March 7, 2024

6 Key Takeaways from Signify's Annual Report

In a down year, the United States underperformed vs. Rest of World

Signify's recently published 2023 Annual Report is rich with information, and we've sifted through it to highlight key insights that have not been widely reported throughout the year and are of particular interest to Inside Lighting’s primarily North American audience of lighting people.

The report provides a comprehensive overview of the company's global financial performance and makes numerous references to advancing Diversity, Equity, and Inclusion (DEI) initiatives as well as the company's ambitious sustainability goals and achievements, which are often publicized throughout the year.

Notably, the 208-page annual report gives a special mention to New England lighting agent Reflex Lighting for its role in retrofitting 1000w metal halide fixtures at the Boston Convention & Exhibition Center with Cooper Lighting Solutions Metalux Benchmark LED High Bay fixtures. A total of 378 fixtures were installed in three phases, allowing the exhibition halls to remain operational during the installation process.

Key takeaways from Signify’s 2023 Annual Report, curated for North American lighting people, include:

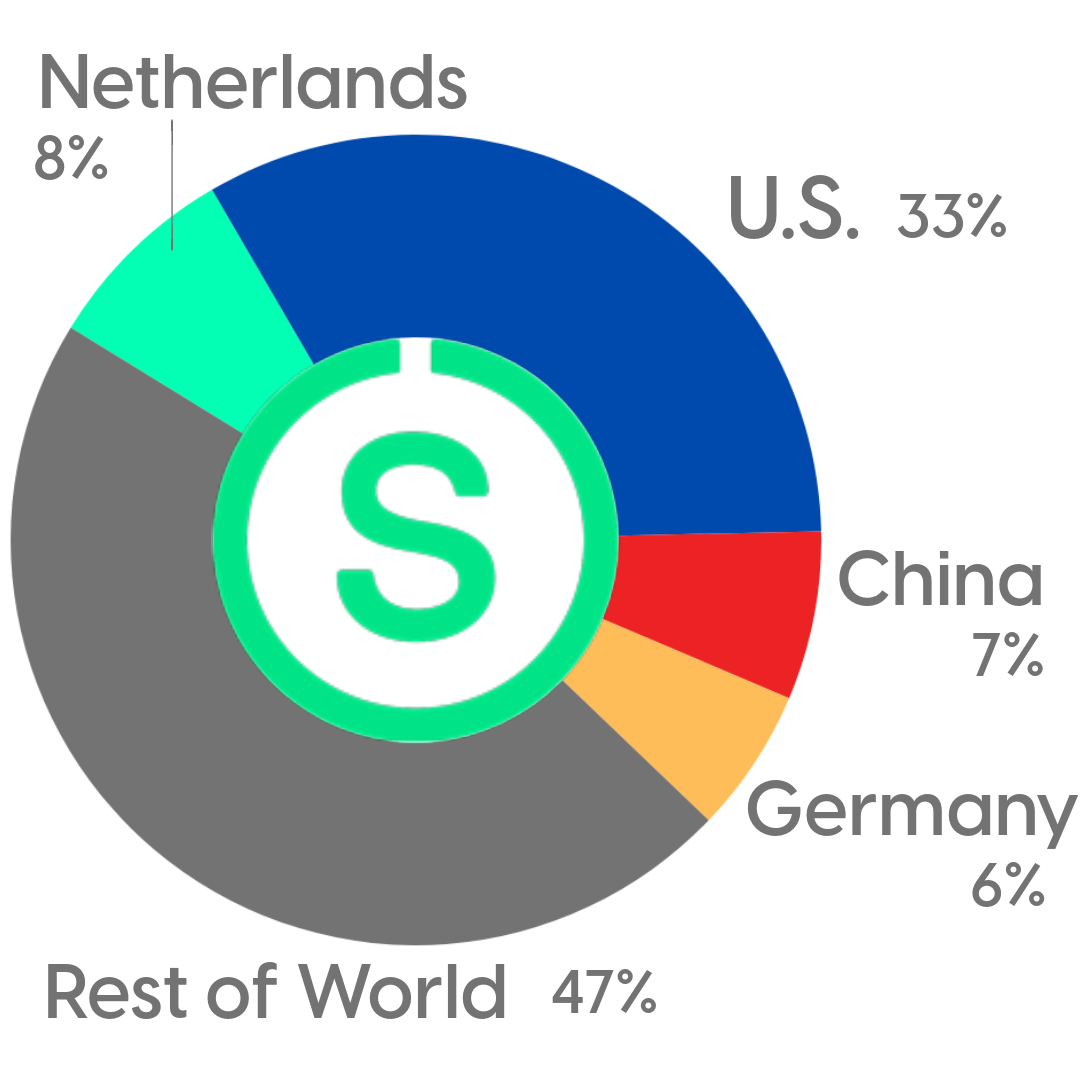

1. The U.S. underperformed vs. Rest of World

As a whole, Signify experienced a nominal sales dip of 10.8% in 2023. The U.S. market experienced slightly more decline.

In its quarterly earnings reports, Signify does not carve out granular results by country, so revenues for the US are rolled into the global region described as Americas. In the recently published Annual Report, Signify gives visibility to U.S. specific results.

In 2023, Signify reported sales of €2.212 billion in the United States ($2.413 billion), down from €2.522 billion (approximately $2.748 billion) the previous year. This decline represents a 12.3% decrease in U.S. sales revenue, a significant shift in the company's largest market.

|

| Global Sales by Country |

From a lighting group and brand perspective, the total sales of $2.413 billion in the US encompass the following categories and brands:

- Cooper Lighting Solutions

- Philips lamps, both professional and consumer

- Advance drivers

- Genlyte Solutions luminaire and control brands

- Color Kinetics

- and certain other brands and product groups

For context, when Signify acquired Cooper Lighting in 2020, the company reported that Cooper Lighting's revenues were approximately $1.58 billion at the time.

The 2023 results include the first quarter acquisition of Minnesota based Intelligent Lighting Controls (ILC) which had positive effect of 0.5% on the Americas revenue number.

When assessing the U.S. sales in the context of global figures, the United States accounted for 33% of Signify's total sales in 2023, a slight dip from the 33.6% share in 2023.

2. Artificial Intelligence

Signify is charting a course toward a digital future, intensifying its investment in data science to expand artificial intelligence (AI) applications within the company. According to the annual report, “AI is now being deployed to enhance our customer experience and optimize our operations. All global customer care centers are now powered by generative AI, which has significantly improved customer experience. AI has also been deployed in the design of our 3D-printed luminaires, where an end-to-end fine-tuned text to image model generates texture images.”

This deployment of AI extends beyond customer service. Signify has introduced an advanced digital platform for professional clients, enhancing agent interactions and propelling e-commerce, particularly in the United States. The implementation of a global e-commerce infrastructure has markedly boosted B2B online sales, demonstrating the company's commitment to integrating AI in practical, customer-centric ways.

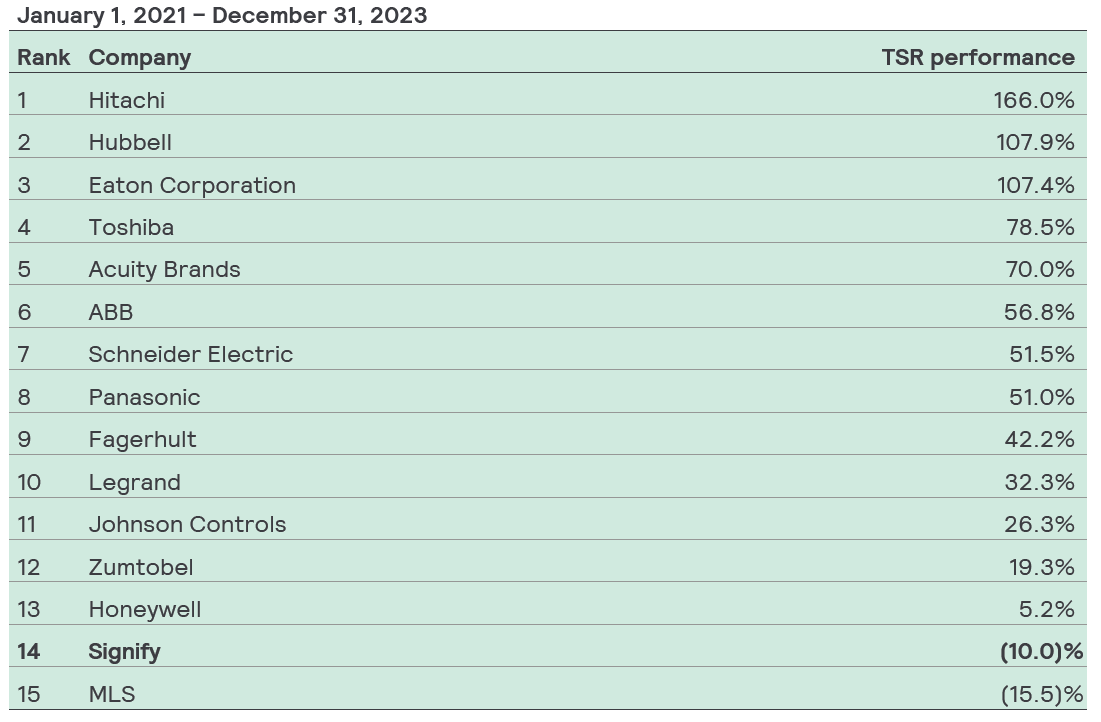

3. Signify's three-year shareholder return was markedly low compared to its peers

For the three-year period from January 1, 2021, to December 31, 2023, Signify's performance significantly lagged behind that of its industry peers. Twelve of the fifteen companies saw a shareholder return of 19% or greater, while Signify's return was -10%. This placed Signify 14th in the peer group ranking, as indicated in the following table.

As of January 1, 2022, Cree was replaced by MLS Co Ltd in the peer group. MLS turned out to be the only company that Signify outperformed on this list. If Signify's ranking among the peer companies had been in the top half, CEO Eric Rondolat would have been eligible for a portion of his variable compensation plan, with a sliding reward scale based on the company's rank.

4. Americas employee headcount

In 2023, Signify's global workforce decreased to 31,920 full-time employees, down 7.8% from 34,619 in 2022.

Signify's operations in the Americas, which encompasses the United States, Canada, and Latin America, have undergone changes in their full-time employment numbers over the past year, as reflected in recent data. The region as a whole saw a decrease in employees from 9,468 in 2022 to 8,275 in 2023, marking a 12.6% reduction.

Signify Full Time Employees 2023, Americas Region

| Region | 2022 | 2023 |

| Canada | 643 | 640 |

| Latin America | 5,868 | 4,935 |

| United States of America | 2,957 | 2,700 |

| Americas TOTAL | 9,468 | 8,275 |

Latin America, with a significant majority of activities believed to be in Mexico, also observed a decrease in employee numbers, from 5,868 in 2022 to 4,935 in 2023. In terms of Signify's overall presence in the Americas, Latin America represented 61.9% of the total employees in 2022 and 59.6% in 2023, indicating a slight shift in the makeup of the workforce within the region.

The United States accounts for a decent portion of this change. The USA's employee count reduced from 2,957 in 2022 to 2,700 in 2023, translating to an 8.7% decrease.

Despite changes in employment numbers, the number of manufacturing sites across all subregions has remained stable from 2022 to 2023. Each subregion, including the Americas as a whole, Canada, Latin America, and the United States, maintained the same number of sites: 18 for the entire Americas, 2 for Canada, 8 for Latin America, and 8 for the United States. This stability in operational infrastructure suggests a consolidation of workforce rather than a scaling back of physical operations within the region.

The operational changes cited above do not include the recently announced wind down of the company’s San Marcos, Texas facility which is occurring in 2024.

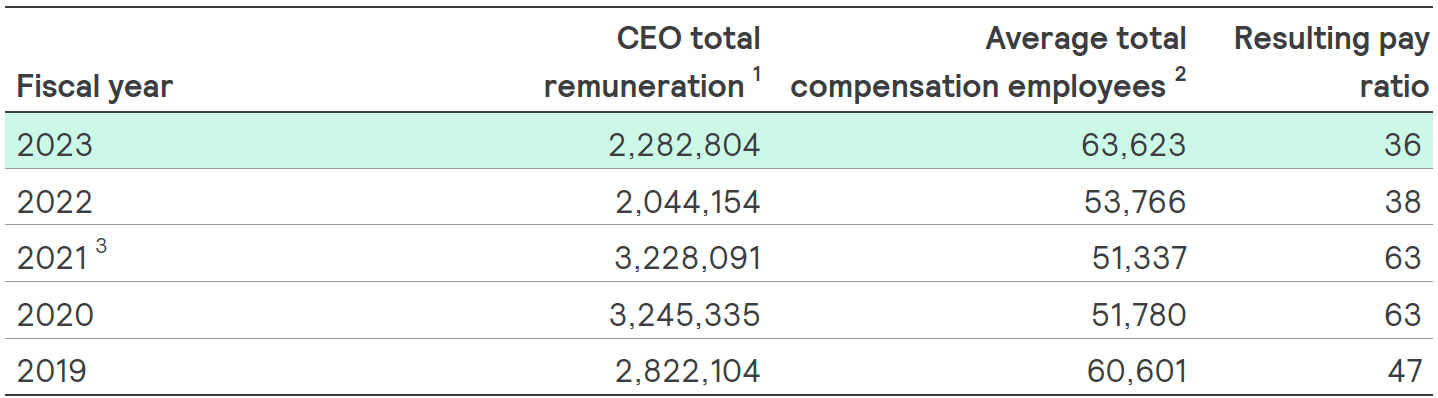

5. Significant Increase in Average Employee Compensation

The data on Signify's full-time employee average compensation, which includes total employee benefit expenses, saw a notable increase in 2023.

The average total compensation for the company rose significantly by 18.3% in 2023, from €53,766 ($57,489) in 2022 to €63,623 ($68,107) in 2023. This increase does not necessarily indicate that all employees received 18% raises. Instead, the company has explained in the past that a series of headcount reductions around the world have more significantly impacted factory positions than white-collar office jobs. Therefore, this large percentage rise in average compensation is likely the result of reducing the number of lower-compensated factory workers.

6. CEO compensation

Compensation for Signify CEO Eric Rondolat, seemingly remains a bargain compared to the compensation for CEOs of global multi-billion corporations. In 2023, Rondolat earned €2.3 million, with his income over the past five years ranging from €2.0 to €3.2 million.

Rondolat's tenure, which began during a pivotal time for Signify—then part of Philips—in 2012, has been noteworthy. At that time, Signify was one of the "Big 3" global lamp makers, alongside OSRAM Sylvania and GE Lighting, in an era when LED technology was rapidly emerging but fluorescent and HID lighting remained dominant. Under Rondolat's leadership, Signify adeptly navigated these industry shifts, maintaining its competitive edge even as it faced rising competitors like Cree Lighting, known for their aggressive push in the LED market.

Signify’s Supervisory Board has proposed re-appointing Eric Rondolat as CEO and Chair of the Board of Management at the Annual General Meeting of Shareholders, scheduled for May 2024.