March 10, 2023

LSI Raises the Bar on its Future Growth

One year ago, LSI Industries stock was trading at $6.60 per share. Yesterday, the stock closed at $15.88.

In 2021, we first heard of LSI Industries' ambitions to be a $500 million company by 2025 and initially thought that might be a bit overzealous. LSI generated $306 million of revenue in 2020 and $316 million in 2021. In the current fiscal year 2023 which ends on June 30, the company is projecting between $490 and $500 million in revenue, essentially shaving two years off an ambitious five-year plan.

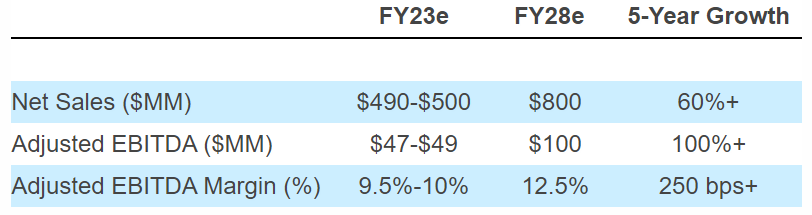

This week, the Cincinnati-based lighting and display company issued a public statement that centers around a new five-year plan through fiscal year 2028. The new financial targets? Deliver $800 million in sales and $100 million adjusted profit by fiscal year 2028.

Publicly traded companies like LSI don't often offer such specificity on long-term financial goals. And growing revenues 60% over five years will require approximately 9.9% growth each year.

The anticipated 2023 goal achievement of $490-500 million was aided by the 2021 acquisition of JSI Store Fixtures, who at the time was generating approximately $70 million in revenues. Based on LSI's track record, getting to $800 million is doable, but we wonder if the company is eyeing another strategic acquisition or two to provide some extra tailwind.

We've learned to not underestimate LSI in recent years, as the company's solid and consistent performance has rewarded stakeholders and investors handsomely. One year ago, LSI Industries (NASDAQ: LYTS) stock was trading at $6.60 per share. Yesterday, the stock closed at $15.88.

Nov 2022: LSI Industries CEO, Jim Clark, discusses company culture and growth with Al Uszynski of inside.lighting

Below is the announcement from LSI Industries:

LSI Industries Introduces Strategic Plan Update, Five-Year Financial Targets

“Fast Forward” Strategy to Deliver $800 million in Net Sales and $100 million Adjusted EBITDA by FY28

CINCINNATI -- LSI Industries Inc. (Nasdaq: LYTS, “LSI” or the “Company”) a leading U.S. based manufacturer of indoor/outdoor lighting and display solutions, today introduced its long-term strategic growth plan, including new, five-year financial targets through FY28.

MANAGEMENT COMMENTARY“During the last three years, our team has demonstrated significant progress on our business transformation strategy, one that emphasizes targeted commercial expansion within higher-value, growth-oriented vertical markets, improved operational efficiency, and a disciplined approach toward capital allocation,” stated James A. Clark, President and Chief Executive Officer of LSI Industries. “During this period of transformation, we’ve built a balanced, integrated lighting and display solutions platform, introduced a record number of new products, strengthened our partner and end-user relationships, expanded our procurement and sourcing capabilities, and successfully integrated a significant strategic acquisition with the purchase of JSI.”

“Having built a strong foundation for profitable growth, LSI will now seek to build scale through its distinct vertical market model, positioning us to deliver superior value to both customers and shareholders,” continued Clark. “Today, with the introduction of our Fast Forward strategy, we are publishing new, five-year financial targets. Over the next five years, we project net sales growth of more than 60%, Adjusted EBITDA growth of more than 100% and Adjusted EBITDA margin expansion of approximately 250+ basis points, or 12.5% of net sales. We anticipate sales growth will be evenly balanced across both organic and inorganic investments.”

“In the current fiscal year 2023 ended June 30, 2023, we project net sales of approximately $490-$500 million and Adjusted EBITDA of $47-$49 million, or ~9.5% to 10% of net sales,” concluded Clark.

FAST FORWARD STRATEGY OVERVIEW

LSI’s Fast Forward Strategy seeks to deliver sustained commercial expansion, operational excellence and disciplined capital allocation, consistent with the Company’s focus on long-term value creation. Key elements of the Strategy include the following:

- Seek to expand “customer share” within existing verticals through a combination of new customer originations; increasing penetration of existing customer accounts; and expansion within adjacent, complimentary new applications/solutions

- Seek to expand “market share” into new high-value verticals, utilizing existing solutions in addition to adjacent, complementary new applications/solutions

- Continue the ongoing launch of vertical/customer specific new products, and build and scale new competencies and solutions, some of which acquired through targeted acquisitions

INTRODUCING FY28 FINANCIAL TARGETS

In conjunction with the launch of LSI’s Fast Forward Strategy, the Company has introduced FY28 financial targets for net sales, Adjusted EBITDA, and Adjusted EBITDA margin.

Consistent with the Company’s focus on disciplined capital allocation, LSI is committed to maintaining a long-term ratio of net debt to trailing twelve-month adjusted EBITDA of at or below 3.0x.

In conjunction with this press release, accompanying presentation materials are available in the Investor Relations section of LSI’s corporate website at www.lsicorp.com.