Cree Reports Financial Results for the Fourth Quarter of Fiscal Year 2020

First tariffs. Then the Huawei ban. And now COVID-19. Component company, Cree, Inc. has dealt with many headwinds over the last two years.

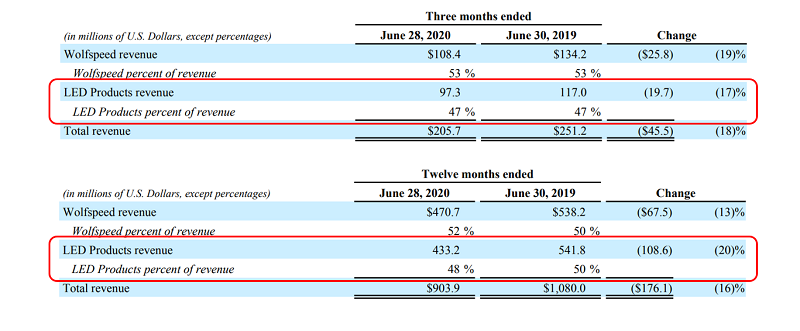

Cree, Inc. derives about half of its revenues from LED component sales. The other half is from the Wolfspeed business unit that produces RF components, power components and substrates.

Cree, Inc. closed its FY2020 in June and just announced its quarterly and full-year financial results. The LED components revenue is reported separately. While revenues performed greater than Wall Street expectations, profits underperformed causing the stock to drop after hours on Tue Aug 18.

Below are the published Q4 and FY2020 results from Cree, Inc.

NOTE: Cree Lighting, the maker of luminaires, is owned by Ideal Industries and is no longer part of Cree, Inc.

Cree Reports Financial Results for the Fourth Quarter of Fiscal Year 2020

DURHAM, N.C. August 18, 2020 -- Cree, Inc. (Nasdaq: CREE) today announced revenue of $205.7 million for its fourth quarter of fiscal 2020, ended June 28, 2020. This represents an 18% decrease compared to revenue of $251.2 million reported for the fourth quarter of fiscal 2019, and a 5% decrease compared to the third quarter of fiscal 2020. GAAP net loss from continuing operations attributable to controlling interest for the fourth quarter was $39.5 million, or $0.36 per diluted share, compared to GAAP net loss from continuing operations attributable to controlling interest of $34.5 million, or $0.33 per diluted share, for the fourth quarter of fiscal 2019. On a non-GAAP basis, net loss from continuing operations attributable to controlling interest for the fourth quarter of fiscal 2020 was $20.0 million, or $0.18 per diluted share, compared to non-GAAP net income from continuing operations attributable to controlling interest for the fourth quarter of fiscal 2019 of $11.6 million, or $0.11 per diluted share.

For fiscal year 2020, Cree reported revenue of $903.9 million, which represents a 16% decrease when compared to revenue of $1,080.0 million for fiscal 2019. GAAP net loss attributable to controlling interest from continuing operations was $191.7 million, or $1.78 per diluted share. This compares to a GAAP net loss attributable to controlling interest from continuing operations of $57.9 million, or $0.56 per diluted share, for fiscal 2019. On a non-GAAP basis, net loss from continuing operations attributable to controlling interest for fiscal year 2020 was $49.1 million, or $0.45 per diluted share, compared to non-GAAP net income from continuing operations attributable to controlling interest of $76.9 million, or $0.74 per diluted share, for fiscal 2019.

“Our performance in the fourth quarter demonstrates solid execution despite the unprecedented challenges presented by the ongoing pandemic and geopolitical concerns. I would like to thank all our employees for their tremendous efforts in allowing us to safely operate our business and support our customers around the world,” said Cree CEO, Gregg Lowe. “Fiscal 2020 marked a transition year in our journey to become a global semiconductor powerhouse and we remain firmly committed to our capacity expansion plans to capitalize on what we believe to be a multi-decade growth opportunity for silicon carbide.”

Business Outlook:

For its first quarter of fiscal 2021, Cree targets revenue in a range of $203 million to $217 million. GAAP net loss is targeted at $83 million to $87 million, or $0.76 to $0.79 per diluted share. Non-GAAP net loss is targeted to be in a range of $22 million to $26 million, or $0.20 to $0.24 per diluted share. Targeted non-GAAP net loss excludes $61 million of estimated expenses, net of tax, related to stock-based compensation expense, amortization or impairment of acquisition-related intangibles, factory optimization restructuring and start-up costs, net accretion on convertible notes, and project, transformation, transaction and transition costs. The GAAP and non-GAAP targets do not include any estimated change in the fair value of Cree’s Lextar investment.

Quarterly Conference Call:

Cree will host a conference call at 5:00 p.m. Eastern time today to review the highlights of the fourth quarter results and the fiscal first quarter 2021 business outlook, including significant factors and assumptions underlying the targets noted above. The conference call will be available to the public through a live audio web broadcast via the Internet. For webcast details, visit Cree's website at investor.cree.com/events.cfm.

Supplemental financial information, including the non-GAAP reconciliation attached to this press release, is available on Cree's website at investor.cree.com/results.cfm.

About Cree, Inc.

Cree is an innovator of Wolfspeed® power and radio frequency (RF) semiconductors and lighting class LEDs. Cree’s Wolfspeed product families include silicon carbide materials, power-switching devices and RF devices targeted for applications such as electric vehicles, fast charging inverters, power supplies, telecom and military and aerospace. Cree’s LED product families include blue and green LED chips, high-brightness LEDs and lighting-class power LEDs targeted for indoor and outdoor lighting, video displays, transportation and specialty lighting applications.

For additional product and Company information, please refer to www.cree.com.

Download the recently released FY2020 reports that includes financial details, disclaimers and other details.

Don’t miss the next big lighting story…Click here to subscribe to the inside.lighting InfoLetter |