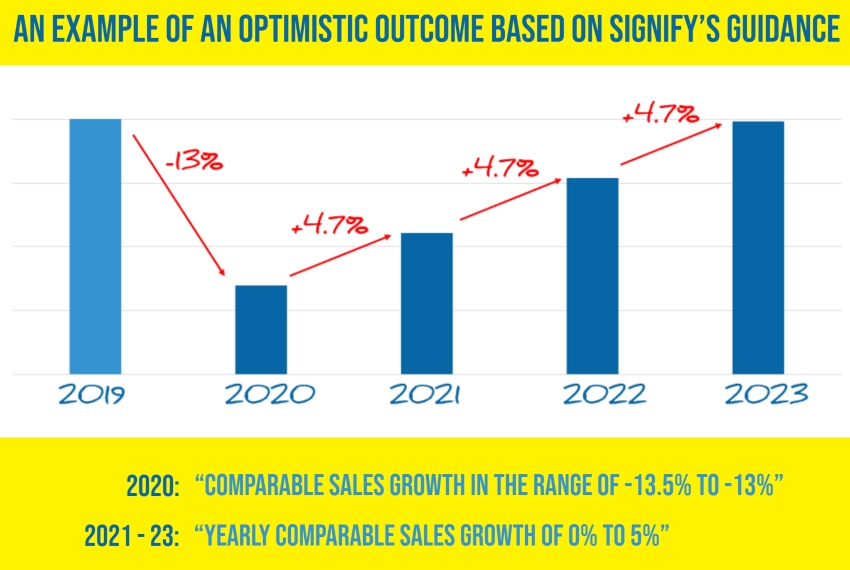

Signify Guidance Predicts Slow Recovery

During its investor event today, Signify provided revenue guidance through 2023.

Below is an inside.lighting illustration of their guidance, using a 2021-23 CAGR of 4.7% followed by the details of Signify's Capital Markets Day from the company's press release. It may take Signify 3 more years to get back to comparable sales levels of 2019. Today, Signify (Euronext: LIGHT) stock closed at €35.50; a decline of 4.24%

Signify presents strategy to drive profitable growth and provides update on 2020 outlook and new financial guidance for 2021-2023 at Capital Markets Day

PRESS RELEASE: December 9, 2020

Eindhoven, the Netherlands – Signify (Euronext: LIGHT), the world leader in lighting, today holds a virtual Capital Markets Day from 14:00 till 18:00 CET. During the event, Signify will provide further details on its strategic plan and performance trajectory for 2021-2023.

“The general lighting market underwent a radical transformation, moving from conventional to LED and to connected lighting. Today, we will outline our intent to further strengthen our leadership, targeting attractive growth and profit pools,” said Eric Rondolat, CEO of Signify. “Looking ahead, we expect the headwinds facing our industry from the transition to LED to abate over the coming years. Our innovation-led strategy will continue to shape lighting industry standards and will accelerate the next technological leap towards connectivity. The progress we have made in the past few years uniquely positions us to achieve technology-driven growth on multiple dimensions. More than ever, sustainability remains at the heart of everything we do, driving growth opportunities that will create long-term value for all our stakeholders. The execution of our 5 Frontiers strategy, based on innovation-led growth and sustainability, will help us build a best-in-class financial profile.”

For FY 2020, Signify expects:

- Comparable sales growth in the range of -13.5% to -13%

- Adj. EBITA margin in the range of 10.2% to 10.6%

- Free cash flow above 11% of sales

For the period 2021-2023, Signify guidance is:

- Yearly comparable sales growth of 0% to 5%

- Adj. EBITA margin of 11% to 13% by 2023

- Free cash flow above 8% of sales for the period 2021-2023

- ROCE of at least 11% for the period 2021-2023

Moreover, the company increases its Cooper Lighting synergy target from USD 60 million to USD 100 million

Signify’s Capital Markets Day will start today at 14:00 CET / 13:00 GMT / 08:00 EST. From this time onwards, please click on this link to follow the webcast and download the presentations that will be used during the day.

For further information, please contact:

Signify Investor Relations

Rogier Dierckx

Tel: +31 6 1138 4609

E-mail: [email protected]

Signify Corporate Communications

Elco van Groningen

Tel. +31 6 1086 5519

Email: [email protected]

About Signify

Signify (Euronext: LIGHT) is the world leader in lighting for professionals and consumers and lighting for the Internet of Things. Our Philips products, Interact connected lighting systems and data-enabled services, deliver business value and transform life in homes, buildings and public spaces. With 2019 sales of EUR 6.2 billion, we have approximately 37,000 employees and are present in over 70 countries. We unlock the extraordinary potential of light for brighter lives and a better world. We achieved carbon neutrality in 2020, have been in the Dow Jones Sustainability World Index since our IPO for four consecutive years and were named Industry Leader in 2017, 2018 and 2019. News from Signify is located at the Newsroom, Twitter, LinkedIn and Instagram. Information for investors can be found on the Investor Relations page.

Important Information

Forward-Looking Statements and Risks & Uncertainties

This document and the related oral presentation contain, and responses to questions following the presentation may contain, forward-looking statements that reflect the intentions, beliefs or current expectations and projections of Signify N.V. (the “Company”, and together with its subsidiaries, the “Group”), including statements regarding strategy, estimates of sales growth and future operational results.

By their nature, these statements involve risks and uncertainties facing the Company and its Group companies, and a number of important factors could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement as a result of risks and uncertainties. Such risks, uncertainties and other important factors include but are not limited to: adverse economic and political developments, the impacts of COVID-19, rapid technological change, competition in the general lighting market, development of lighting systems and services, successful implementation of business transformation programs, impact of acquisitions and other transactions, reputational and adverse effects on business due to activities in Environment, Health & Safety, compliance risks, ability to attract and retain talented personnel, adverse currency effects, pension liabilities, and exposure to international tax laws. Please see “Risk Factors and Risk Management” in Chapter 12 of the Annual Report 2019 for discussion of material risks, uncertainties and other important factors which may have a material adverse effect on the business, results of operations, financial condition and prospects of the Group. Such risks, uncertainties and other important factors should be read in conjunction with the information included in the Company’s Annual Report 2019.

Additional risks currently not known to the Group or that the Group has not considered material as of the date of this document could also prove to be important and may have a material adverse effect on the business, results of operations, financial condition and prospects of the Group or could cause the forward-looking events discussed in this document not to occur. The Group undertakes no duty to and will not necessarily update any of the forward-looking statements in light of new information or future events, except to the extent required by applicable law.

Market and Industry Information

All references to market share, market data, industry statistics and industry forecasts in this document consist of estimates compiled by industry professionals, competitors, organizations or analysts, of publicly available information or of the Group’s own assessment of its sales and markets. Rankings are based on sales unless otherwise stated.

Non-IFRS Financial Measures

Certain parts of this document contain non-IFRS financial measures and ratios, such as comparable sales growth, adjusted gross margin, EBITA, adjusted EBITA, and free cash flow, and other related ratios, which are not recognized measures of financial performance or liquidity under IFRS. The non-IFRS financial measures presented are measures used by management to monitor the underlying performance of the Group’s business and operations and, accordingly, they have not been audited or reviewed. Not all companies calculate non-IFRS financial measures in the same manner or on a consistent basis and these measures and ratios may not be comparable to measures used by other companies under the same or similar names. A reconciliation of these non-IFRS financial measures to the most directly comparable IFRS financial measures is contained in this document. For further information on non-IFRS financial measures, see “Chapter 18 Reconciliation of non-IFRS measures” in the Annual Report 2019.

Presentation

All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up to totals provided. All reported data are unaudited. Unless otherwise indicated, financial information has been prepared in accordance with the accounting policies as stated in the Annual Report 2019 and semi-annual report 2020.

Market Abuse Regulation

This press release contains information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |