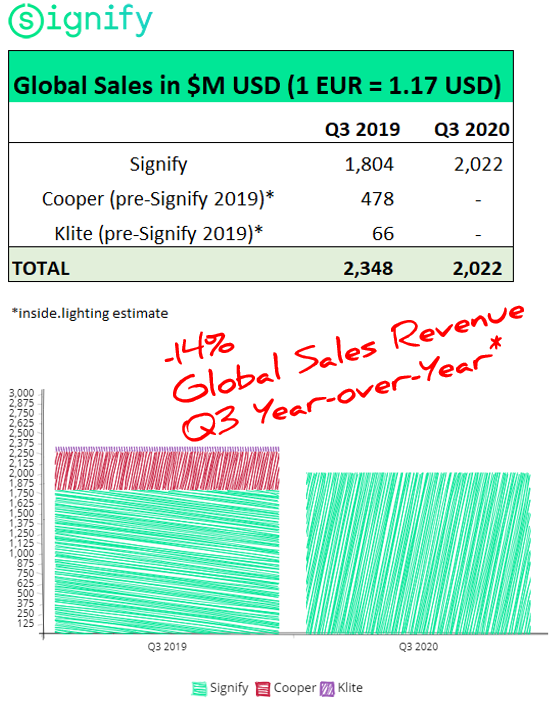

Signify + Cooper: Estimated Sales Dip 14%

Signify reported its Q3 results on Friday October 23. The financial results were for the quarter ending September 30. The results were for Signify's second full-COVID-impacted quarter.

Some of the highlights include:

- An increase in 7 million installed connected light points.

- LED sales represent 82% of total sales.

- Cooper Lighting integration and synergies ahead of plan.

- Reduction in the overall gross debt position.

- New products in the following categories: Philips Hue, Aquaculture LED, smart cities, UV-C.

The Americas Region revenues were 498M EUR ($582M USD). The Americas represent 29% of Global sales.

When calculating the pre-acquisition 2019 revenue of Cooper Lighting and Klite Lighting, inside.lighting estimates that the aggregate sales of Signify + Cooper + Klite are down -14%.

Financial Reports and Signify Press Release Below:

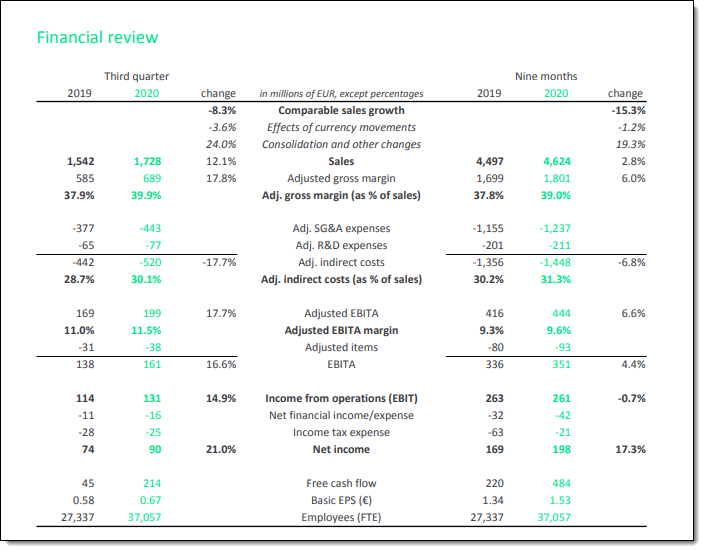

Third quarter 20201

- Signify’s installed base of connected light points increased from 64 million in Q2 20 to 71 million in Q3 20

- Sales of EUR 1,728 million, nominal sales growth of 12.1% and CSG of -8.3%

- LED-based sales represented 82% of total sales (Q3 19: 81%)

- Adj. indirect costs down EUR 22 million, or -4.9% excl. FX effects and changes in scope2

- Adj. EBITA margin increased by 50 bps to 11.5%, including currency impact of -30 bps

- Adj. EBITA margin of the growing profit engines increased by 130 bps to 12.3%

- Net income of EUR 90 million (Q3 19: EUR 74 million)

- Free cash flow increased to EUR 214 million (Q3 19: EUR 45 million)

- Cooper Lighting integration and synergies ahead of plan

- Achieved carbon neutrality and set course to double positive impact on environment and society in 2025

- Debt prepayment of EUR 350 million to reduce overall gross debt position; net leverage at 2.2x

Eindhoven, the Netherlands – Signify (Euronext: LIGHT), the world leader in lighting, today announced the company’s 2020 third quarter results. “We are very proud of our carbon neutrality achievement in Q3 and of the launch of our new sustainability program aimed at doubling our positive impact on the environment and society in 2025. Amidst difficult market dynamics caused by the COVID-19 pandemic, this financial quarter we are reporting yet another resilient performance underpinned by our consumer and connected lighting. Our gross margin improvement, through rigorous price management, translated into a higher operational margin. Our discipline in working capital management allowed us to generate a solid free cash flow for the quarter, while as previously announced, we reduced our debt by EUR 350 million,” said CEO Eric Rondolat. “Given the acceleration of the pandemic in many regions, we remain cautious about market developments, but confident in our ability to further adapt, which we have demonstrated since the beginning of the year. Our teams remain focused on making continued good progress on the integration of Cooper Lighting and Klite, while relentlessly driving our growth platforms to develop new business opportunities in line with our strategy.”

Outlook

Given recent developments of the pandemic, Signify does not provide financial guidance for full year 2020. Signify remains confident in the underlying resilience of its businesses and operating model, and that its liquidity needs are well covered by the financial framework it has in place. During the virtual Capital Markets Day 2020, which is scheduled on December 9, Signify will provide more details on its expectations for the medium-term.

Conference call and audio webcast

Eric Rondolat (CEO), René van Schooten (CFO) and Javier van Engelen (CFO) will host a conference call for analysts and institutional investors at 9:00 a.m. CET to discuss third quarter 2020 results. A live audio webcast of the conference call will be available via the Investor Relations website.

Financial calendar

October 27, 2020: EGM 2020

December 9, 2020: Capital Markets Day 2020

January 29, 2021: Fourth quarter and full year results 2020

1This press release contains certain non-IFRS financial measures and ratios, such as comparable sales growth, EBITA, adjusted EBITA and free cash flow, and related ratios, which are not recognized measures of financial performance or liquidity under IFRS. For a reconciliation of these non-IFRS financial measures to the most directly comparable IFRS financial measures, see appendix B, Reconciliation of non-IFRS financial measures, of this press release.

2Changes in scope relate to the consolidation of Cooper Lighting and Klite

Forward-Looking Statements and Risks & Uncertainties

This document and the related oral presentation contain, and responses to questions following the presentation may contain, forward-looking statements that reflect the intentions, beliefs or current expectations and projections of Signify N.V. (the “Company”, and together with its subsidiaries, the “Group”), including statements regarding strategy, estimates of sales growth and future operational results.

By their nature, these statements involve risks and uncertainties facing the Company and its Group companies, and a number of important factors could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement as a result of risks and uncertainties. Such risks, uncertainties and other important factors include but are not limited to: adverse economic and political developments, the impacts of COVID-19, rapid technological change, competition in the general lighting market, development of lighting systems and services, successful implementation of business transformation programs, impact of acquisitions and other transactions, reputational and adverse effects on business due to activities in Environment, Health & Safety, compliance risks, ability to attract and retain talented personnel, adverse currency effects, pension liabilities, and exposure to international tax laws. Please see “Risk Factors and Risk Management” in Chapter 12 of the Annual Report 2019 for discussion of material risks, uncertainties and other important factors which may have a material adverse effect on the business, results of operations, financial condition and prospects of the Group. Such risks, uncertainties and other important factors should be read in conjunction with the information included in the Company’s Annual Report 2019.

Additional risks currently not known to the Group or that the Group has not considered material as of the date of this document could also prove to be important and may have a material adverse effect on the business, results of operations, financial condition and prospects of the Group or could cause the forward-looking events discussed in this document not to occur. The Group undertakes no duty to and will not necessarily update any of the forward-looking statements in light of new information or future events, except to the extent required by applicable law.

Market and Industry Information

All references to market share, market data, industry statistics and industry forecasts in this document consist of estimates compiled by industry professionals, competitors, organizations or analysts, of publicly available information or of the Group’s own assessment of its sales and markets. Rankings are based on sales unless otherwise stated.

Non-IFRS Financial Measures

Certain parts of this document contain non-IFRS financial measures and ratios, such as comparable sales growth, adjusted gross margin, EBITA, adjusted EBITA, and free cash flow, and other related ratios, which are not recognized measures of financial performance or liquidity under IFRS. The non-IFRS financial measures presented are measures used by management to monitor the underlying performance of the Group’s business and operations and, accordingly, they have not been audited or reviewed. Not all companies calculate non-IFRS financial measures in the same manner or on a consistent basis and these measures and ratios may not be comparable to measures used by other companies under the same or similar names. A reconciliation of these non-IFRS financial measures to the most directly comparable IFRS financial measures is contained in this document. For further information on non-IFRS financial measures, see “Chapter 18 Reconciliation of non-IFRS measures” in the Annual Report 2019.

Presentation

All amounts are in millions of euros unless otherwise stated. Due to rounding, amounts may not add up to totals provided. All reported data are unaudited. Unless otherwise indicated, financial information has been prepared in accordance with the accounting policies as stated in the Annual Report 2019 and semi-annual report 2020.

Change in reporting segments

Effective Q2 2020, to further adapt to the industry transition and strengthen customer centricity, Signify changed the organizational structure, which included changing the previously four business groups (BG’s) to three divisions.

- Division Digital Solutions (formerly BG Professional, including Cooper Lighting Solutions) offers luminaires, lighting systems and services for the Internet of Things to the customers in the professional segment;

- Division Digital Products (combines BG LED and BG Home). This division offers LED lamps, LED luminaires and connected products, including Hue and Wiz, and LED electronics to professional customers, OEM partners and consumers. By bringing together its entire consumer LED portfolio, Signify can better manage this lighting category for its channel partners; and

- Division Conventional Products (formerly BG Lamps) continues to focus on conventional lamps and electronics for professional customers, OEM partners and consumers. It is organized separately to bring a clear distinction between conventional and digital offerings.

In line with this change, effective Q2 2020, Signify's operating segments are Digital Solutions, Digital Products, and Conventional Products. The segments are organized based on the nature of the products and services. ‘Other’ represents amounts not allocated to the operating segments and includes certain costs related to central R&D activities to drive innovation as well as group enabling functions.

Market Abuse Regulation

This press release contains information within the meaning of Article 7(1) of the EU Market Abuse Regulation.

For further information, please contact:

Signify Investor Relations

Rogier Dierckx

Tel: +31 6 1138 4609

E-mail: [email protected]

Signify Corporate Communications

Elco van Groningen

Tel: +31 6 1086 5519

E-mail: [email protected]

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |