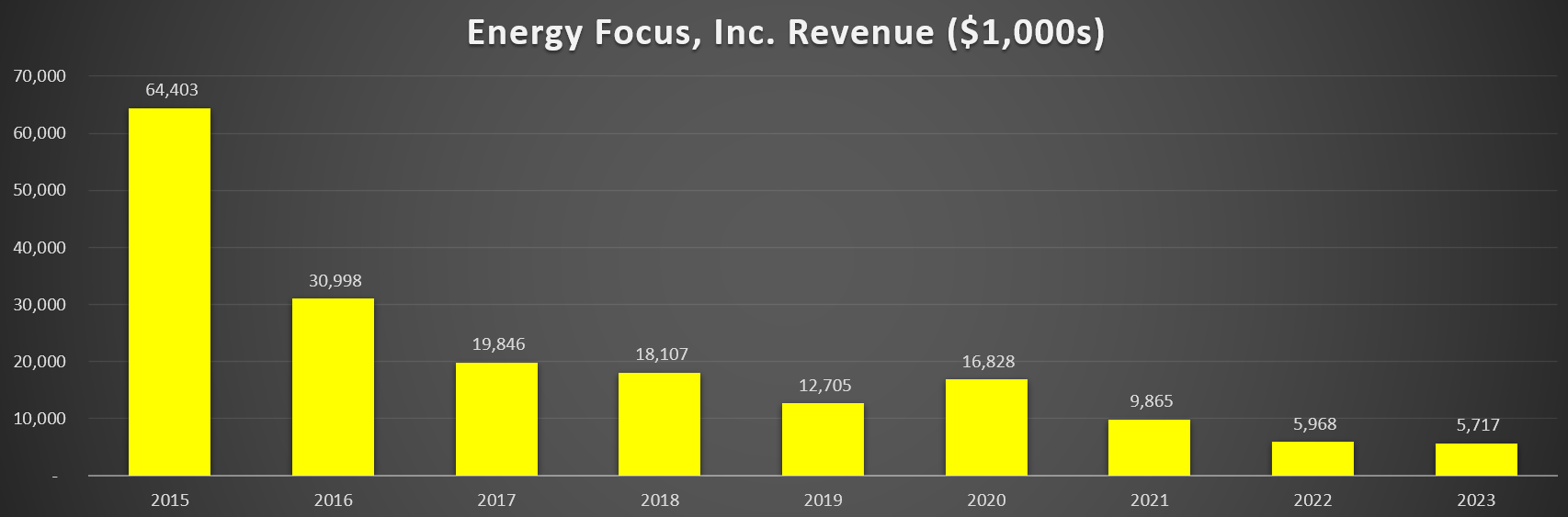

The annual report reveals a continued decline in net sales, with figures dropping from $5.968 million in 2022 to $5.717 million in 2023, staying below the $6-million mark. This marginal revenue decrease is part of a longer trend of receding sales over the past decade. Furthermore, the company's financial struggles are underscored by a history of operating losses, culminating in a net loss of $4.3 million for 2023, an improvement from the $10.3 million net loss in 2022. The report attributes $2.4 million in net cash used in operating activities primarily to the incurred net loss, highlighting ongoing cash flow concerns.

Customer Diversification Risk

Energy Focus reported significant customer concentration in its 2023 sales, with two clients contributing to nearly half of its net sales. Notably, the company's primary distributor for the U.S. Navy accounted for about 35% of these sales, while a shipbuilder for the Navy contributed approximately 13%. This marks a noticeable increase from 2022, where two customers made up 27% of net sales, with the Navy's primary distributor and a regional commercial lighting retrofit company accounting for 13% and 14%, respectively.

Furthermore, as of December 31, 2023, one distributor to the U.S. Department of Defense represented a substantial 74% of Energy Focus's net trade accounts receivable. When combined with receivables from Navy shipbuilders, this figure reached 78% of total net accounts receivable, a significant rise from 30% at the end of 2022.

Despite an 85.6% surge in sales to the military market, the company faced a downturn in the commercial sector, where sales plummeted by 57.5%. This shift underscores Energy Focus's growing reliance on military contracts, contrasting with its dwindling commercial market presence.

Financial Sustainability Concerns

The report candidly addresses Energy Focus's reliance on external financing for operational continuity. The need for additional financing in the near term is underscored, with an acknowledgment of the potential difficulties in securing favorable terms or any funding at all. This reliance places the company in a precarious position, with the risk of having to significantly alter or even curtail operations if sufficient funding is not secured.

Workforce Reductions

The company's efforts to mitigate financial pressures have led to significant workforce reductions. By the end of 2023, Energy Focus reported having only 13 full-time employees and one part-time employee, all based in the United States, alongside one temporary contractor. This reduction in workforce, initiated in the second quarter of 2023, significantly decreased payroll-related expenses, indicating a strategic move to streamline operations in response to financial constraints.

Energy Focus, Inc.'s annual report for 2023 provides a transparent look into the company's ongoing challenges, from declining sales and operational losses to workforce reductions and high customer concentration risks. While the slight improvement in net loss and the strategic reduction in workforce indicate efforts to stabilize operations, the heavy reliance on the military sector and the need for external financing highlight significant vulnerabilities.